Building a business isn’t easy. Every day you make choices, big and small, to help it grow, but fraudsters are constantly looking for ways to steal your hard-earned money.

Between 2023 and 2028, global online payment fraud is expected to cost merchants over $362 billion. These losses aren’t theoretical; they’re happening right now, impacting businesses just like yours.

Fraud protection may sound complex, but with the right information and tools, it’s a straightforward way to safeguard your revenue and reputation.

So, are you ready to take the first step in fraud prevention? Let’s get started.

TL;DR: Key Takeaways on Fraud Prevention

- Fraud is a massive problem, businesses will lose over $362 billion by 2028 (worldpay report).

- Fraud prevention stops unauthorized transactions before they happen, while chargeback prevention protects completed sales from being disputed.

- Common scams include identity theft, stolen card fraud, friendly fraud, phishing, and ransomware.

- Effective fraud prevention includes:

- Multi-Factor Authentication (MFA) to verify customer identity.

- AI-powered fraud detection tools that flag suspicious activity.

- Regular transaction monitoring to catch fraud early.

- Secure payment gateways like FastoPayments for real-time fraud screening.

- E-commerce merchants face additional risks, including chargeback abuse and Shopify’s limited fraud prevention tools.

- FastoSafe helps businesses reduce fraud and chargebacks by 70% in 60 days.

The right fraud prevention strategy keeps your business secure, profitable, and ahead of scammers.

What is Fraud Prevention?

Fraud prevention is a set of strategies, tools, and processes designed to stop fraud before it happens. It protects your business from unauthorized transactions, identity theft, and financial losses.

Imagine someone trying to use a stolen credit card on your website. Fraud prevention systems detect unusual patterns, such as multiple purchases from the same IP address in a short time, and block the transaction before it goes through.

Think of it as a security barrier, always working in the background to detect, analyze, and prevent fraud without interfering with legitimate customers.

Fraud Prevention vs. Chargeback Prevention

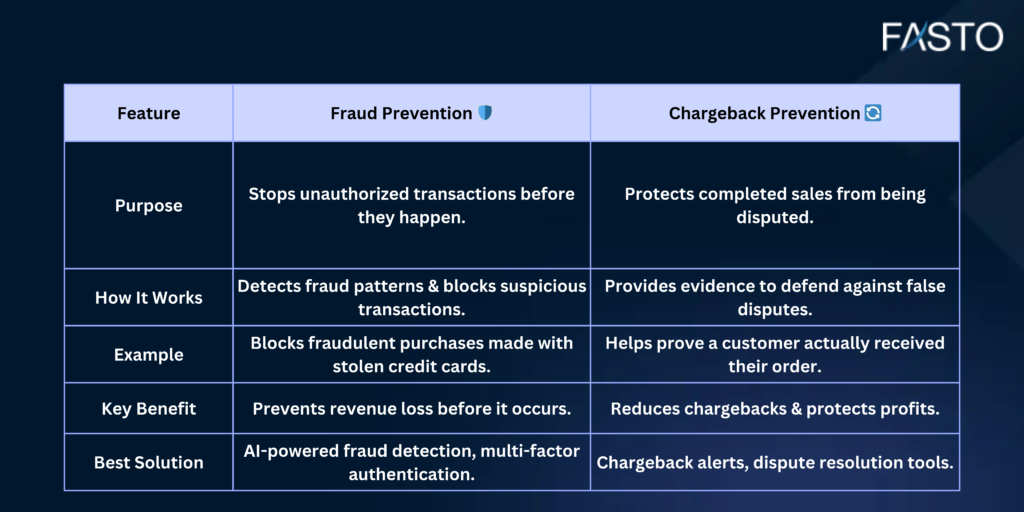

Many merchants confuse fraud prevention with chargeback prevention, but they serve different purposes:

- Fraud Prevention stops unauthorized transactions before they happen. For example, it blocks fraudulent purchases from stolen credit cards.

- Chargeback Prevention protects completed sales from being disputed. If a customer falsely claims they never received their order, chargeback prevention helps you prove otherwise.

Both systems work together to safeguard your revenue. Using a solution like FastoSafe ensures comprehensive fraud and chargeback protection in one system.

Common Scams & Fraud You Need to Be Aware Of

The online world offers convenience, but it also comes with risks. Fraudsters are constantly evolving their tactics, so staying informed is your best defense.

1. Identity Theft

Fraudsters steal personal information to impersonate real customers. In 2022 alone, over 1.1 million identity theft cases were reported to the Federal Trade Commission (FTC).

2. Stolen Card Fraud

Criminals use stolen credit card details to make purchases, leading to chargebacks and financial losses for merchants.

3. Friendly Fraud (Chargeback Abuse)

Some customers intentionally dispute legitimate transactions, falsely claiming they never received their order. Banks often side with the buyer unless you have strong fraud prevention measures in place.

4. Phishing & Malware Attacks

Cybercriminals use fake emails and websites to trick businesses into revealing sensitive payment data.

5. Ransomware

Ransomware locks your business data and demands a payment to restore access. Regular backups and strong cybersecurity measures are essential for protection.

Best Practices for Fraud Prevention or Protection

Protecting your business from fraud doesn’t have to be overwhelming. Implement these proven fraud prevention strategies to keep your business secure:

1. Implement Multi-Factor Authentication (MFA)

MFA adds an extra layer of security by requiring customers to verify their identity using:

- A password or PIN (something they know)

- A one-time code sent to their phone (something they have)

- Biometric verification (something they are, like a fingerprint)

Even if a fraudster steals a password, MFA ensures they can’t complete a transaction without the second layer of verification.

2. Use Advanced Fraud Detection Software

Fraud detection tools analyze transaction patterns and flag unusual activity.

