Introduction: Why Declined Transactions Matter

Declined payments are more than a technical error. They represent lost revenue, frustrated customers, and potential long-term trust issues for businesses. Every failed payment is not just a missed sale but an interruption in customer experience that could send them to competitors.

For subscription services, e-commerce stores, and high-risk merchants, understanding declined transactions and optimizing payment flows is essential to both revenue stability and customer retention.

Global approval rates vary significantly. Domestic transactions in established markets like the US or EU can achieve approval rates above 90 percent, while cross-border transactions can plummet to 60 percent or lower. This gap highlights the need for proactive strategies: preventing avoidable declines, recovering failed payments quickly, and future-proofing systems against evolving fraud and regulatory challenges.

This guide dives deep into every part of the decline management process. You will learn:

How to distinguish between soft and hard declines, and why it matters for your retry strategy.

Best practices to prevent declines before they happen, including fraud filters and local payment adoption.

How to optimize retries and use multi-acquirer routing to boost approval rates.

The global landscape of declines and why local methods like PIX or UPI outperform cards in many regions.

Practical recovery tactics and customer engagement strategies post-decline.

Future-proofing your payments with adaptive fraud models, tokenization, and emerging methods.

Real-world examples of financial opportunity unlocked by better decline management.

By the end, you’ll understand how to transform payment declines from a persistent pain point into a competitive advantage for your business.

Understanding Declined Transactions

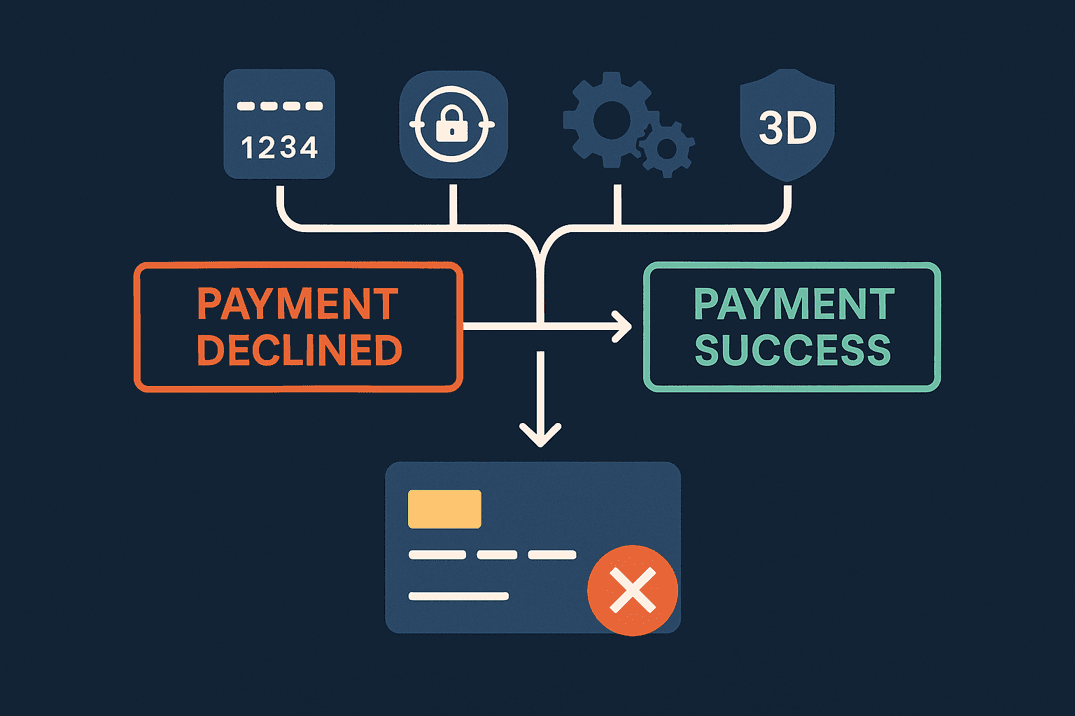

Soft vs Hard Declines

Declines fall broadly into two categories: soft declines and hard declines.

Soft declines are temporary and often solvable. They occur due to reasons like insufficient funds, network errors, or temporary issuer restrictions. These transactions can usually be retried successfully if timed correctly or routed differently.

Hard declines, on the other hand, are permanent failures such as a stolen card, closed account, or invalid card number. Retrying these wastes resources, adds unnecessary costs, and can even harm your merchant approval metrics with acquirers and issuers.

The ability to distinguish between soft and hard declines is critical. Without it, merchants risk repeatedly retrying transactions that will never succeed, frustrating customers and damaging brand trust.

Common Decline Codes and Reasons

Understanding the exact reason codes provided by card networks and issuers helps merchants diagnose problems and act intelligently:

Code 05 – Do Not Honor: Issuer declined without specifying details, often fraud related.

