The Complete Guide to Recurring Card Payments and Subscription Billing Systems

Introduction

Recurring billing, also known as recurring card payments, is a payment model that allows businesses to charge customers automatically for ongoing services or subscriptions. This approach is powered by a subscription billing system, which manages the entire process from sign-up to renewal. It is the foundation for many modern businesses, from SaaS platforms to membership sites and subscription boxes.

FastoPayments specializes in helping businesses set up and manage recurring billing with high approval rates, chargeback prevention, and seamless integrations for both low and high-risk industries.

What is Recurring Billing?

Recurring billing is an automated process where customers are charged on a regular schedule, such as weekly, monthly, quarterly, annually or is even up for interpretation, for access to products or services. The key difference from one-time payments is that the customer’s card is stored securely, and the payment is processed automatically until the customer cancels or the subscription ends.

For businesses, recurring billing creates predictable revenue. For customers, it eliminates the hassle of manually making payments each billing cycle.

Types of Recurring Payments

Recurring card payments can take several forms, depending on the subscription billing system and the product or service offered:

Time-Based Recurring Payments

Customers are charged at regular intervals such as weekly, monthly, quarterly, or annually. This model is common for SaaS products, gyms, streaming services, and membership programs and just about anything which provides content or product to the consumer on a monthly basis.

Usage-Based Recurring Payments

Billing is based on consumption or usage levels, such as data usage, API calls, or number of transactions. This is frequently used by telecom services, cloud platforms, and metered utilities.

Initial Payment Plus Recurring (Trial Subscriptions)

Customers start with a free or reduced-cost trial, then transition to standard recurring billing after the trial period. This model helps reduce friction during onboarding and increases conversion rates.

Hybrid Recurring Models

Some businesses combine models, such as charging an initial setup fee followed by monthly billing, or adding a base subscription fee plus usage charges.

How Does a Subscription Billing System Work?

A subscription billing system simplifies and automates recurring card payments. Here is how it typically works:

-

Sign-Up and Product Selection

The customer chooses a product or service plan that requires recurring payments. -

Checkout and Card Authorization

Payment details are securely captured, often using tokenization to avoid storing sensitive data directly. -

Automated Recurring Charges

The system processes payments at agreed intervals, sending confirmations and invoices automatically. -

Renewals and Upgrades

Customers can upgrade, downgrade, or renew subscriptions easily without re-entering payment details. -

Cancellation and Compliance

The process includes clear options for cancellation to comply with regulations and maintain trust.

Who Needs Recurring Card Payments?

Recurring billing is essential for businesses that provide ongoing access or continuous services. Examples include:

-

SaaS platforms and software tools

-

Subscription box services (food, beauty, lifestyle)

-

Gyms, wellness memberships, and personal training

-

Streaming services and content platforms

-

High-risk industries such as adult entertainment, online dating, and fan sites where FastoPayments specializes in providing secure recurring billing solutions

Benefits of Recurring Billing

-

Predictable Revenue

Businesses gain stable cash flow and can forecast future income more accurately. -

Customer Convenience

Automatic payments eliminate the need for customers to manually authorize transactions each time. -

Operational Efficiency

Reduces administrative work by automating invoicing and payment collection. -

Increased Customer Lifetime Value

Subscription models naturally encourage long-term relationships with customers.

Challenges and Chargeback Risks

Recurring billing has many advantages, but it also comes with challenges that must be managed carefully whereas one of them is chargebacks, the other could be fraud or continuing support offered to consumers, not understanding the process.

Chargebacks and Disputes

Customers may forget about a subscription or not recognize the transaction on their bank statement, leading to disputes and chargebacks. Visa’s VAMP rules introduced stricter chargeback thresholds, with most merchants needing to keep their ratios below 0.9%. Failure to do so can result in higher fees, penalties, or even termination of merchant accounts. For a deeper explanation, refer to our chargeback prevention guide.

Payment Failures

Payment failures occur when a scheduled recurring charge cannot be processed. This can happen for several reasons:

-

Expired Cards: Credit or debit cards often expire every 2–4 years. If the customer does not update their card details, the payment will automatically fail.

-

Insufficient Funds: Customers may not have enough balance available at the time of the recurring charge, which leads to a declined transaction.

-

Bank Declines or Network Errors: Occasionally, payments fail due to bank-side fraud checks, connectivity problems, or processing errors.

-

Closed Accounts: If a customer cancels their card or switches banks, future recurring payments cannot be processed until new details are provided.

These failures disrupt cash flow and may lead to service interruptions, customer churn, or additional support costs. A strong subscription billing system addresses this by:

-

Sending automated reminders to update card details before expiration

-

Offering multiple payment methods (credit, debit, local alternatives) to reduce reliance on a single card

-

Retrying failed transactions using smart retry logic (e.g., retrying after 24 or 48 hours)

-

Notifying customers immediately about failed payments to encourage quick resolution

-

Additional merchant accounts could be used as it always depends on acquirer as well as gateway as they can contribute to certain decline reasons

Customer Churn

Customer churn refers to the percentage of subscribers who cancel their recurring payments or fail to renew their subscriptions. High churn rates are common in recurring billing models and can severely affect predictable revenue.

