Stop chargebacks before they start

Protect your business from costly chargebacks with simple, automated prevention tools that will save you time and money.

- Trusted by +500 companies

Prevention Solutions

Choose the right protection level for your business

Rapid Dispute Resolution (RDR)

Protect your business from costly chargebacks with simple, automated prevention tools that will save you time and money.

Transform your dispute management with automated resolution that prevents chargebacks before they occur.

Ethoca Alerts

Ethoca Alerts provide early notification of confirmed fraud and disputes, allowing merchants to stop orders before fulfillment, prevent chargebacks, and reduce unnecessary losses.

Stay ahead of disputes with Ethoca Alerts that give real-time notifications of confirmed fraud, helping you stop risky orders and cut chargeback losses.

Chargeback Alert Network (CDRN)

Real-time electronic alerts

Quick refund capabilities

Extended response window

Get 24-hour advance notice of potential chargebacks and maintain control over your dispute resolution process.

Response & Representment

Response and representment services help merchants fight chargebacks by identifying friendly fraud, compiling strong evidence, and increasing the chances of recovering lost revenue.

Strengthen your dispute process with response and representment that builds compelling evidence, overturns invalid claims, and secures revenue back to your business.

Turn Chargebacks Into Revenue with CE 3.0

Fight back against friendly fraud with Visa’s Compelling Evidence 3.0. By matching disputed purchases to past verified transactions, you can prove genuine customer activity and shift liability back to the cardholder. Gain higher win rates, protect revenue, and keep chargeback ratios low.

Stay Ahead with TC40 Fraud Alerts

Get notified the moment an issuer reports suspected fraud. TC40 alerts give you the chance to react fast, block repeat transactions, and reduce the risk of chargebacks hurting your business.

Win Back Customers with Order Insight

Resolve disputes before they turn into chargebacks. Order Insight shares detailed transaction data with issuers in real time, helping customers recognize purchases, prevent misunderstandings, and protect your revenue.

Stop disputes automatically

Stop chargebacks before they happen. Our Rapid Dispute Resolution (RDR) system automatically handles Visa disputes based on rules you set. With 99% coverage of Visa transactions and zero impact on your chargeback ratio, you can protect your revenue while saving time and money.

Compare Protection Options

Feature | Rapid Dispute Resolution (RDR) | Chargeback Alert Network (CDRN) |

Coverage | Visa only (99% of transactions) | 50% Visa, 60% Mastercard |

Resolution | Automatic based on rules | 24-hour window |

Best for | Digital goods, subscriptions, high-volume merchants | High-ticket items, complex services |

Impact on CB ratio | No impact on dispute ratio | May impact if not resolved |

Processing fees | Refund only | Potential chargeback fees if unresolved |

Our Partnership

Fasto has partnered with Chargebacks911 to deliver industry-leading chargeback prevention and dispute management solutions. By combining our merchant-first approach with Chargebacks911’s expertise in alerts, RDRs, CDRNs, Ethoca, and representment, we give businesses the tools to reduce losses, recover revenue, and protect long-term growth.

Working with Fasto allows us to extend our proven dispute management technology to more merchants who need reliable protection and recovery solutions.

Chargebacks911

This partnership ensures our clients have access to best-in-class chargeback alerts and representment services, helping them safeguard revenue and focus on scaling their business.

FastoPayments

FAQ

Frequently Asked Questions

Why should I partner with FastoPayments instead of other payment providers?

FastoPayments is more than a payment provider. We offer a complete ecosystem for partners, combining global card processing, banking solutions, local payment methods, hosting, and corporate structuring.

Our agile and tailored approach helps partners unlock new markets while ensuring compliance, speed, and scalability. We provide transparent communication and dedicated support at every step.

What types of businesses or consultants can partner with FastoPayments?

We welcome partnerships with consultants, financial intermediaries, agencies, hosting providers, and corporate service firms.

If your clients need payment processing, IBAN banking, mass payouts, or merchant accounts in high-risk sectors such as adult, nutraceutical, travel, or digital services, FastoPayments provides the expertise and infrastructure to support your growth.

What regions and industries does FastoPayments cover for partnerships?

FastoPayments operates globally with a strong presence across the UK, EEA, Europe, and North America. We specialize in industries including dating, travel, edtech, adult, vape and nutraceuticals.

Our partnerships help you serve clients needing secure payment gateways, merchant accounts, or cross-border banking.

How does FastoPayments support its partners?

Partners receive monthly strategic calls, solution overviews, and priority support. We ensure clear and transparent communication, provide updates on new services, and offer co-branded opportunities to strengthen your offerings.

Our success-driven approach is built on mutual growth and to enable options for partners which are not currently available.

Can I earn commissions or revenue share as a FastoPayments partner?

Yes, our partnership model includes competitive revenue sharing and commission structures for successful referrals and onboarded merchants.

Whether you are referring startups, established merchants, or high-risk businesses in industries like adult, dating, or vape, we provide fair and scalable incentives tailored to your efforts. We can work on a referral basis or as the main point of contact, whichever is preferred by you.