Code 51 – Insufficient Funds: Customer lacks available funds in their account.

Code 54 – Expired Card: Card expired and needs updating.

Code 14 – Invalid Card Number: Incorrect number entered or card inactive.

Code 62 – Restricted Card: Card blocked by issuer, often due to cross border or regulatory issues.

These codes vary by scheme (Visa, Mastercard, Amex, local networks) but generally indicate whether retries or alternative methods are viable.

Why Understanding Declines Matters

Misinterpreting decline types leads to wasted retry attempts and unnecessary fees. For example, retrying hard declines repeatedly can increase operational costs and raise red flags with acquirers. On the other hand, ignoring soft declines means missing recoverable revenue.

Correctly categorizing declines enables:

Smarter retry logic that avoids wasted costs.

Better customer communication (“Your card expired, please update it” vs “Transaction declined”).

Improved fraud filtering by learning from issuer response patterns.

Merchants that analyze decline data closely often uncover patterns such as specific BIN ranges or regions performing poorly which can guide routing decisions and boost approval rates.

Preventing Declines Before They Happen

Fraud Filters and Risk Scoring

Fraud prevention is critical, but poorly configured filters often block legitimate customers. Merchants that rely on rigid thresholds, such as flat velocity limits or fixed transaction amounts, risk high false positive rates. Research shows that false positives can account for up to 10 percent of total declines in some industries, representing millions in lost revenue annually. Adaptive fraud filters use behavioral analysis and real time data to distinguish good customers from fraudulent ones. By continuously learning from past transactions, these systems reduce declines without compromising security.

Account Hygiene and Card Updates

A significant percentage of declines occur because stored payment details are outdated. Studies indicate that 20 to 30 percent of recurring billing declines are linked to expired or reissued cards. Customers frequently receive new cards due to expiration, bank mergers, or fraud replacement. Using account updater services and network tokenization ensures that recurring transactions continue without interruption, even if the underlying card number changes. This reduces involuntary churn and protects subscription revenue streams.

Customer Data Accuracy

Incorrect information, such as mismatched billing addresses or CVV codes, is one of the simplest but most common causes of avoidable declines. Up to 15 percent of declines can be attributed to simple data errors at checkout. Encouraging customers to double check entries and validating data before submission can prevent these errors. Implementing address verification and real time form validation further reduces unnecessary declines and minimizes customer frustration.

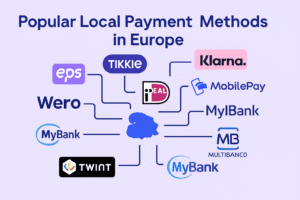

Local Payment Adoption

Credit and debit cards are not always the dominant payment method in every market. In Brazil, PIX now handles more than 90 percent of instant digital transactions, while India’s UPI has overtaken cards as the preferred method for online payments. Offering local methods reduces friction, bypasses issuer restrictions, and improves approval rates. Merchants entering new markets should evaluate which local methods can complement cards and integrate them early.

Preventing declines before they happen requires balancing security, customer experience, and local market expectations. By addressing fraud, maintaining up to date account data, and aligning with preferred payment methods, merchants create smoother checkout experiences and protect revenue. Even a small improvement in pre-transaction optimization can lift approval rates by several percentage points, which can translate into hundreds of thousands of euros in recovered revenue for businesses processing high volumes.

Smarter Retry Strategies and Transaction Routing

Dynamic Retry Timing

Not all declines should be retried immediately. Blind retries waste money and risk damaging approval metrics. Smart retry strategies begin by identifying whether the decline is soft or hard. Soft declines, such as insufficient funds or temporary network errors, may succeed if retried after conditions improve. For example, merchants processing payroll-related subscriptions often see higher retry success when scheduled shortly after common payday cycles. Timing retries to align with these patterns can increase recovery rates by 10 to 15 percent.

Multi Acquirer Routing

Relying on a single acquirer limits flexibility and exposes merchants to localized outages or issuer restrictions. By integrating multiple acquirers, transactions can be routed dynamically to whichever acquirer has historically shown the highest approval rates for a particular BIN, region, or card type. For example, a merchant serving both European and Latin American markets may route EU-issued Visa cards through a domestic acquirer while routing Brazilian transactions through a local partner for higher success.

BIN Level and Country Specific Logic

Bank Identification Numbers (BINs) reveal valuable insights about issuing banks, card types, and geographic origin. By analyzing approval performance at the BIN level, merchants can identify patterns, such as specific banks in Asia consistently approving through one acquirer but declining through another. Implementing BIN based routing ensures each transaction is sent through the most compatible path, reducing declines without adding friction for the customer.

