Running a high-risk business means facing real payment processing problems. Account closures, excessive fees, and processing disruptions directly impact your bottom line.

But these challenges have solutions. The right payment processor can solve high-risk merchant issues, keeping your revenue flowing and your business growing.

In this guide, we’ll explore:

-

Why high-risk payment processing challenges occur

-

The 8 most common payment issues for high-risk businesses (and practical strategies to overcome each one)

-

How FastoPayments offers tailored solutions to support your business growth

8 Common Payment Processing Issues (And How to Fix Them)

1. High Chargeback Rates & Risk of Account Closure

High chargeback rates can trigger costly fees, harm your reputation, and even result in your account closure. Chargebacks happen when customers dispute transactions, often due to fraud, confusion, or dissatisfaction.

While the direct fees from chargebacks are substantial, the hidden costs are even more damaging. Each dispute requires staff time for investigation and response, diverting resources from growth initiatives.

Additionally, excessive chargebacks trigger increased scrutiny from card networks, potentially leading to higher processing rates across all transactions. For many merchants, this creates a challenging cycle of increasing costs and diminishing margins.

To minimize chargebacks, implement advanced fraud detection systems like 3D Secure, utilize real-time chargeback alerts from networks like Ethoca and Verifi, and offer excellent customer support to quickly address and resolve customer complaints before they escalate into disputes.

2. Unexpected Account Freezes & Fund Holds

Sudden account freezes or holds disrupt cash flow, leaving your business stranded without funds. These freezes occur due to suspicious activities, transaction spikes, or unclear business models.

To prevent this, maintain open communication with your payment provider, clearly explain your business operations, and proactively review your processing activities to address potential red flags promptly.

3. Lack of Transparency in Fees & Pricing

Hidden fees and complex pricing structures can severely impact profitability, making it difficult to forecast costs accurately. Transparency is key.

Partner with payment processors offering clear, straightforward pricing models. Carefully review contracts for hidden terms, ask detailed questions about fee structures, and negotiate favorable terms upfront to avoid surprises.

4. Limited Payment Options for High-Risk Businesses

High-risk merchants often struggle with limited payment acceptance options, leading to lost sales and customer dissatisfaction.

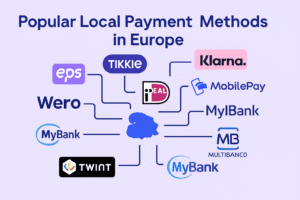

Ensure your chosen provider specializes in high-risk industries and offers comprehensive payment methods (including credit and debit cards, ACH bank transfers, e-wallets, and cryptocurrency) to meet your customers’ diverse preferences and maximize sales potential.

5. Poor Customer Support from Payment Providers

Inadequate customer support can turn minor issues into major disruptions, especially in high-risk sectors. Choosing a provider known for exceptional support is crucial.

Look for providers offering 24/7 access to knowledgeable representatives, rapid response times, and proactive account management, ensuring you receive immediate assistance whenever issues arise.

6. Fraud Prevention & Security Concerns

Fraud and security breaches can devastate your financial health and severely damage customer trust. Combat these threats by investing in advanced fraud prevention tools such as machine learning algorithms, secure payment gateways, and PCI DSS compliance measures.

Utilize additional authentication methods like 3D Secure 2.0 to verify transactions effectively without compromising user experience.

7. Slow Approval Times & Strict Underwriting

Prolonged approval processes and overly stringent underwriting requirements delay your ability to accept payments, hindering business growth.

Streamline your merchant account approval by selecting payment processors with expertise in your specific industry, clear documentation requirements, and efficient onboarding processes. Providers experienced with high-risk businesses typically expedite approval times significantly.

8. The Age Verification Imperative

Industries like gambling, cannabis, vaping, and adult must implement robust age verification systems to prevent minors from accessing age-restricted products and services. This creates multi-layered challenges:

-

Real-time verification requirements that must balance thoroughness with user experience

-

Integration complexities between verification services and checkout processes

-

Varying legal age requirements across different jurisdictions

-

Rising customer abandonment rates with each additional verification step

Many merchants struggle to implement solutions that meet legal requirements without creating excessive friction in the customer journey. Each abandoned transaction represents both lost revenue and wasted acquisition costs.

💡 Interested in learning more about what’s included in a typical high-risk merchant account? View our complete breakdown of FastoPayments’s high-risk merchant accounts.

How FastoPayments Helps Solve These Challenges

“Many high-risk merchants don’t realize how chargebacks, fraud, and unclear pricing impact their success. We focus on transparency, fast approvals, and strong support.” — Dennis Pedersen, CEO of Fasto

FastoPayments isn’t just another processor, we’re your strategic partner in navigating high-risk challenges:

-

Tailored Solutions: Industry-specific tools for CBD, gambling, Adult and more.

-

Transparent Pricing: Rates starting as low as 3% per transaction.

-

Dedicated Support: 24/7 access to payment experts.

Simplify Your High-Risk Payment Processing Today

Navigating payment processing as a high-risk merchant doesn’t have to be complicated. While traditional banks might leave you in the dark, providers like FastoPayments bring clarity, reliability, and peace of mind.

With transparent pricing, cutting-edge fraud protection, and dedicated support, FastoPayments ensures your business can operate smoothly, securely, and confidently, no matter your industry’s complexities.

Ready to simplify your payment processing? Open your high-risk merchant account or set up a high-risk payment gateway with FastoPayments.