Visa’s VAMP: Understanding the New Fraud and Chargeback Calculations That Could Put You at Risk

Visa’s updated compliance model, the Visa Acquirer Monitoring Program (VAMP), is more than just a policy refresh. It is a major shift in how fraud and chargebacks are tracked, calculated, and penalized. Whether you are a merchant, a PSP, or an acquirer, this system changes how risk is measured and enforced across the entire payments ecosystem.

Let’s break it down: what VAMP replaces, how the new ratios are calculated, and why it matters more than ever to get proactive about fraud prevention and chargeback management.

What Did Visa Replace, and Why?

Before VAMP, Visa managed fraud and dispute risk through two separate frameworks:

Visa Fraud Monitoring Program (VFMP)

Visa Dispute Monitoring Program (VDMP)

Each program evaluated individual merchants based on thresholds. If a merchant received over 100 chargebacks in a month and exceeded a 0.9 percent chargeback-to-transaction ratio, they would get flagged. Similarly, a fraud ratio above 1.0 percent triggered inclusion in VFMP.

While this model served its purpose, it also had blind spots. Acquirers could onboard dozens of borderline-risk merchants, each staying just under the thresholds, yet collectively exposing the ecosystem to high levels of fraud. Visa took notice.

VAMP introduces a unified model that shifts the focus from individual merchants to the entire acquiring portfolio.

From Individual Merchant Monitoring to Portfolio-Level Risk

Under VAMP, Visa no longer looks at merchants in isolation. Instead, acquirers and payment providers are held accountable for the aggregate performance of their merchant portfolios.

This means:

If an acquirer is onboarding high-risk merchants without proper fraud controls, they could face fines or restrictions, even if no single merchant crosses the threshold.

Merchants are at risk of being dropped, not because of their own performance, but because their PSP is under pressure to clean up the portfolio.

The use of fraud prevention tools, including 3D Secure, RDR (Rapid Dispute Resolution), and chargeback alerts, is now considered critical, not optional.

Recurring billing businesses, such as subscription services, membership programs, and SaaS providers, face particular challenges here. Forgotten renewals, unclear billing cycles, and outdated payment methods can lead to higher dispute rates, which in turn raise a portfolio’s VAMP ratio.

How Visa Now Calculates Risk: TC40, TC15, and TC05

To determine whether an acquirer or merchant portfolio exceeds acceptable fraud or dispute thresholds, Visa uses internal reporting codes. These include:

| Code | Meaning |

|---|---|

| TC40 | Fraud reports submitted by issuing banks. Triggered when fraud is suspected, even before a formal chargeback is filed. |

| TC15 | Actual chargebacks (disputes), including both fraud-related (code 10.x) and non-fraud categories. |

| TC05 | Total number of settled Visa transactions in the given month. |

Formula:(TC40 + TC15) ÷ TC05 = Fraud or Dispute Ratio

Example

You have:

100 TC40 fraud alerts

50 TC15 chargebacks

12,000 TC05 settled transactions

(100 + 50) ÷ 12,000 = 1.25 percent

This chart illustrates how TC40 fraud reports and TC15 chargebacks combine to form the fraud or dispute ratio against TC05 transactions. Even a slight increase in fraud or disputes can raise the ratio significantly if overall transaction volume does not grow in parallel.

That 1.25 percent fraud or dispute ratio is above Visa’s standard thresholds and would likely trigger compliance action under VAMP.

VAMP Penalty Stages: What Happens if You’re Flagged?

Visa applies tiered thresholds to classify acquirers, and by extension, their merchants, into different risk levels:

| Stage | Ratio Threshold | What Happens |

|---|---|---|

| Above Standard | 0.5% – 0.7% | Warnings and monitoring begin, portfolio review required |

| Excessive | 0.7% – 1.0% | Fines start, stricter fraud controls, required use of 3D Secure |

| Severe Breach | 1.0% and above | Highest penalties, possible account terminations and reviews |

How Acquirers Respond Internally to VAMP Flags

When an acquirer is flagged under VAMP, the impact does not just come from Visa’s side. Acquirers often take internal risk-control actions to protect themselves and meet Visa’s remediation demands. This can include:

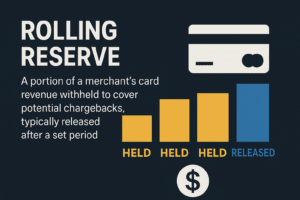

Reserve Increases: Raising rolling reserves or adding upfront security deposits for merchants considered higher risk.

