Rolling Reserve: The Merchant’s Guide

Understanding rolling reserves is essential for any business that accepts card payments. While often viewed as a restriction or a sign of risk, a rolling reserve is a fundamental mechanism within payment acquiring that protects both merchants and acquirers from financial exposure connected to chargebacks, fraud, and delivery risk.

In the global payments landscape, acquirers operate under constant regulatory oversight and are responsible for managing their exposure to potential losses. A reserve acts as a financial safeguard, ensuring that if a merchant cannot cover chargebacks or refund liabilities, there are already funds set aside to handle those claims.

The specific amount, duration, and structure of a rolling reserve depend on several factors including the merchant’s risk category, the rules of Visa and Mastercard, and the internal policy of the acquiring bank. In low-risk industries, a reserve might only last 30 days at 5 percent. In high-risk industries such as adult, travel, or subscription-based businesses, it can reach between 10 and 20 percent with hold periods of up to 180 days.

“A rolling reserve can be seen as an unwanted saving, but ultimately it is still the merchant’s money and will be paid out accordingly and in due time, whether still processing or not.”

— Dennis E. R. Pedersen, Director at FastoPayments

For merchants, understanding how rolling reserves function is not just about compliance. It is about protecting cash flow, improving negotiation power, and building a record of trust with acquirers. When managed correctly, a reserve can be reduced, capped, or even removed through consistent performance and proper dispute management.

This guide provides a detailed explanation of how rolling reserves are calculated, why acquirers apply them, and how merchants can strengthen their position through stable data and reporting. It also explores how programs such as Visa’s VAMP and Mastercard’s Excessive Chargeback Program directly influence acquirer risk decisions and reserve policies across multiple regions.

Whether you are a new merchant entering a higher-risk vertical or an established business expanding across different markets, this guide will help you understand the principles behind reserves and how to manage them as part of a stronger, long-term payment strategy.

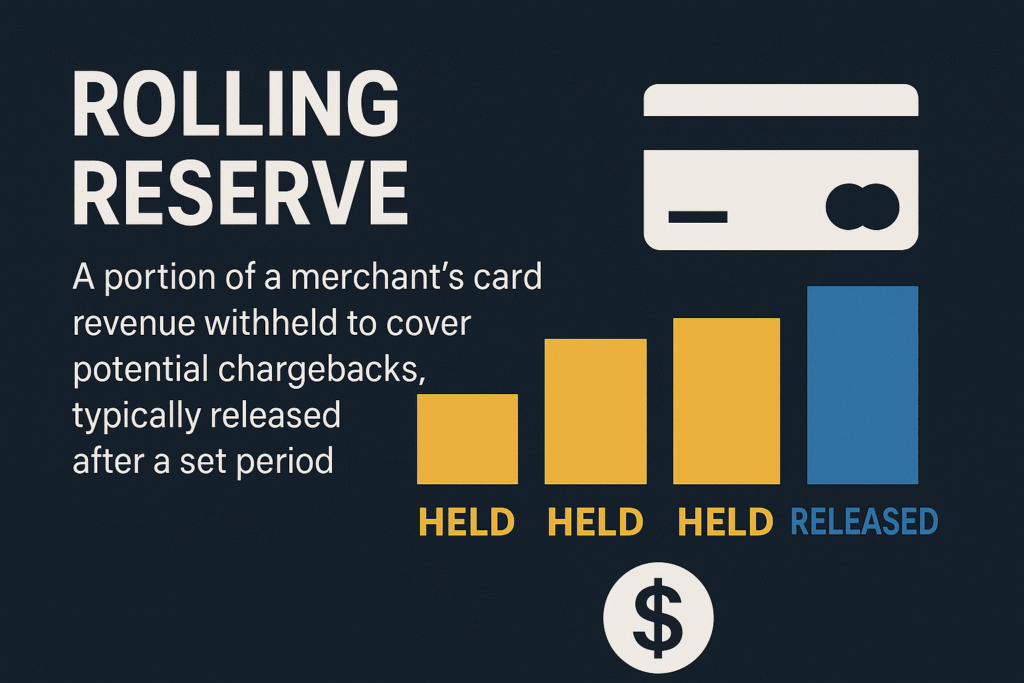

What is a Rolling Reserve

A rolling reserve is a financial mechanism used by acquiring banks to manage risk in card payment processing. It represents a percentage of a merchant’s transaction volume that is temporarily withheld to cover potential chargebacks, refunds, or fraudulent transactions that may occur after a payment has been completed.

When a merchant accepts card payments, the acquirer settles funds daily or weekly. However, card networks such as Visa and Mastercard allow consumers to dispute transactions long after the original purchase. This creates a liability window for the acquirer, who remains responsible for those claims even if the merchant’s balance is insufficient or the business ceases operations. The rolling reserve acts as a safeguard, ensuring funds are available to absorb that potential exposure.