Orchestration and Gateway Flexibility

Payment orchestration layers sit above multiple gateways and acquirers, providing merchants with centralized control over routing and retry logic. This approach allows real time decision making, such as sending retries to alternate gateways, changing authentication flows, or automatically switching to local payment methods when cards fail. Merchants using orchestration often see approval improvements of 5 to 8 percent compared to those locked into a single payment gateway.

Financial Impact Example

Consider a merchant processing 50,000 transactions per month at an average ticket size of €50. A 5 percent decline rate means 2,500 failed transactions, equating to €125,000 in lost monthly revenue. If smarter retry logic and multi acquirer routing recover even 20 percent of these declines, that is €25,000 in additional revenue every month or €300,000 annually. The cost of implementing routing and orchestration is often outweighed by these gains within the first few months of deployment.

Smarter retries and routing strategies not only recover lost revenue but also provide long term insights into issuer behavior, helping merchants continuously optimize and stay ahead of evolving payment challenges.

Global Decline Landscape

Regional Variance in Approval Rates

Approval rates differ significantly between regions due to regulatory frameworks, issuer behavior, and consumer payment preferences. Industry data from payment market studies shows:

| Region | Domestic Approval Rate | Cross-Border Approval Rate |

|---|---|---|

| North America | 85% – 90% | 60% – 70% |

| Europe | 90% – 93% | 75% – 80% |

| Latin America | 75% – 85% | 50% – 60% |

| Asia-Pacific | 80% – 88% | 55% – 65% |

These figures highlight why merchants should avoid applying a single global strategy. Localized acquiring, routing, and payment method adoption can prevent millions in lost revenue each year.

Local Payment Methods and Their Impact

Local payment methods bypass traditional card networks, reduce declines, and align with consumer trust in their markets. Many settle instantly, cost less, and improve conversion rates.

PIX (Brazil)

Market Share: Over 90 percent of real-time bank transfers in Brazil, according to the Brazilian Central Bank.

Innovativeness: Instant QR code-based payments linked directly to bank accounts, bypassing card networks entirely.

Best Practice: Integrate PIX for Brazilian customers to minimize card declines, lower transaction costs, and enable near-instant settlement.

UPI (India)

Market Share: Over 70 percent of mobile transactions in India, reported by the National Payments Corporation of India.

Innovativeness: A unified platform connecting multiple bank accounts for seamless bank-to-bank transfers without card involvement.

Best Practice: Crucial for merchants entering India to capture the dominant payment method and avoid high card failure rates.

iDEAL (Netherlands)

Market Share: Around 70 percent of Dutch e-commerce transactions, according to the Dutch Payments Association.

Innovativeness: A direct debit system connected to bank accounts, offering instant payment confirmation and reduced chargebacks.

Best Practice: Essential for Dutch e-commerce merchants as cards are secondary in this market and iDEAL guarantees higher approval rates.

MobilePay (Denmark and Finland)

Market Share: Used by over 50 percent of Denmark’s population, based on Nordic banking statistics.

Innovativeness: Combines peer-to-peer and retail payments, fully integrated with banking apps for convenience and trust.

Best Practice: Offer MobilePay when serving Denmark or Finland to accommodate mobile-first users who prefer wallet-based payments over card entry.

Klarna (Europe, BNPL)

Market Share: Approximately 20 percent adoption in Nordic e-commerce and expanding rapidly in Germany and the US, per European e-commerce surveys.

Innovativeness: Buy Now, Pay Later service providing flexible installment plans and improving conversion rates for higher-ticket purchases.

Best Practice: Ideal for merchants targeting younger demographics or selling premium products, increasing basket size and retention.

Alipay and WeChat Pay (China)

Market Share: Combined 80 percent share of China’s digital payments ecosystem, according to iResearch China.

Innovativeness: Super-app ecosystems merging payments with messaging and e-commerce, enabling seamless in-app purchases.

Best Practice: Critical for merchants serving Chinese consumers domestically or abroad, as cards are rarely preferred in this segment.

ACH (United States)

Market Share: Over 30 percent of recurring billing in utilities and subscriptions, according to NACHA reports.

Innovativeness: Low-cost bank-to-bank transfer system suited for recurring or high-value transactions, offering reliable settlement.

Best Practice: Use ACH as a fallback for recurring billing in the US to minimize churn and lower processing costs when cards fail.

Cartes Bancaires (France)

Market Share: More than 60 percent of domestic card transactions in France, as reported by French Payments Market Reports.

Innovativeness: National card scheme that processes transactions locally, providing better approval rates and fewer fraud flags than international networks.

Best Practice: For French customers, prioritize routing through Cartes Bancaires to maximize domestic approvals and reduce cross-border fees.

