Online & Recurring Payment Solutions for Subscription Businesses

Subscription-based businesses often face unique challenges when it comes to payment processing, from recurring billing complexities to elevated fraud and chargeback risks. FastoPayments provides reliable, compliant solutions tailored for content platforms, SaaS products, memberships, and digital services. Our system supports recurring payments, smart billing logic, and built-in fraud prevention to keep your revenue flowing securely.

- Trusted by +500 companies

BENEFITS

High-Risk Merchant Account Benefits for Subscription Businesses

With over 1 million transactions processed monthly worldwide, FastoPayments provides secure recurring billing and payment solutions for high-risk subscription businesses, including adult platforms, membership services, and digital content providers, no matter where you’re located.

- Complete subscription payment processing solution designed for high-risk businesses, including adult platforms, digital services, and membership-based websites.

- Expertly managed merchant accounts for subscription businesses, backed by over 10 years of experience in high-risk payment processing.

- VIP-level support available 24/7 via our platform, live chat, and more — because your business runs around the clock.

Enabling Subscription Businesses with Flexible and Secure Payment Systems

Choosing the right high-risk merchant account is critical for subscription-based businesses. From recurring billing to secure card processing, a reliable payment solution ensures smooth transactions and satisfied subscribers, even in high-risk or restricted industries.

At FastoPayments, we provide tailored payment solutions that support growth across SaaS, membership platforms, content services, and other recurring revenue models. Our system supports multiple billing cycles, dynamic retry logic, and global payment options.

With built-in fraud and chargeback prevention, real-time analytics, and automated subscription management tools, you gain full control over your revenue flow. Our platform helps you reduce churn, identify subscriber trends, and refine your strategy with data-backed insights.

