Understanding Transaction Authorizations and Their Impact on Payments

Every card payment begins with authorization, the point where a transaction is approved or declined. Managing this step correctly can raise approval rates, reduce chargebacks, and build stronger customer trust.

This guide explains the main authorization types and how to use them to improve your payment flow and protect your business.

What is an Authorization?

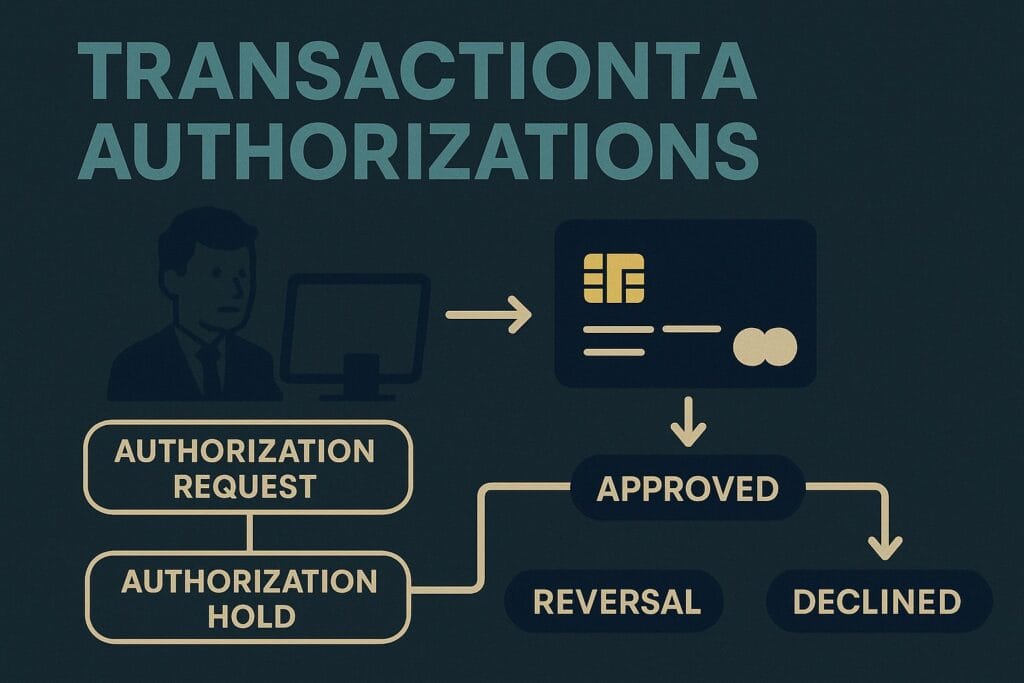

An authorization confirms whether a cardholder has sufficient funds and whether the transaction appears valid. It is a temporary hold, not an immediate charge.

The process begins when the merchant’s PSP sends a request through the card network to the card issuer. The issuer checks available funds, spending limits, and possible fraud indicators before sending a response. This response determines whether the transaction is approved, declined, or referred for further review.

When approved, the merchant can capture the funds immediately or adjust the transaction amount before settlement. This verification stage defines the reliability and safety of the entire payment process.

Standard Authorization

This is the most straightforward and commonly used type of authorization. It is typically completed within hours, allowing merchants to confirm the transaction and capture the payment quickly.

Standard authorizations work best for instant sales, such as online retail or quick service transactions, where goods or services are delivered immediately. It is the default process for most e-commerce and point-of-sale payments.

Pre-Authorization

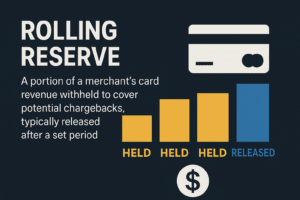

A pre-authorization, also known as an authorization hold, reserves funds on the customer’s card without completing the charge. This type gives merchants flexibility to confirm product availability, verify identity, or adjust amounts before settlement.

It is frequently used by hotels, rental services, travel merchants, and subscription platforms that handle delayed fulfillment. By holding funds, merchants can secure payment while reducing refund requests, chargeback risk, and customer disputes.

Related Reading:

Pre-authorizations are one of the most effective ways to protect merchants from disputes and unnecessary declines. They allow funds to be verified before capture while giving customers flexibility. For a deeper look at how pre-authorizations work, including real-world use cases and compliance steps, read our full guide on Pre-Authorizations in Payment Processing.