Why churn happens:

-

Customers may forget about the value they are receiving and cancel to cut expenses.

-

A lack of clear communication regarding billing cycles or price changes can lead to frustration.

-

Poor user experience or service interruptions can push customers to competitors.

-

Unclear cancellation policies may create distrust, prompting disputes or chargebacks instead of orderly cancellations.

Impact of churn:

-

Reduced recurring revenue and difficulty forecasting cash flow

-

Increased acquisition costs as you must replace lost customers

-

Damage to brand reputation if cancellations lead to disputes or negative reviews

How to reduce churn:

-

Provide transparent billing information and reminders before renewal dates

-

Offer flexible plans, including pause options, upgrades, or downgrades instead of forcing cancellations

-

Use automated win‑back emails or targeted offers to re‑engage customers

-

Analyze cancellation reasons to improve services or pricing

Compliance Requirements

Businesses handling recurring card payments must follow strict security and regulatory standards to protect customer data and avoid legal or financial penalties. The two most critical areas are payment security compliance and consumer protection policies.

Payment Security (PCI DSS Compliance)

The Payment Card Industry Data Security Standard (PCI DSS) is mandatory for any business that stores, processes, or transmits cardholder data. For recurring billing, this means:

-

Secure storage of payment details using tokenization or encryption to prevent unauthorized access.

-

Regular security audits to ensure systems remain compliant and resistant to breaches.

-

Network monitoring and vulnerability scans to detect and mitigate risks before they affect customers.

-

Access controls ensuring only authorized personnel handle sensitive payment information.

Failing to comply can result in heavy fines, loss of processing privileges, and severe reputational damage.

Consumer Transparency and Cancellation Policies

Regulations also require clear disclosure of billing terms and easy cancellation processes to protect customers. This includes:

-

Clear communication of billing frequency, renewal dates, and amounts at the point of purchase.

-

Providing reminders before trial periods end or before significant price changes.

-

Ensuring cancellation is simple, often requiring just a few clicks, and confirming cancellations via email or receipts.

-

Adhering to Visa’s VAMP (Visa Acquirer Monitoring Program) requirements, which set strict thresholds for disputes and chargebacks in subscription models.

Global Considerations

If you serve international customers, additional compliance factors may apply:

-

GDPR (General Data Protection Regulation) for European customers, which governs how personal and payment data is collected and stored.

-

Local consumer protection laws in each operating country, which may have stricter rules on refunds, cancellations, or trial periods.

By building compliance into your subscription billing system from the start, you reduce risk, improve customer trust, and avoid costly disputes with card networks or regulators.

How FastoPayments Helps

FastoPayments provides a tailored subscription billing system for businesses that need reliability, flexibility, and compliance. Our solutions include:

-

High Approval Rates

We partner with acquiring banks experienced in high-risk and subscription models to maximize transaction success. -

Chargeback Management

Integrated tools to monitor disputes and ensure alignment with Visa’s VAMP rules. -

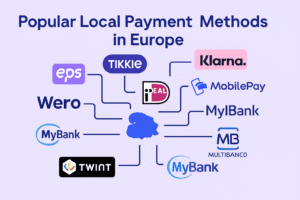

Multiple Payment Options

Accept credit cards, local payment methods, and alternative options to serve a global audience. -

Seamless Integration

Easy-to-use APIs and hosted payment pages that work with major e-commerce platforms like Shopify, WooCommerce, and custom builds. -

Global Coverage

Support for recurring card payments across Europe, North America, and beyond.

Real-World Example: Luzzoo

One of our clients, Luzzoo, needed a robust recurring billing solution to manage ongoing subscription payments. Their business model required high approval rates and strong chargeback protection due to operating across multiple markets.

By implementing FastoPayments’ subscription billing system, Luzzoo was able to:

-

Automate recurring card payments securely using tokenization

-

Improve approval rates with optimized routing to acquiring banks

-

Reduce chargebacks through proactive alerts and Visa VAMP-compliant processes

-

Provide a seamless customer experience, increasing retention and lifetime value

This example highlights how the right recurring billing partner can help businesses scale and maintain compliance in high-risk or global markets.

Is Recurring Billing Right for Your Business?

If your business relies on repeat customers, predictable revenue, or a membership model, recurring billing is an essential strategy. Implementing the right subscription billing system ensures seamless customer experience, higher retention rates, and better cash flow management.

FastoPayments offers scalable solutions that handle compliance, reduce chargeback risks, and optimize approval rates for merchants in both low and high-risk industries.

💡 Interested in learning more about what’s included in a typical high-risk merchant account? View our complete breakdown of FastoPayments’s high-risk merchant accounts.