Does FastoPayments offer custom solutions for partners’ clients?

Absolutely. We do not believe in one-size-fits-all. Every partner’s client portfolio is unique, so we tailor payment processing, banking, and corporate structuring solutions to each client’s needs.

This includes bespoke merchant accounts, mass payout systems, full paytech infrastructure, chargeback prevention and fraud detection plus much more.

What onboarding process should I expect as a partner?

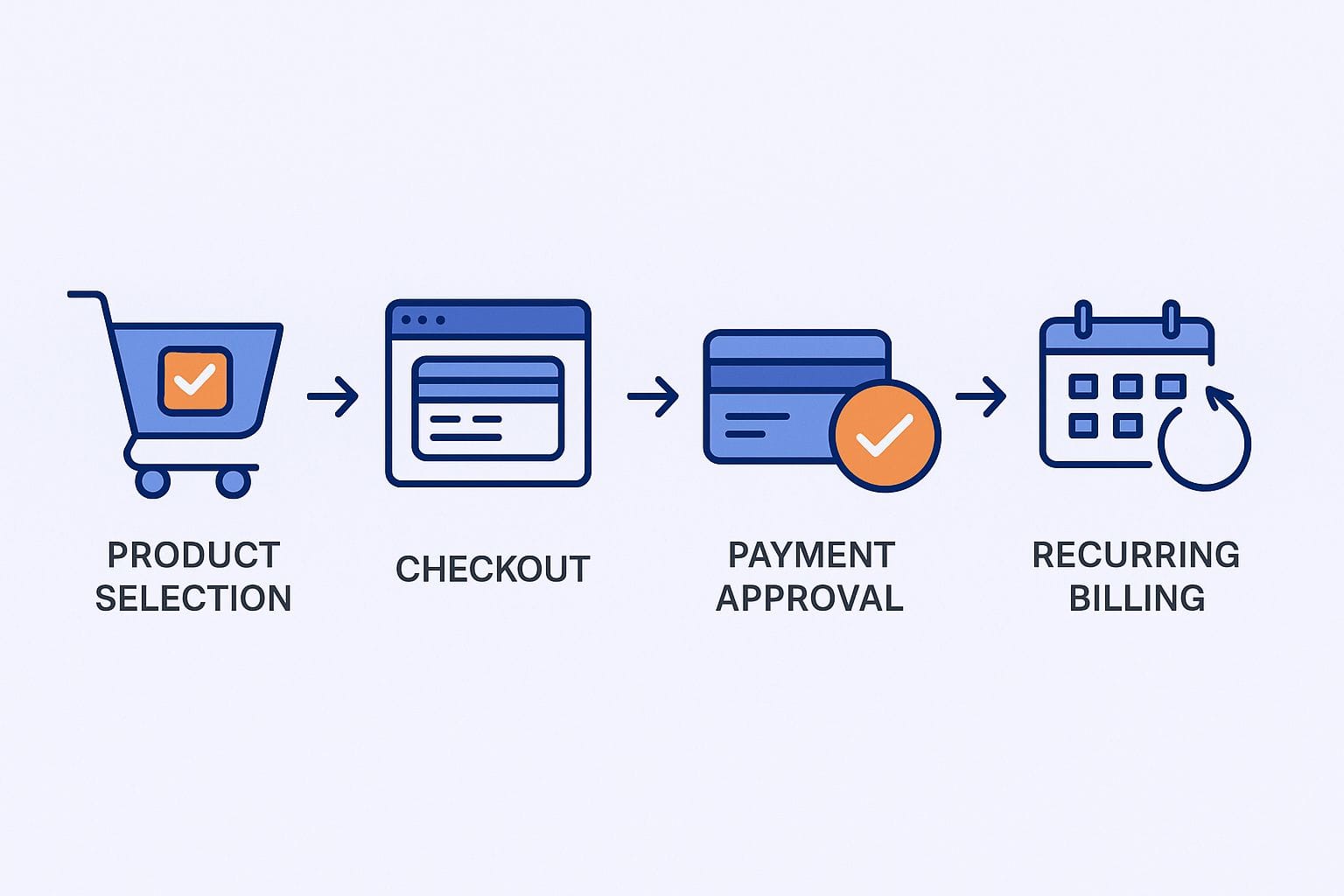

Partnering with FastoPayments is a simple and structured process.

Once you contact us, we schedule an initial call to understand your business and explore the potential fit.

If there is alignment, we sign a mutual NDA to ensure confidentiality and to assess the opportunities in more detail.

From there, we proceed with a formal partner agreement. Once signed, you are fully onboarded and ready to move forward with us.

We are also developing a dedicated partner dashboard that will provide real-time overviews of your referred merchants and earned commissions, giving you full visibility and control.

How can I get started with the FastoPayments partnership program?

Simply reach out via our partnership inquiry form or contact our team directly.

We will discuss your business model, partnership potential, and how we can collaboratively grow your revenue streams with payment processing, banking, and business structuring solutions.