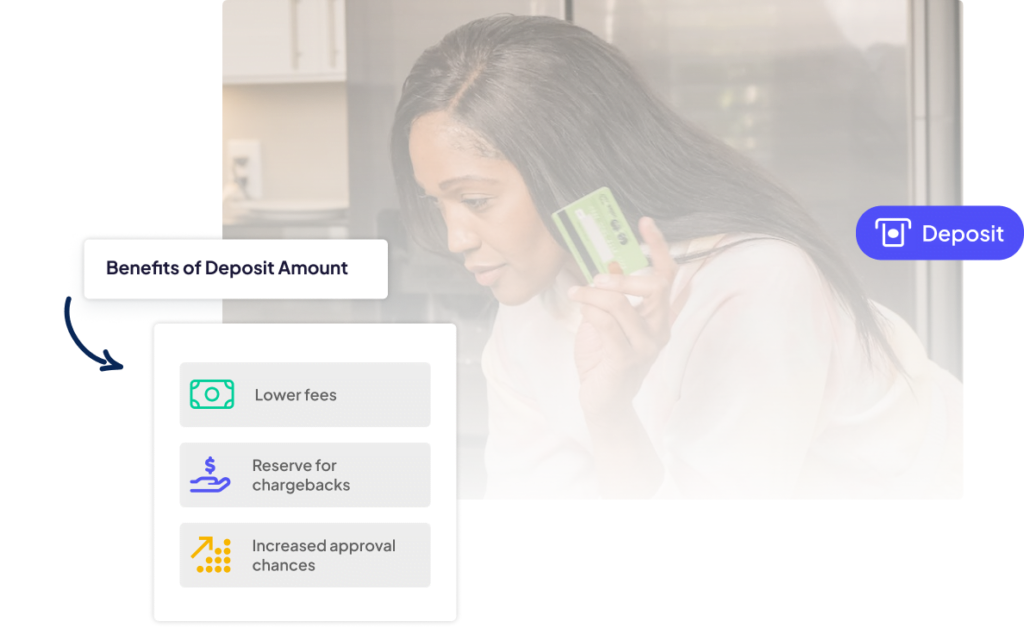

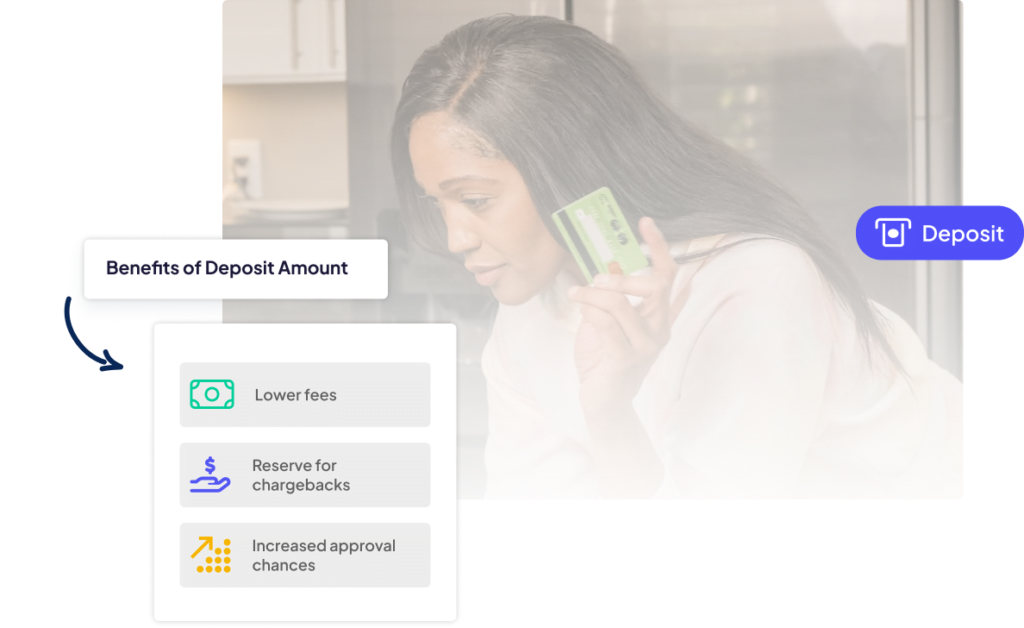

We also offer flexible pricing, seamless dispute handling, and fast onboarding so you can stay compliant and competitive without the risk of frozen funds or unnecessary disruptions.

Grow your subscription business with confidence. FastoPayments delivers the infrastructure you need to scale securely.

Reliable Merchant Services for Recurring Billing

and Subscription Models

Subscription businesses face unique payment challenges, especially in high-risk industries. FastoPayments simplifies the process by offering customized solutions built for recurring transactions, international billing, and chargeback protection. Whether you run a content platform, SaaS product, or membership service, our system adapts to your business model and helps you operate efficiently while staying compliant.

Recurring Billing Solutions

Tap into our deep experience in recurring payment processing to scale your subscription business. Our team delivers reliable billing solutions, smart automation, and hands-on support designed to reduce churn, simplify operations, and drive long-term growth.

Flexible Payment Infrastructure

Deliver smooth, secure recurring payments with a range of supported billing methods built for high-risk subscription models. Our system makes it easy for customers to subscribe with confidence, helping you boost retention and increase conversions across global markets.

Secure and Compliant Payment Flow

Maintain trust and compliance with secure, privacy-first payment flows. Our advanced solutions protect sensitive data, reduce fraud risks, and support PCI-compliant processing, giving users confidence and helping your business meet global regulatory standards.

Chargeback Management

Protect your revenue with advanced chargeback mitigation for subscription businesses. FastoPayments combines intelligent risk analysis with proactive fraud prevention to reduce disputes, secure transactions, and improve payment stability, helping you retain more income and grow confidently.

24/7 quality Customer Support

Benefit from our dedicated team of payment professionals available around the clock. We offer prompt, expert assistance to resolve any issues swiftly, ensuring uninterrupted service and fostering a reliable user experience that keeps customers satisfied and engaged.

