What Is a PSP (Payment Service Provider)?

A Payment Service Provider (PSP) is a company that enables businesses to accept and manage payments across different channels, including online stores, mobile apps, and physical points of sale. A PSP itself is not a licensed financial institution. Instead, it operates as a facilitator that connects merchants to licensed acquiring banks, card networks, and other payment partners.

In practice, a PSP combines technology, partnerships, and commercial expertise to give merchants a complete payment infrastructure. It provides the payment gateway, transaction routing, and reporting tools that make accepting global payments simple and efficient. By bridging the gap between merchants and acquirers, a PSP helps businesses enter new markets faster and handle transactions more effectively.

How a PSP Works

A PSP operates as both a technical and commercial intermediary, managing every stage of a transaction from initiation to settlement. Its platform ensures that payments are secure, optimized, and connected to the right financial partners.

1. Transaction capture and data protection

When a customer makes a payment, the PSP captures the details securely through an API, checkout form, or POS terminal. The data is encrypted to comply with PCI DSS standards before being transmitted to the acquiring bank or payment network.

2. Authorization and routing

The PSP sends the transaction to the appropriate acquiring bank or network for approval. Many PSPs use intelligent routing, which selects the acquirer most likely to approve a specific card type, BIN, or region. This improves success rates and reduces declines.

3. Fraud checks and authentication

Before a transaction is finalized, the PSP applies multiple fraud screening layers. These may include 3D Secure verification, velocity checks, device fingerprinting, and AI-driven risk scoring. This step helps merchants lower chargeback ratios and prevent fraudulent activity.

4. Settlement and reconciliation

Once approved, the acquirer processes the payment, and the PSP provides the merchant with detailed transaction records. The PSP itself does not hold or move funds but supports full visibility of settlements and payouts through reporting tools.

5. Compliance and analytics

PSPs monitor activity along with compliance of the acquirers within their regulations such as AML and card network standards. They also provide analytics dashboards where merchants can track authorization rates, chargebacks, refunds, and overall performance across different payment methods and regions.

Through this process, the PSP serves as the technical backbone that connects merchants with the broader payment ecosystem.

PSP vs Direct Acquirer

A PSP and an acquiring bank work closely together, but their roles are distinct.