- AI-Powered Fraud Detection: Detects suspicious behaviors and high-risk transactions.

- Device Fingerprinting: Identifies fraudsters using stolen credentials across multiple accounts.

- Geolocation Tracking: Flags orders from high-risk regions known for fraud.

For example, if a customer usually spends $50 per order but suddenly attempts a $5,000 transaction, fraud detection software alerts you immediately.

3. Monitor Transactions Daily

Regularly reviewing your transactions helps you spot fraudulent activity before it escalates. Look for:

- Payments from unfamiliar locations

- Mismatched billing and shipping addresses

- Multiple transactions from the same card in a short period

If you spot suspicious activity, freeze the transaction and investigate immediately.

4. Secure Payment Gateways & Encryption

Choosing a trusted payment processor like FastoPayments ensures real-time fraud screening and AI-powered security.

End-to-end encryption also ensures that payment data is converted into protected code, making it impossible for hackers to intercept.

5. Customer Verification & Due Diligence

- Ask for ID verification for high-value transactions

- Use Address Verification System (AVS) to match billing addresses

- Require CVV codes for card transactions

6. E-Commerce Fraud Prevention

If you are running an online store, you need to take these extra steps:

- Regular security audits: To check for vulnerabilities in your payment system.

- PCI DSS Compliance: Ensure your business meets Payment Card Industry Data Security Standards.

- HTTPS & SSL Encryption: To protect your website from cyber threats.

Effective Strategies for Credit Card Fraud Protection

Credit card fraud is a major issue, “consumers reported losing $12.5 billion to fraud in 2024, which represents a 25% increase over the prior year” FTC data shows. Fraudulent transactions can lead to chargebacks, revenue loss, and reputational damage. Here are six key strategies to protect your business from credit card fraud:

1. Card Verification Value (CVV) Checks

Requiring customers to enter the CVV (Card Verification Value) adds an extra layer of security. Since fraudsters typically only have stolen card numbers, not CVV codes, this helps prevent unauthorized transactions.

2. Address Verification System (AVS)

AVS cross-verifies the billing address entered by the customer with the address on file with the card issuer. If there’s a mismatch, the system can flag the transaction or require additional verification.

3. Two-Factor Authentication (2FA)

Enable 2FA for all transactions to verify the identity of customers. Encourage customers to enable 2FA on their accounts for added protection against unauthorized access.

4. Transaction Velocity Monitoring

Fraudsters often make multiple transactions in a short time to maximize their gains before the stolen card is reported. Velocity monitoring detects:

- Unusually high transaction volume from the same user or IP

- Multiple declined attempts in a row

- Rapidly increasing order values

By flagging these patterns, you can stop fraudulent purchases before they go through.

5. Geolocation Restrictions

Restricting transactions to specific geographic regions can help reduce fraudulent activities, especially if your business primarily serves local customers.

6. 3D Secure (3DS) Authentication

3D Secure (3DS) adds another authentication step at checkout, requiring customers to verify their identity with:

- A one-time passcode (OTP) sent to their phone

- Biometric authentication (fingerprint, Face ID, etc.

Using 3D Secure shifts liability for fraud-related chargebacks to the card issuer, meaning your business won’t be held financially responsible for disputed transactions.

E-Commerce Fraud Prevention

Running an online store comes with huge opportunities, but also major fraud risks. Unlike physical stores, online businesses don’t interact with customers face-to-face, making fraud harder to detect. Before diving into prevention strategies, let’s first recognize the challenges.

Fake Identities

Fraudsters can steal customer data, such as credit card numbers, login credentials, and personal details, and use it to impersonate real buyers. Some even create fake accounts with stolen identities to commit fraud across multiple merchants.

This makes it difficult to distinguish genuine customers from scammers, increasing the risk of fraudulent transactions and chargebacks.

Hidden Threats

E-commerce fraud is often invisible until it causes major financial damage. Unlike obvious scams, it blends in with normal transactions, making it difficult to detect until chargebacks start rolling in.

The longer fraud goes unnoticed, the harder it is to recover losses. Businesses need proactive fraud detection tools to identify and stop these threats before they escalate.

Strategies to Prevent E-Commerce Fraud

1. Regular Security Checkups

Routine security audits can help you spot weaknesses before fraudsters do. Make sure that:

- Your shopping cart software is up to date

- You regularly scan your site for vulnerabilities

- You use strong passwords and authentication protocols

2. PCI DSS Compliance

If you process card payments, you need to be PCI DSS (Payment Card Industry Data Security Standard) compliant. This ensures your payment processing follows strict security standards.

For businesses using SaaS-based platforms, such as FastoSafe, PCI compliance is built-in, simplifying security management.

3. HTTPS for Secure Transactions

Using HTTPS encryption ensures that all customer data is securely transmitted, preventing cybercriminals from intercepting payment information. Investing in an SSL certificate further protects transactions and customer data from hacking attempts.

Don’t wait until fraud becomes a problem

Fraud prevention isn’t optional, it’s essential for protecting your business from financial losses, chargebacks, and cyber threats.

By implementing AI-powered fraud detection, MFA, encryption, and proactive monitoring, you can reduce fraud risks and build trust with customers.

How FastoSafe Protects Your Business from Fraud

FastoSafe offers a comprehensive fraud protection system tailored for high-risk merchants.

- AI-Powered Fraud Screening: Detects and blocks suspicious transactions.

- Chargeback Prevention (Ethoca & Verifi CDRN): Alerts you before disputes escalate.

- End-to-End Encryption: Secures all customer data.

- Real-Time Risk Analysis: Identifies threats before they become losses.

With FastoSafe, merchants see a 70% reduction in chargebacks within 60 days.

Ready to protect your business? Get your free fraud assessment today!

A version of this article was published in 2023 and last updated in 2025.