Domestic vs Cross-Border Acquiring

Domestic acquiring boosts approval rates by 10 to 20 percent by aligning transactions with local banks and currencies. For example, Cartes Bancaires transactions processed domestically in France consistently outperform the same transactions routed through Visa or Mastercard internationally. Cross-border acquiring remains valuable for rapid market entry but requires careful balancing with local methods to offset higher decline rates and increased fraud checks.

Financial Impact of Local Optimization

A merchant processing €20 million annually in Europe with an 8 percent decline rate could recover approximately €600,000 in revenue by adopting methods like iDEAL and Cartes Bancaires alongside domestic acquiring. Scaled across multiple regions, this optimization can generate millions in additional revenue each year.

Why This Matters

Merchants who break down approval rates by region and method often discover inefficiencies hidden in aggregate data. By localizing payment flows, businesses not only boost approval rates but also strengthen customer trust by offering familiar payment experiences. This approach drives higher conversions and long-term retention, especially for recurring billing and cross-border e-commerce.

Customer Recovery and Post-Decline Engagement

Preventing payment failures is crucial, but recovery determines whether a customer stays or leaves after a decline occurs. Even one failed transaction can damage trust or push a customer to competitors. How merchants handle these moments can turn a negative experience into a loyalty-building opportunity.

Why Recovery Matters

Declined transactions represent more than lost sales; they risk damaging the customer relationship. A confused or embarrassed customer may abandon the purchase without explanation and silently churn. According to payment recovery studies, businesses that proactively address declines through communication and alternative solutions recover up to 30 percent more lost transactions than those relying on silent retries.

Immediate Customer Communication

Impact: Customers who understand why a payment failed are more likely to act. Silence leads to frustration and lost trust.

Best Practice: Send real-time notifications via SMS, email, or in-app alerts explaining the failure in simple terms and guiding the next steps (e.g., update payment info, retry with another method). Clear communication signals reliability and reduces abandonment.

Offering Alternative Payment Options

Impact: Giving customers multiple ways to pay reduces checkout drop-offs. Many customers prefer switching to a familiar local or wallet-based option rather than fixing a card issue immediately.

Best Practice: Offer digital wallets (Apple Pay, Google Pay), local methods (PIX, iDEAL), or BNPL services as fallback options. For subscriptions, allow customers to store multiple payment methods and set an alternate default to minimize future failures.

Personalized Retry Campaigns

Impact: Strategic retries recover revenue without spamming customers or incurring excessive costs.

Best Practice: Differentiate between soft declines (e.g., insufficient funds) and hard declines (e.g., stolen card). For soft declines, retry intelligently, such as after pay cycles. For hard declines, guide customers to update details or select a new payment method instead of repeated failed attempts.

Customer Support as a Recovery Channel

Impact: A well-handled support interaction can transform a failed payment into a trust-building moment.

Best Practice: Train support teams to quickly identify decline reasons and walk customers through resolution. Equip them with scripts and recovery tools, such as sending secure payment links or offering temporary account extensions to retain loyalty.

Human and Brand Impact

Declines affect both customer psychology and brand reputation. A customer who experiences multiple failures without explanation may never return, even if the issue is minor. Conversely, merchants who recover gracefully are often remembered for excellent service. Recovery is not just about fixing a payment; it is about reinforcing brand reliability at a critical moment.

Quick Recovery Wins

Proactively notify customers within minutes of a failure.

Offer at least two alternative payment options beyond cards.

Provide human support for high-value customers to resolve issues personally.

Use multi-channel outreach (SMS + email + app) for higher re-engagement rates.

Financial Opportunity Example

A subscription service processing €2 million monthly with an 8 percent decline rate loses €160,000 every month. Recovering just 25 percent of those declines equals €40,000 per month or nearly €500,000 annually. Adding proactive communication and alternative payment options often pays for itself in weeks.

Future-Proofing Decline Management

Managing payment declines is not just about solving today’s issues. Payment systems are evolving rapidly. Fraud tactics are becoming more sophisticated, consumer behavior is shifting toward new payment methods, and regulatory frameworks are tightening worldwide. To maintain high approval rates and customer trust, merchants must build systems that adapt and scale with these changes rather than react to them when problems arise.

Adaptive Fraud and Risk Models

Traditional fraud filters often rely on static rules like fixed velocity limits or spending thresholds. While these methods can block obvious fraud, they also reject legitimate transactions when customer behavior does not fit expected patterns. Adaptive fraud models powered by machine learning analyze behavioral signals in real time, learning from historical data and adjusting dynamically as new fraud tactics emerge.

By continuously refining risk scoring, merchants can block fraudulent transactions without creating unnecessary friction for legitimate customers. This reduces false declines, which are one of the most damaging sources of revenue leakage, and ensures security evolves alongside threat patterns.