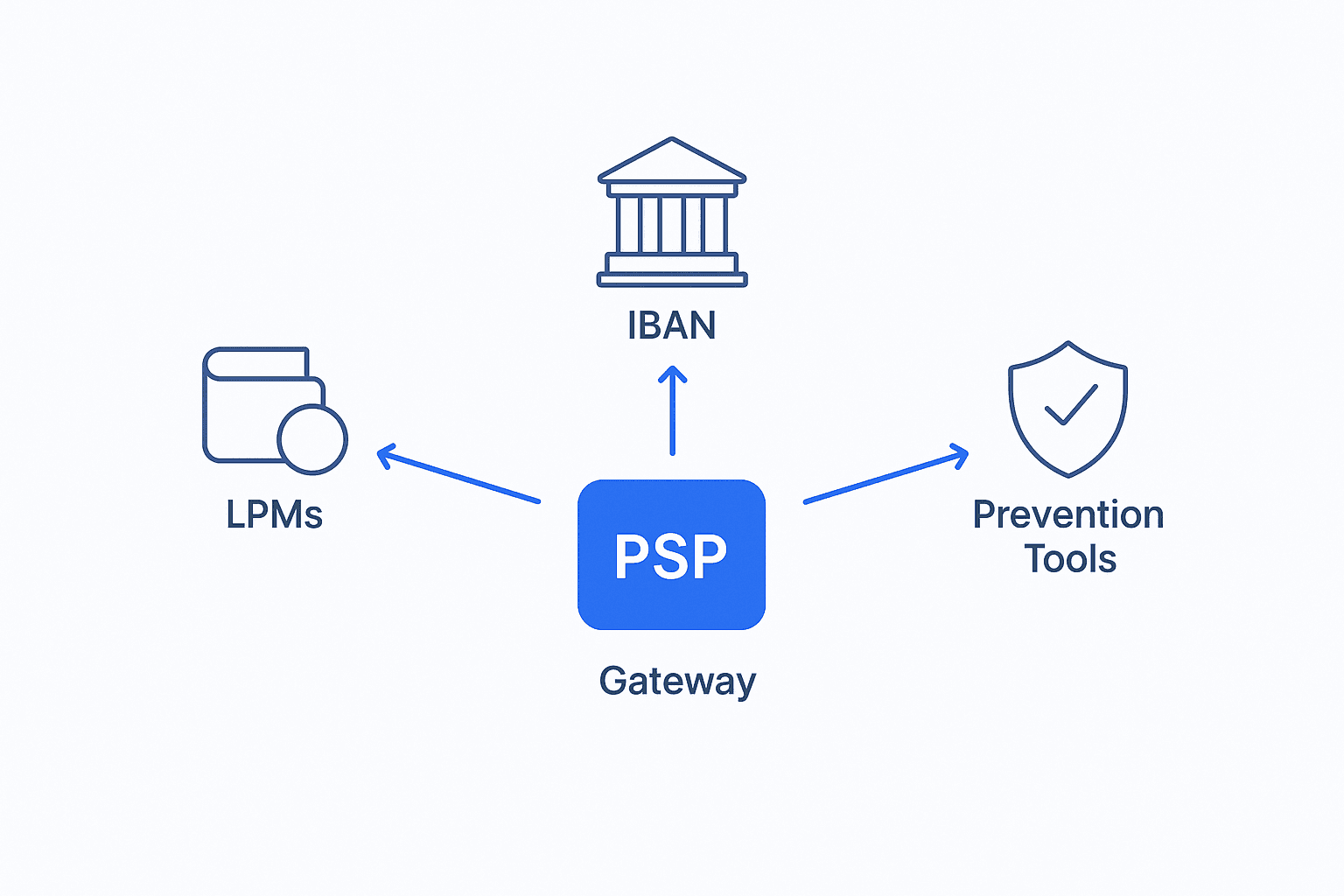

A PSP acts as an intermediary. It focuses on providing the technology and connections needed to process payments across multiple partners. Merchants gain access to several acquiring banks, local payment methods, and fraud prevention tools through a single integration.

An Acquirer is a licensed financial institution that handles the actual flow of funds between the cardholder and the merchant. The acquirer manages the merchant account, performs settlement, and carries regulatory responsibility for holding and transferring funds.

Merchants using a PSP benefit from flexibility and improved coverage. According to industry research, businesses working with multi-acquirer PSP setups see approval rates up to 12 percent higher than those using a single acquirer.

Core Services of a PSP

A modern PSP combines technology, analytics, and commercial partnerships to provide a complete solution for payment acceptance and optimization.

Payment acceptance

Merchants can process Visa, Mastercard, American Express, SEPA transfers, and a wide range of local payment methods such as iDEAL, Bancontact, Bizum, Klarna, and MobilePay. This allows them to serve customers across regions and preferences.

Recurring billing and subscriptions

PSPs manage recurring payments for membership platforms, subscription services, and digital content providers. Automated renewals and retry logic reduce churn and maintain steady revenue streams.

Mass payouts and disbursements

For affiliate programs, partner networks, and content creators, PSPs support large-scale outgoing payments through cards, bank accounts, or local methods, providing faster and compliant global disbursement capabilities.

Fraud prevention and chargeback management

Modern PSPs use AI-driven tools, BIN tracking, and behavioral analysis to detect suspicious activity before it impacts merchants. They also help manage chargebacks by providing insights into dispute sources and prevention strategies.

Tokenization and secure data storage

Tokenization replaces sensitive card information with secure identifiers. This keeps customer data safe, enables one-click and recurring payments, and ensures compliance with global data protection standards.

Multi-currency processing and settlement reporting

PSPs support multiple currencies and offer detailed reporting across acquirers and currencies. While they do not handle the funds themselves, they provide a full view of transaction performance and settlement flow.

Together, these capabilities allow merchants to streamline operations, improve success rates, and scale efficiently without the complexity of managing multiple banking relationships.

Why Businesses Choose PSPs

Working with a PSP simplifies payment management and accelerates business growth. Instead of setting up individual connections with each bank or payment network, merchants can use one platform for all transactions.