Why it exists

A rolling reserve is not a penalty or fee but a form of collateral that protects both the acquirer and the payment ecosystem. It ensures the acquirer can honor chargebacks, refunds, or compliance claims without assuming direct financial loss.

For example:

Visa allows disputes to be raised up to 120 days after the transaction or the expected delivery date.

Mastercard enforces similar limits, typically 90 to 120 days depending on the reason code.

Because this dispute period extends beyond the date funds are released, acquirers retain a small portion of revenue to cover any future liabilities that might arise during that timeframe.

Extended dispute periods and high-risk exceptions

While the general rule limits chargebacks to around 120 days, some business models face longer liability periods of up to 540 days, or roughly 18 months. These extended timeframes apply to industries or scenarios where delivery occurs long after the purchase or where recurring billing is involved.

Travel and hospitality services

Airlines, cruises, and event organizers can face chargebacks up to 540 days after the original purchase if the service is not provided.Subscription or membership-based models

For recurring payments, cardholders may dispute ongoing charges if a service was canceled but billing continued.Prepaid or delayed delivery goods

High-value items that are custom-made or shipped months after purchase can fall under extended liability windows.Regulatory and consumer protection exceptions

Some chargeback codes allow extra time when merchants are affected by insolvency, fraud investigations, or legal restrictions preventing delivery.

These scenarios explain why acquirers may hold reserves longer for certain merchant types, even when overall chargeback volumes are low. The reserve ensures funds remain available to cover long-tail disputes that appear outside standard timeframes.

Typical reserve duration by industry

| Industry | Reserve Percentage (Typical) | Hold Period | Key Risk Factor |

|---|---|---|---|

| Retail / E-commerce | 5%–10% | 30–90 days | Product returns and delivery issues |

| Digital Services / SaaS | 5%–10% | 60–120 days | Subscription disputes and refund requests |

| Adult / Entertainment | 10%–20% | 90–180 days | High chargeback ratio and content disputes |

| Travel / Hospitality | 10%–15% | Up to 540 days | Delayed delivery and cancellations |

| High-ticket / Luxury Goods | 10%–20% | 90–180 days | Non-delivery or authenticity claims |

| Subscription and Continuity | 10%–15% | 120–180 days | Recurring billing and consumer cancellations |

Why Acquirers Apply Rolling Reserves

Rolling reserves exist because every card transaction carries delayed financial exposure. Between the time a customer pays and the end of the chargeback window, the acquirer remains responsible for that payment under the rules of Visa and Mastercard.

Core reasons behind reserve implementation

Chargeback protection

A rolling reserve ensures that the acquirer can fund legitimate chargebacks even months after the original transaction. Since chargebacks can be raised up to 120 days after a purchase, and in some sectors up to 540 days, maintaining a reserve ensures coverage without affecting operational liquidity.It is also important to understand that in subscription or recurring billing models, a chargeback does not apply to the entire series of payments. Each monthly payment is treated as an individual transaction, which means a customer can dispute multiple charges across different months.

Fraud mitigation

According to Visa’s global fraud prevention update, its network blocked more than US$40 billion in attempted fraud during 2024. Likewise, Mastercard estimates that global chargeback losses to merchants will exceed US$42 billion by 2028, with nearly half related to friendly fraud.Liquidity management

Reserves stabilize an acquirer’s working capital. By maintaining a portion of merchant funds, acquirers can process refunds and chargebacks without creating settlement delays.Regulatory and network compliance

Visa’s Acquirer Monitoring Program (VAMP) and Mastercard’s Excessive Chargeback Programs (ECMP and HECM) monitor chargeback ratios and fraud levels. When thresholds are exceeded, acquirers must demonstrate that reserves and controls are in place.Support for new or high-risk merchants

Merchants with limited history or fluctuating performance often begin with an uncapped reserve until consistent, stable processing data supports a reduction.

How a Rolling Reserve Works

A rolling reserve operates as a cycle of withheld and released funds. The acquirer holds a set percentage of daily or monthly sales for a defined period, then releases those funds while collecting new ones.

Example: 10% reserve with a 180-day hold period

| Month | Gross Sales | 10% Held | Released (from 6 months prior) | Net Reserve Change | Reserve Balance |

|---|---|---|---|---|---|

| March | €100,000 | €10,000 | €0 | +€10,000 | €10,000 |

| April | €120,000 | €12,000 | €0 | +€12,000 | €22,000 |

| May | €130,000 | €13,000 | €0 | +€13,000 | €35,000 |

| June | €110,000 | €11,000 | €0 | +€11,000 | €46,000 |

| July | €140,000 | €14,000 | €0 | +€14,000 | €60,000 |

| August | €150,000 | €15,000 | €0 | +€15,000 | €75,000 |

| September | €160,000 | €16,000 | €10,000 | +€6,000 | €81,000 |

After six months, the cycle stabilizes. The acquirer always maintains a rolling buffer, while the merchant receives predictable payouts.