Payment Analytics & Reporting

Gain a competitive edge with advanced analytics that uncover transaction patterns and customer behavior. Apply these insights to fine-tune your strategy, optimize operations, and increase long-term revenue across your subscription business.

Opening a Merchant Account for Recurring Payment Models

Getting a high-risk merchant account for your subscription business is straightforward with FastoPayments. With over a decade of experience in recurring and high-risk payment processing, we simplify onboarding with fast approval, secure integration, and expert support tailored to your business model.

Step 1.

Research payment gateway options

Although the criteria for dating sites are stricter overall, we think it’s still important for nightlife merchants to do research regarding their options. Look for a provider who can actually help you sustain and grow your business through their merchant services.

Step 2.

Prepare your application

Since your business is most likely considered to be high-risk, there are going to be extra requirements you’ll need to comply with to get a merchant account for nightlife businesses.

Ultimately, regardless of the type of online dating site you have, the application process itself tends to be quite long and drawn out with all the documentation and legal requirements involved.

Step 3.

Start accepting payments

Once your nightlife business merchant account is approved, you can start receiving payments from your customers. With our adult-specific payment processing gateway, customers can pay in different currencies and from different countries.

Payment Integrations

FastoPayments seamlessly integrates with popular platforms like WooCommerce and Shopify. Every business is unique, which is why our API allows you to customize your payment gateway according to your specific needs.

Whether you prefer a host page integration or server-to-server setup, FastoPayments’s payment API ensures that your high-risk e-commerce payment processing is optimized for efficiency and future-proofed for continued success.

Get a Quote

Get Quote

YOUR QUESTIONS

Frequently Asked Questions

What is a high-risk merchant account for subscription-based businesses?

A high-risk merchant account for subscription businesses is built to support recurring billing in industries that face increased chargeback risk or regulatory complexity.

This includes SaaS platforms, adult content creators, video streaming services, membership communities, digital marketplaces, e-learning platforms, and coaching services. These business models often struggle with approval from traditional providers. FastoPayments offers subscription payment processing that supports ongoing transactions, protects against disputes, and adapts to your specific industry needs.

Why are recurring subscription models considered high-risk by payment providers?

Recurring billing introduces unique risks, such as customer disputes from forgotten renewals, free trials converting to paid plans, and unclear cancellation terms.

When combined with industries like adult content, wellness, or coaching, the risk of chargebacks increases further. Payment processors categorize these models as high-risk due to refund exposure, content restrictions, and international customer bases. FastoPayments is experienced in managing this complexity and provides solutions designed to protect revenue while ensuring compliance.

What features matter most in a payment processor for subscription businesses?

For businesses relying on recurring revenue, essential features include flexible billing cycles, automatic retries for failed payments, fraud filters, chargeback prevention tools, and global payment support.

Whether you’re running a SaaS platform, adult subscription site, streaming service, or a membership-based coaching business, your processor should also offer secure card storage, multi-currency billing, and customizable checkout flows. FastoPayments delivers all of this through a single high-risk-ready solution that supports long-term growth.

How long does it take to set up a high-risk merchant account for a subscription model?

Setup timelines usually range from 3 to 7 business days, depending on your business type and how quickly documentation is submitted. FastoPayments helps subscription merchants across adult, education, digital products, and B2B services prepare for fast approval by guiding you through compliance, KYC, and onboarding.

We ensure that your payment system is up and running as quickly as possible so you can focus on scaling your recurring revenue.

How can subscription-based businesses reduce chargebacks and failed payments?

To minimize lost revenue, businesses should combine proactive communication with advanced billing tools. Send reminders before billing cycles, allow easy cancellations, use clear billing descriptors, and implement retry logic for failed payments.

Platforms in high-risk verticals such as adult content, e-learning, or health subscriptions benefit from FastoPayments’ real-time fraud prevention, card updater services, and automated dispute response tools. These features help maintain healthy chargeback ratios and strengthen customer trust over time.