The main benefits include:

-

Access to multiple acquirers and local payment methods through one integration.

-

Improved approval rates and reduced failed transactions.

-

Centralized reporting across currencies, regions, and payment partners.

-

Simplified compliance, with the PSP maintaining data security and technical standards.

-

Faster onboarding and easier market expansion.

These advantages make PSPs essential partners for businesses that operate internationally, manage recurring revenue, or work within higher-risk industries that require adaptable and reliable payment infrastructure.

The Importance of Flexibility

Flexibility is what defines a modern PSP. Merchants need partners that can evolve with their operations, customer preferences, and market changes.

At FastoPayments, flexibility means providing more than just payment routing. Through tools like MeHosting, merchants gain access to fast, secure web hosting and infrastructure that support their online platforms. Combined with corporate structuring, IBAN banking offering and localized payment options, this ecosystem helps businesses scale globally while staying compliant and efficient.

A PSP is a strategic technology partner that connects merchants to a network of financial institutions and tools, helping them increase approval rates, reduce risk, and expand into new markets with confidence.

What is the main role of a Payment Service Provider (PSP)?

A Payment Service Provider helps merchants accept and manage payments without setting up direct relationships with banks or card networks. It acts as the technological and commercial bridge between the merchant and the acquiring banks.

The PSP provides the gateway, transaction routing, fraud checks, and reporting, while the acquirer handles fund settlement and holds the financial license.

Is a PSP a licensed financial institution?

No. A PSP is not a licensed entity. It partners with licensed acquirers and financial institutions to process transactions.

The PSP’s focus is on technology and infrastructure, not on holding or moving funds. The acquirer is the party responsible for regulatory and financial compliance.

What is the difference between a PSP and a payment gateway?

A payment gateway is a technical tool that captures and encrypts payment data.

A PSP includes a gateway but also manages acquirer connections, risk systems, and reconciliation tools.

Think of the gateway as one component, while the PSP represents the complete payment ecosystem that surrounds it.

How do PSPs help merchants improve approval rates?

PSPs use multi-acquirer routing to send each transaction to the acquirer most likely to approve it.

This reduces declines and increases successful payments. They also monitor BIN ranges, currency compatibility, and regional performance, which helps merchants achieve higher acceptance rates and fewer lost sales.

Do PSPs handle compliance and data security?

Yes. PSPs maintain PCI DSS certification and use data encryption to protect every transaction. They also ensure merchants follow card network standards and anti-fraud regulations.

However, the acquirer remains responsible for the flow of funds and the main regulatory oversight.

Can a PSP support high-risk or international merchants?

Yes. Many PSPs specialize in high-risk or cross-border industries. By working with multiple acquiring partners and offering local payment methods (LPMs), they provide merchants with stronger coverage, higher approval rates, and alternative banking options suited to their risk profile.

How does a PSP differ from an acquirer or merchant account provider?

An acquirer is a licensed bank that processes and settles payments. A PSP is the intermediary that connects the merchant to one or more acquirers through a single integration.

The PSP manages technology, reporting, and fraud tools, while the acquirer handles fund movement and compliance.

What are local payment methods (LPMs) and why are they important?

Local payment methods are region-specific ways to pay, such as iDEAL in the Netherlands, MobilePay in Denmark, or Bizum in Spain.

A PSP integrates these into one system, helping merchants reach more customers and increase checkout conversions by offering familiar payment choices.

Can a PSP provide mass payouts or recurring billing?

Yes. Many PSPs offer recurring billing for subscription-based businesses and mass payout tools for affiliates or partners.

These features reduce administrative work, improve cash flow control, and create a smoother financial operation for global merchants.

Why should a business use a PSP instead of integrating directly with a bank?

Working directly with a bank limits flexibility.

A PSP provides access to multiple acquirers, alternative payment methods, fraud systems, and unified reporting through one integration.

This gives merchants faster setup, broader market reach, and better transaction performance without managing complex individual connections.

💡 Interested in learning more about what’s included in a typical high-risk merchant account? View our complete breakdown of FastoPayments’s high-risk merchant accounts.