Capped vs Uncapped Rolling Reserves

A capped reserve has a defined limit, such as €100,000. After reaching the cap, no more funds are held.

A prepaid capped reserve collects the cap amount before processing begins, allowing full settlements thereafter.

An uncapped reserve grows indefinitely with sales, giving maximum protection to the acquirer but reducing liquidity for the merchant.

| Feature | Capped Rolling Reserve | Uncapped Rolling Reserve |

|---|---|---|

| Maximum Limit | Fixed (e.g. €100,000) | None |

| Liquidity Impact | Predictable after cap is reached | Increases with sales |

How to change a Rolling Reserve

Keep disputes comfortably below scheme attention

The single strongest signal you can send to an acquirer is a clean dispute profile. Aim to stay well below common network triggers and keep that trend stable over time. Build a dispute prevention loop that starts before the sale and continues after delivery. That means clear descriptors that match your brand, transparent refund terms, fast refunds where appropriate, proactive shipment updates, and customer support that resolves issues before a bank is involved. Use chargeback alerts to intercept bank disputes and close them as refunds where it makes sense. Present a monthly reason code breakdown and show how you fixed the top causes.

What to include in your evidence pack: rolling three to six months of dispute ratios, reason code trends, refund-to-sales ratio, and average dispute age to closure.

Raise the bar on fraud controls and document the impact

Acquirers care less about the tools you buy and more about the measurable reduction in risk. Deploy 3D Secure where it fits the journey, tune AVS and CVV rules, add velocity checks, and block high-risk BINs or geographies that do not convert. If you use a risk engine, show score distribution, acceptance thresholds, and false positive rates. If you adopted step-up authentication, show how disputes moved down after rollout.

What to show: before-and-after snapshots for fraud rates, the share of transactions with strong authentication, and any reduction in first-party fraud disputes.

Treat refunds as a risk control, not a loss

Fast, visible refunds prevent avoidable chargebacks. Publish a simple refund policy, repeat it on the checkout and in post-purchase emails, and give customers a self-serve status page. Measure refund speed from request to confirmation and include the median time in your reviews. Where you cannot refund, explain why, and document the communication trail. Acquirers reward predictability.

What to show: refund SLA adherence, percentage of disputes pre-empted by a timely refund, and examples of clear customer messaging.

Smooth the volume curve and make growth predictable

Reserves rise when volume is volatile. Level out promotions, signal seasonality in advance, and set soft caps per day or per campaign so approval and fraud models are not shocked by spikes. If you add a new product line or a new country, share the rollout plan and expected ticket sizes. Stability is a trust signal.

What to show: month-over-month volume stability, average ticket size distribution, and planned campaign calendars with expected uplift.

Report like an acquirer would

Do not wait for a review. Send a structured performance update on a regular cadence. Keep it concise and decision-ready.

What to include:

Processing overview: sales, refunds, approval rate, average ticket size, top countries.

Disputes and fraud: ratios, reason codes, chargeback alerts caught, 3DS adoption.

Operations: fulfilment times, on-time delivery rate, cancellation rate, support response speed.

Changes since last review: policy updates, fraud rule tuning, descriptor tests, new carriers or fulfilment partners.

Requests: the specific reserve change you want, backed by the data above.

Add independent assurance where it helps

External validation reduces perceived model risk. If you maintain PCI DSS compliance, include the current attestation. If a third-party fraud provider or chargeback partner supplies performance reports, attach those. If you improved KYC or content moderation in a higher-risk vertical, summarise the new control and link it to the reduction in disputes.

What to show: current PCI evidence, partner dashboards, and a short narrative that connects each control to an observed metric improvement.

Negotiate structure, not just percentage

Reserves are flexible instruments. If the headline rate is hard to move immediately, propose alternatives that improve liquidity without reducing protection.

Options to request:

A reserve cap at a defined amount so the balance stops growing once trust is established.

A shorter hold period after a probationary window if KPIs remain clean.

Conversion from uncapped rolling to capped rolling after a set period of stability.

A prepaid capped reserve that fills the cap upfront so future settlements pay in full.

A partial release of any surplus above recent dispute exposure.

Frame each request with data. For example, if your last six months of net liability never exceeded a certain threshold, the cap proposal should align with that figure plus a buffer.

Communicate early and often

Surprises create risk. Tell your acquirer about country launches, new fulfilment models, subscription trials, or marketing events ahead of time. Share the controls you will use, the expected uplift, and how you will monitor outcomes. When you treat the acquirer like a risk partner, reviews move faster and outcomes are more favourable.

What to keep steady: a single point of contact, a predictable reporting cadence, and a short written plan for any significant business change.