Incremental Authorization

Incremental authorizations are used when the final transaction amount exceeds the initial authorization. Rather than processing a new charge, the merchant extends the original one, maintaining compliance and improving user experience.

Common in hospitality, travel, and SaaS models, incremental authorizations cover cases such as extended hotel stays or upgrades during a subscription period. They ensure accurate billing while preserving customer trust through transparency and proper linkage to the original authorization.

Partial Authorization

A partial authorization allows the transaction to proceed even if the full amount is not available. The approved amount is processed, and the remaining balance can be covered through another payment method.

This approach is valuable for retail environments or marketplaces where split payments are common. It prevents full declines, keeps conversion rates high, and gives customers flexibility in completing their purchase.

Reauthorization

When an authorization expires before capture, a reauthorization confirms that the funds are still available. This typically occurs with subscription renewals, pre-orders, or delayed shipments.

Reauthorizing ensures that merchants remain compliant with card network rules and maintain a seamless payment experience for returning customers. It also reduces the risk of late presentment chargebacks and processing errors.

Reversal or Void

If a customer cancels an order or the merchant decides not to complete a transaction, a reversal (void) releases the hold on the customer’s funds. This step is crucial in maintaining transparency and preventing unnecessary disputes.

Sending reversals quickly, ideally within 24 hours, helps maintain positive customer relationships and reduces administrative work related to chargebacks or refund claims.

Why Authorization Management Matters

Strong authorization management is more than operational efficiency; it directly influences merchant reputation and approval rates. A smooth, well-timed authorization flow prevents false declines, keeps compliance high, and strengthens customer confidence.

Merchants who actively manage their authorization logic can detect patterns, identify unnecessary declines, and use acquirer routing strategies to maximize success. For high-risk merchants or cross-border sales, this step can make the difference between stable revenue and lost transactions.

How FastoPayments Helps Merchants Optimize Authorizations

FastoPayments provides merchants with technology built to improve approval ratios and protect every stage of the transaction. Through advanced routing, automated reversals, and support for complex authorization types like pre and incremental, we simplify what many acquirers treat as rigid.

Our solutions include real-time analytics on approval trends, acquirer response codes, and issuer decline reasons. Whether operating in adult, travel, SaaS, or high-risk industries, FastoPayments gives merchants the control they need to keep transactions secure, compliant, and profitable.

Where Strategy Meets Performance

Each authorization is a moment of truth that decides between revenue and rejection. With the right strategy and technology, that moment can work in your favor.

FastoPayments helps merchants turn complex authorization handling into a data-driven advantage. From first approval to final capture, we give businesses the tools to improve efficiency, prevent losses, and build trust at every step of the payment process.

What is a transaction authorization in payments?

A transaction authorization is the process where a card issuer verifies if a customer has sufficient funds and if the transaction appears valid.

It is a temporary hold placed before the final payment capture. Authorizations protect both merchants and customers by ensuring funds are available and fraud checks are passed before completing the charge.

What is the difference between authorization and capture?

Authorization reserves the funds on a customer’s account, while capture completes the transaction and transfers the funds to the merchant.

In many cases, these happen together, but some merchants use pre-authorization to confirm funds before capture, especially in industries like travel and hospitality.

How long does a card authorization last?

The duration of a card authorization depends on the card network and issuer.

Typically, Visa authorizations expire after seven days, while Mastercard may hold them for up to 30 days. If not captured within that window, the authorization is automatically released back to the cardholder.

What is a pre-authorization hold and when should merchants use it?

A pre-authorization hold reserves funds without completing the payment. Merchants use it when final amounts are uncertain or when they want to confirm availability before delivering goods or services.

It is widely used in hotels, rental services, and recurring billing to reduce refund and chargeback risks.

What is a reversal or void in payment processing?

A reversal, also known as a void, cancels an authorized transaction before it settles. This releases the hold on the customer’s account.

Merchants use reversals to prevent unnecessary charges when an order is canceled or updated, helping reduce disputes and maintain customer trust.

💡 Interested in learning more about what’s included in a typical high-risk merchant account? View our complete breakdown of FastoPayments’s high-risk merchant accounts.