Portfolio Audits: Reviewing all merchants for patterns of fraud or disputes, including recurring billing merchants where renewal disputes are common.

Transaction Caps: Imposing temporary limits on processing volumes to manage exposure.

Tighter Onboarding Standards: Freezing approvals for new high-risk merchants until ratios improve.

These actions are often taken before Visa imposes the harshest penalties. Merchants can feel the effects even if they are personally compliant. Working with a PSP that communicates clearly about these steps is essential.

Recurring Billing Risks Under VAMP

Recurring billing merchants face unique challenges because disputes often arise from:

Forgotten subscriptions or auto-renewals customers didn’t recognize.

Outdated card details triggering failed rebills that appear suspicious.

Lack of clear reminders or cancellation flows leading to “friendly fraud.”

Best Practices for Recurring Billing Merchants

Send pre-renewal reminders before charges occur.

Provide self-service portals for cancellations and payment method updates.

Use descriptive billing descriptors that clearly identify your service.

Apply 3D Secure where possible, even for stored credentials.

These measures help subscription-based businesses keep disputes and fraud low, which is essential for maintaining a healthy VAMP ratio.

Checklist: How Merchants Can Avoid VAMP Flags

Track and Monitor

Review fraud and chargeback ratios weekly.

Set alerts for unusual spikes in disputes.

Implement Security Measures

Enable 3D Secure on card-not-present transactions.

Deploy AI-based fraud filters and device fingerprinting.

Resolve Disputes Proactively

Use RDR and CDRN tools to address disputes early.

Offer clear refund policies and communicate with customers.

Optimize Billing Practices

Ensure billing descriptors are clear to prevent confusion.

For recurring billing, send renewal reminders, allow flexible cancellations, and clearly display subscription terms to avoid misunderstandings.

Work With the Right PSP

Partner with providers experienced in high-risk compliance and recurring billing models.

Quick FAQ About VAMP Compliance

Does VAMP replace VFMP and VDMP?

Yes. VAMP combines fraud and dispute monitoring into one program.

Do merchants see TC40 fraud alerts?

No. TC40s are shared between issuing banks and Visa, not shown in merchant dashboards.

Does resolving a dispute remove it from VAMP calculations?

No. TC40 and TC15 events remain counted even if resolved or refunded.

Can a compliant merchant still be penalized if their PSP is flagged?

Yes. Visa penalizes the acquirer’s portfolio, so compliant merchants can still face consequences.

What’s New in 2025 for VAMP?

In 2025, Visa introduced adjustments to VAMP thresholds and monitoring processes:

Stricter “Above Standard” levels: Closer to 0.5% portfolio thresholds.

Expanded coverage: Applies to more merchant categories, including emerging fintech and subscription models.

Faster remediation timelines: Acquirers are expected to submit corrective plans within shorter windows, often 30 days.

Heightened scrutiny on recurring billing: Due to rising subscription-based disputes, Visa is actively flagging acquirers with high renewal-related chargebacks.

How FastoPayments Helps You Stay VAMP-Compliant

At FastoPayments, we do more than process payments. We help merchants stay compliant, reduce exposure to penalties, and continue operating with confidence.

Our Support Includes:

Smart Chargeback Prevention: Automated alerts and dispute tools.

Integrated Fraud Filters: AI-driven screening and full 3D Secure implementation.

Transparent Risk Dashboards: Live tracking of fraud and chargeback activity.

RDR and CDRN Support: Fast resolution before disputes escalate.

High-Risk Expertise: Proven strategies for industries like adult, CBD, coaching, subscriptions, and recurring billing models.

VAMP raises compliance expectations but also offers an edge to merchants who are prepared. FastoPayments ensures you meet those expectations and protect your revenue.

Want to make sure your business is VAMP-ready? Contact our team to get started.

💡 Interested in learning more about what’s included in a typical high-risk merchant account? View our complete breakdown of FastoPayments’s high-risk merchant accounts.