Example of a reserve reduction timeline

| Period | Average Chargeback Ratio | Fraud Ratio | Reserve Structure | Action Taken by Acquirer |

|---|---|---|---|---|

| Months 1–3 | 1.2% | 0.4% | 10% uncapped | Monitoring phase |

| Months 4–6 | 0.8% | 0.2% | 10% capped at €100,000 | Reserve capped |

| Months 7–9 | 0.5% | 0.1% | 5% capped at €50,000 | Reserve reduced |

| Months 10–12 | 0.3% | 0.1% | 0% reserve | Reserve removed |

Where FastoPayments Can Assist

FastoPayments supports onboarding and reserve management across:

European Union (EU)

European Economic Area (EEA)

United Kingdom (UK)

United States (USA)

Canada

Jersey, Guernsey, Isle of Man, and Gibraltar

How we help merchants

Onboarding consultation – Reviewing business model and risk profile before application.

Reserve negotiation – Securing capped or prepaid structures whenever possible.

Performance monitoring – Tracking data and initiating reserve reduction reviews.

Regional expertise – Guiding merchants across EU, UK, and North American acquirers.

Final Word From US

Rolling reserves are a necessary part of the acquiring ecosystem. They ensure the financial stability of payment networks while allowing merchants in all industries to process safely and responsibly.

Although reserves can restrict liquidity temporarily, they are not a permanent loss. With strong dispute management, clean processing data, and transparent reporting, merchants can gradually move toward reduced or fully removed reserves.

FastoPayments partners with merchants to ensure fair, transparent, and data-driven reserve management across all supported regions.

What is the typical rolling reserve percentage?

Rolling reserves generally range between 5 and 20 percent depending on the merchant’s risk category, transaction size, and processing history. Low-risk merchants, such as traditional retail or established e-commerce, often start at 5 percent for 30 to 90 days.

Higher-risk verticals, such as adult, travel, or subscription-based models, may see 10 to 20 percent with holding periods between 90 and 180 days. Acquirers periodically review performance, and consistent low dispute ratios often lead to a reduction or complete removal of the reserve.

Can a rolling reserve ever be removed entirely?

Yes. Rolling reserves are not meant to be permanent. Once a merchant demonstrates strong operational stability, low chargeback and fraud ratios, and a track record of compliant processing, the acquirer can remove the reserve altogether.

This typically occurs after six to twelve months of clean data. Merchants that present clear evidence through reporting and maintain active communication with their acquirer are more likely to have reserves reviewed and lifted sooner.

What is the difference between a capped and uncapped reserve?

A capped reserve has a defined upper limit. Once the cap is reached, no further funds are held, and existing reserves begin to roll and release on a predictable schedule.

An uncapped reserve, by contrast, continues to grow with each settlement until the acquirer adjusts the structure.

Capped reserves are preferred for merchants with consistent processing history and low chargeback rates. Uncapped reserves are more common for new or higher-risk merchants, giving the acquirer greater protection during the early stages of processing.

What is a prepaid capped reserve?

A prepaid capped reserve, also known as a pre-funded or upfront reserve, is collected before live processing begins. The acquirer sets a fixed cap amount, and the merchant either deposits or has early funds withheld to reach that balance.

Once the reserve is filled, future settlements are paid in full without additional holdbacks. This structure provides instant protection for the acquirer while allowing merchants to manage cash flow more easily over time.

How do chargebacks influence reserve structure?

Chargebacks directly affect how reserves are structured and reviewed. A higher chargeback ratio signals greater financial exposure for the acquirer and can lead to longer holding periods or higher percentages. Merchants maintaining ratios below 0.9 percent for Visa and Mastercard are generally considered compliant and trustworthy.

A sharp or repeated rise in chargebacks, especially above 1 percent, can trigger an increase in reserve percentage or the reintroduction of a hold. Monitoring chargeback reasons and preventing disputes early is the best way to keep reserves minimal and negotiable.

How long does it take for held funds to be released?

Funds in a rolling reserve are released automatically at the end of the agreed hold period. For example, in a 10 percent reserve with a 180-day hold, the funds collected in January are released in July.

Once the rolling cycle stabilizes, merchants receive predictable monthly releases that align with past performance. Some acquirers also allow partial or accelerated releases when dispute ratios improve significantly before the next review period.

Does FastoPayments help negotiate or manage rolling reserves?

Yes. FastoPayments works directly with acquirers to ensure that reserves are applied fairly and transparently. We review onboarding terms, negotiate capped or prepaid structures where possible, and help merchants gather performance data to support reserve reductions.

Our risk team also provides guidance on fraud prevention, chargeback mitigation, and operational compliance to build the foundation for smoother reviews and faster releases.

💡 Interested in learning more about what’s included in a typical high-risk merchant account? View our complete breakdown of FastoPayments’s high-risk merchant accounts.