Tokenization and Automatic Card Updaters

A significant portion of recurring payment declines is caused by card reissuance, whether from expiration, fraud replacement, or bank transitions. Network tokenization replaces sensitive card details with secure tokens that remain valid across reissued cards. Combined with account updater services, this ensures payment credentials are refreshed without customer involvement.

This approach reduces involuntary churn for subscription businesses, protects customer relationships, and removes friction from the payment process, especially at scale where even a small reduction in decline rates can recover significant revenue.

Integrating Emerging Payment Methods

Digital wallets, real-time bank transfers, and Buy Now Pay Later (BNPL) services are reshaping global payment preferences. Ignoring these methods can lead to lost conversions, especially in markets where cards are no longer dominant.

Future-proof payment systems use orchestration layers capable of integrating new methods quickly and routing them intelligently by geography and customer preference. For example, bank-to-bank solutions like UPI in India or PIX in Brazil often outperform cards in both cost and approval rate, while wallets like Apple Pay and Alipay dominate mobile-first user bases.

Preparing for Regulatory Shifts

Regulatory mandates such as Strong Customer Authentication (SCA) under PSD2 in Europe, 3D Secure 2.0, and upcoming data privacy regulations continue to redefine transaction flows. Merchants that adapt early minimize disruptions and avoid customer friction when enforcement begins.

Building flexible infrastructure that can accommodate changing compliance rules, from authentication methods to local data storage requirements, ensures smooth operations and future scalability across multiple markets.

Continuous Optimization and Benchmarking

Future-proofing is not a one-time implementation. Payment environments shift with issuer behavior, consumer trends, and seasonal spikes. Merchants should continuously benchmark their approval rates against industry averages, test multiple acquirers and gateways, and refine retry logic as new data emerges. Regular optimization ensures that improvements compound over time and keeps merchants ahead of competitors who rely on outdated processes.

Long-Term Strategic Advantage

Businesses that future-proof their decline management strategies unlock more than immediate revenue gains. They position themselves as adaptable, customer-centric, and resilient against evolving market conditions. This capability becomes a competitive advantage by reducing churn, boosting lifetime value, and enabling seamless adoption of innovations as they emerge.

Quick Recovery Wins and Practical Tips

Future-proofing strategies ensure long-term stability, but merchants often face immediate pressure to recover revenue from declined transactions. Waiting months for major upgrades is rarely an option, especially when declines are already eroding profit margins and customer trust.

Quick recovery wins deliver tangible results in days or weeks. They recapture lost sales, reduce customer frustration, and provide a foundation for deeper optimization. For merchants battling tight margins or subscription churn, these quick actions can mean the difference between steady growth and ongoing revenue leakage.

Real-Time Decline Notifications

Impact: Without immediate feedback, most customers abandon failed payments. Clear notifications can recover up to 40 percent of declines within 24 hours and significantly reduce support inquiries. They also demonstrate transparency, which builds trust during a frustrating moment.

Best Practice: Automate SMS or email alerts triggered at the moment of failure. Use concise, friendly language that explains the issue and provides a direct link to fix it. Mobile-first notifications often achieve higher engagement rates for digital services and recurring subscriptions.

Simplified Payment Update Flows

Impact: Friction in updating payment details is one of the biggest causes of lost revenue. Every additional step in the process increases abandonment risk. Simplifying flows can increase recovery rates by 20 to 30 percent and reduce calls to support teams.

Best Practice: Offer one-click update links and pre-fill known information securely. Minimize the steps between notification and resolution. For recurring services, allow multiple backup methods to ensure uninterrupted service even when one fails.

Fallback Payment Options

Impact: Customers may prefer switching to an alternative payment method instead of fixing a failed card. Providing fallback options at the moment of failure can immediately reduce abandonment rates and cater to regional preferences, especially in markets where cards are less dominant.

Best Practice: Present alternative methods like wallets, ACH transfers, BNPL, or local payment rails such as PIX or UPI. Position these options prominently during checkout recovery flows to encourage completion and prevent future declines.

Strategic Retry Scheduling

Impact: Blind retries waste processing fees and can trigger issuer suspicion, lowering approval rates further. Timed retries tailored to customer behavior can improve soft decline recovery by 15 to 25 percent while lowering costs.

Best Practice: Use customer insights to align retries with favorable conditions, such as common pay cycles. Avoid retrying hard declines like stolen cards or closed accounts and instead direct those customers toward updating their payment details.

Customer Support Follow-Up

Impact: Personalized outreach can turn a failed payment into a loyalty-building opportunity. High-value customers are far more likely to stay when their issue is addressed quickly and empathetically. Merchants with proactive support see improved retention rates and higher lifetime value.

Best Practice: Equip support teams with insight into decline reasons and tools to offer solutions such as secure payment links or grace periods. Focus outreach on high-value or at-risk customers where the cost of churn is highest.

Benchmark and Iterate

Impact: Recovery strategies lose effectiveness if not regularly monitored and refined. Benchmarking recovery rates and churn impact ensures tactics stay relevant as customer behavior and market conditions change. Continuous optimization can compound results, increasing recovered revenue month after month.

Best Practice: Track metrics like recovery percentage, resolution speed, and post-recovery churn. Adjust messaging, retry timing, and fallback options based on performance insights.

Human Element: Beyond Revenue

Quick recovery wins do more than recover lost sales. They reduce frustration, prevent churn, and reinforce brand reliability at a critical moment. Customers who feel supported are more likely to renew subscriptions, recommend the brand, and remain loyal long-term. In competitive industries, this trust can be as valuable as immediate revenue recovery.

Financial Opportunity Example

A merchant processing 20,000 transactions monthly on one merchant account with a 7 percent decline rate loses 1,400 sales each month. Implementing real-time notifications, fallback methods, and optimized retries can recover 20 percent of these failures, or 280 sales monthly. At an average transaction value of €40, that equals €11,200 per month and over €130,000 annually in additional revenue. For high-volume merchants, these figures scale into millions of euros.

Quick Checklist

Implement real-time notifications for failed payments to prompt immediate action.

Simplify payment update flows with one-click links and minimal steps.

Offer fallback payment options like wallets, bank transfers, or local methods.

Time retry attempts around favorable conditions such as paydays.

Train support teams to handle declines proactively and empathetically.

Continuously track and benchmark recovery metrics for ongoing optimization.

Financial Opportunity Examples

Declined transactions are often viewed as a technical nuisance, but their financial impact is substantial. Even modest improvements in approval rates can unlock significant revenue gains, especially at scale. By quantifying potential recovery, merchants can prioritize investments in payment optimization and justify operational changes to stakeholders.

Scenario 1: Subscription-Based Business

A video streaming platform processes 50,000 monthly subscriptions at €10 each, resulting in €500,000 monthly revenue potential. With an 8 percent decline rate, 4,000 payments fail every month, representing €40,000 in lost revenue or nearly €480,000 annually.

Implementing real-time notifications, tokenization, and strategic retries recovers 25 percent of failed payments, equating to 1,000 recovered subscriptions monthly or €10,000 per month. This adds up to €120,000 annually recovered, plus additional benefits like lower churn rates and improved customer satisfaction scores (retention improves by up to 15 percent with proactive recovery).

Scenario 2: E-Commerce Merchant

An online retailer processes 20,000 transactions per month with an average order value of €60, generating €1.2 million monthly revenue potential. At a 6 percent decline rate, 1,200 transactions fail monthly, totaling €72,000 in lost revenue, or €864,000 annually.

By adopting fallback payment options, optimized routing, and local methods like iDEAL in the Netherlands or PIX in Brazil, they reduce declines by 30 percent. This recovers 360 transactions monthly or €21,600 per month, leading to €260,000 annually recovered revenue. These changes also reduce support inquiries by an estimated 12 percent and increase checkout completion rates by 8 to 10 percent.

Scenario 3: Cross-Border Marketplace

A global marketplace processes 100,000 monthly transactions across multiple regions at an average order value of €45, resulting in €4.5 million monthly revenue potential. Cross-border declines average 12 percent, causing 12,000 failed transactions worth €540,000 lost each month or over €6.4 million annually.

By leveraging domestic acquiring, network tokenization, and local payment rails (e.g., Alipay for Chinese users, UPI for Indian users), they reduce declines by 35 percent. This recovers 4,200 transactions monthly, or €189,000 per month, scaling to €2.2 million annually recovered. This also improves regional trust metrics and reduces payment disputes by up to 20 percent.

Scenario 4: High-Ticket B2B Service

A SaaS provider bills 1,000 clients quarterly at €500 per invoice, generating €500,000 quarterly revenue potential. With a 3 percent decline rate, 30 invoices fail per quarter, representing €15,000 lost every three months, or €60,000 annually.

By introducing account updater services, proactive support follow-ups, and flexible payment terms, they recover 50 percent of failed invoices. This equals €7,500 per quarter recovered or €30,000 annually. Beyond direct recovery, relationship value improves: proactive handling reduces churn in enterprise accounts by up to 20 percent, which can translate to millions in retained contract value.

Summary Table

| Scenario | Monthly/Quarterly Volume | Decline Rate | Recovery Rate | Revenue Recovered (Annually) | Additional Benefits |

|---|---|---|---|---|---|

| Subscription-Based Business | 50,000 subscriptions | 8% | 25% | €120,000 | 15% higher retention |

| E-Commerce Merchant | 20,000 transactions | 6% | 30% | €260,000 | 12% fewer support calls |

| Cross-Border Marketplace | 100,000 transactions | 12% | 35% | €2.2 million | 20% fewer disputes |

| High-Ticket B2B Service | 1,000 invoices quarterly | 3% | 50% | €30,000 | 20% churn reduction |

Broader Strategic Impact

These examples only reflect direct revenue recovery. Indirect gains such as reduced customer churn, stronger partner negotiations, improved lifetime value, and higher checkout satisfaction can multiply overall business impact. When scaled across regions or combined with orchestration strategies, these improvements can transform payments from a cost center into a revenue driver.

Declines are avoidable and recoverable

Declines are often treated as an inevitable cost of doing business, but this does not have to be the case. A significant portion of declines come from preventable issues such as expired or outdated card details, insufficient funds at the time of billing, or overly strict fraud filters that mistakenly block legitimate transactions.

By implementing proactive solutions like tokenization, merchants ensure card data remains up to date even when customers receive a new card.

Combining this with dynamic retry strategies that attempt payments at optimal times, such as after salary deposits, and offering fallback payment methods like local bank transfers or wallets, merchants can prevent many declines before they occur and recover those that do happen more efficiently.

Recovery strategies protect revenue and relationships

When a transaction fails, it is not just revenue at stake but also the customer’s trust in the brand. Without proper recovery strategies, a failed payment can quickly turn into customer churn. Effective recovery involves more than simply retrying the payment.

It includes notifying the customer immediately, explaining why the decline occurred in plain language, and providing them with simple solutions, such as updating payment information or choosing an alternate method.

Proactive support teams can turn an initially negative experience into a moment of trust-building. This approach not only saves the sale but often strengthens the customer relationship, leading to higher retention and lifetime value.

Local and alternative methods improve conversions

Global card networks remain important, but in many markets they are no longer the preferred payment method. In Brazil, instant bank transfer system PIX has become the dominant way consumers pay online. In India, the Unified Payments Interface (UPI) powers the majority of digital transactions.

In China, wallets like Alipay and WeChat Pay account for nearly all e-commerce payments. By offering these local and alternative methods, merchants can significantly improve their approval rates in these regions. Doing so also sends a strong signal to customers that the merchant understands their local needs and preferences, which enhances trust and encourages repeat purchases.

Future-proofing ensures resilience

The payment landscape is not static. Fraud tactics evolve, regulatory requirements tighten, and consumer preferences shift toward emerging methods like real-time bank transfers or Buy Now Pay Later services. Merchants who fail to prepare for these shifts often face sudden drops in approval rates or increased operational costs.

Future-proofing involves building flexible payment systems that can adapt quickly, adopting adaptive fraud models that learn from new patterns, and implementing tools like tokenization and account updater services that minimize disruptions. By staying ahead of these changes, merchants can avoid costly last-minute fixes and ensure their payment infrastructure supports long-term growth.

Financial impact is substantial

Even small improvements in approval rates can lead to significant revenue recovery. For example, a subscription business processing €1 million per month with a 7 percent decline rate loses €70,000 monthly. Reducing declines by just 20 percent would recover €14,000 each month, or €168,000 annually.

When scaled across multiple regions or applied to high-volume e-commerce or cross-border marketplaces, these improvements can quickly reach hundreds of thousands or even millions in additional revenue. Beyond direct gains, optimized payment flows reduce support costs, improve forecasting accuracy, and increase overall customer satisfaction, further amplifying the financial impact.

What FastoPayments Can Do for You

Understanding why payment declines happen is only part of the equation. Acting on this knowledge requires technology, data, and expertise that many businesses struggle to build internally. FastoPayments bridges this gap by providing an end-to-end solution designed to prevent declines before they happen, recover failed payments effectively, and prepare merchants for future payment innovations.

Comprehensive Decline Prevention

FastoPayments helps merchants prevent declines at the source by combining intelligent routing, adaptive fraud tools, and real-time card updates. Our platform uses network tokenization and account updater services to ensure stored card data remains current even when customers receive new cards. This dramatically reduces involuntary churn for subscription businesses and improves first-attempt approval rates for e-commerce transactions.

We also enable multi-acquirer and multi-gateway orchestration, which routes each transaction to the acquirer most likely to approve it based on region, card type, and historical data. This approach allows merchants to minimize declines caused by issuer preferences and regional approval variances.

Optimized Recovery and Customer Engagement

Declines that cannot be prevented can still be recovered. FastoPayments equips merchants with real-time decline notifications sent through SMS, email, or in-app alerts. These notifications explain the failure in clear terms and direct customers to a simplified resolution flow.

We integrate fallback payment options, including local rails, wallets, ACH transfers, and Buy Now Pay Later solutions, allowing customers to complete purchases without friction. Our tools also support personalized retry scheduling, aligning payment attempts with customer behavior to maximize recovery rates without unnecessary costs.

Support for Local and Alternative Payment Methods

Reaching global customers requires more than accepting major card networks. FastoPayments supports over 150 local and alternative payment methods, from PIX in Brazil to UPI in India, Alipay in China, and iDEAL in the Netherlands. This coverage ensures merchants can meet customer preferences in every market and reduce cross-border decline rates that often result from relying solely on global card networks.

Future-Proofing Through Innovation

We continuously update our platform to align with evolving regulations and emerging technologies. Whether it is adapting to new compliance mandates like PSD2 and Strong Customer Authentication, integrating real-time payment schemes, or adopting AI-driven fraud models, FastoPayments ensures merchants remain ahead of industry shifts. Our future-ready architecture enables rapid onboarding of new payment methods and scalable expansion into new regions.

Proven Revenue Impact

Merchants partnering with FastoPayments typically see approval rates improve by 10 to 25 percent within the first three months. For high-volume businesses, this can translate into hundreds of thousands of euros in recovered revenue annually. Combined with reduced chargebacks, lower support costs, and improved customer retention, the return on investment is both immediate and sustained.

Consultative Partnership

Beyond technology, FastoPayments provides ongoing consultation to help merchants interpret their payment data and refine their strategies. Our team works closely with each client to identify patterns in declines, optimize routing rules, and deploy recovery campaigns tailored to specific customer segments and markets. This hands-on approach ensures every merchant maximizes their payment potential.

Next Steps

Merchants interested in improving approval rates and reducing declines can begin with a free consultation where FastoPayments analyzes their current setup and highlights opportunities for quick wins and long-term improvements. This assessment provides clear insights into potential revenue recovery and strategic enhancements without requiring upfront commitment.

Frequently Asked Questions

How much revenue can I realistically recover by optimizing declines?

Recovery potential varies by business model and transaction volume. On average, merchants who implement strategies like tokenization, dynamic retries, and fallback methods see approval rates improve by 10 to 25 percent within three to six months. For high-volume businesses, this can translate into hundreds of thousands of euros in recovered revenue annually.

Does implementing these strategies require major infrastructure changes?

Not necessarily. Many improvements, such as real-time decline notifications and fallback payment methods, can be layered on top of existing payment setups through APIs or gateway orchestration platforms like FastoPayments. This allows merchants to achieve quick wins without overhauling their entire payment system.

Are these strategies compliant with international regulations?

Yes. Optimizations such as tokenization, account updater services, and adaptive fraud models are fully compatible with compliance mandates like PSD2, Strong Customer Authentication (SCA), and PCI DSS. These strategies often simplify compliance by reducing the exposure of sensitive payment data.

How do local payment methods improve approval rates?

Local payment methods like PIX in Brazil, UPI in India, and iDEAL in the Netherlands connect directly to regional banking systems and bypass many of the cross-border friction points associated with global card networks. By offering these methods, merchants can significantly increase approval rates in target markets and build stronger trust with local consumers.

What makes FastoPayments different from other payment processors?

FastoPayments combines multi-acquirer orchestration, local payment coverage, and advanced recovery tools in one platform. Our consultative approach ensures every merchant’s setup is tailored to their market, transaction profile, and growth goals. We do not just process payments. We optimize them for maximum revenue and customer satisfaction.

Glossary

Acquirer

A financial institution or bank that processes card payments on behalf of a merchant. The acquirer communicates with card networks and issuers to authorize transactions.

Tokenization

A security method that replaces sensitive payment data with non-sensitive tokens. These tokens remain valid for processing but cannot be used if intercepted. This reduces fraud and enables seamless card updates.

Account Updater Service

A service provided by card networks or processors that automatically updates stored payment credentials when a customer’s card is reissued or replaced.

Fallback Payment Method

An alternative payment option offered to a customer when the primary method fails. Examples include wallets, bank transfers, or Buy Now Pay Later solutions.

Multi-Acquirer Orchestration

A payment strategy that uses multiple acquiring banks and dynamically routes transactions to the acquirer most likely to approve them based on region, card type, or historical performance.

Soft Decline

A temporary failure that may succeed on retry. This is often caused by insufficient funds or temporary network errors.

Hard Decline

A permanent failure that will not succeed on retry. This is typically caused by closed accounts, stolen cards, or blocked transactions.

Strong Customer Authentication (SCA)

A regulatory requirement under PSD2 that adds extra verification steps for online payments to reduce fraud. It is often implemented through 3D Secure 2.0.

Local Payment Rail

A domestic payment method that connects directly to regional banks, such as PIX in Brazil or UPI in India. These methods often provide higher approval rates than cross-border card payments.

💡 Interested in learning more about what’s included in a typical high-risk merchant account? View our complete breakdown of FastoPayments’s high-risk merchant accounts.