Referral Partners

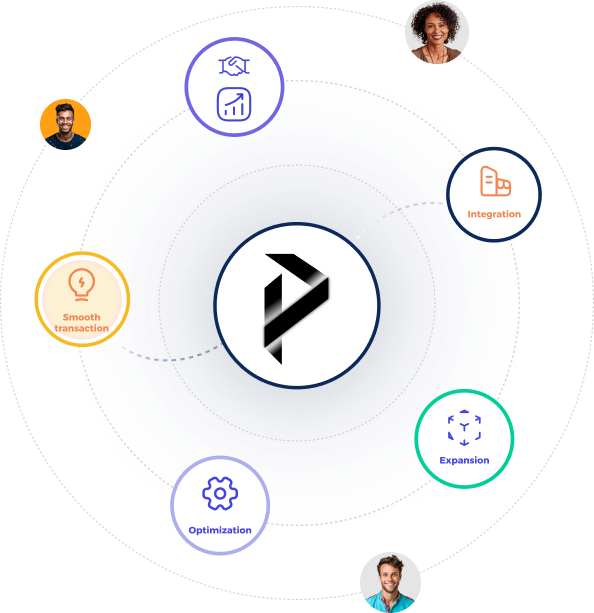

Partner with FastoPayments and access a full range of solutions to drive your business forward. We offer secure cashless transactions, global card processing, customised banking services, reliable hosting, local payment methods, and corporate structuring support. Whether you are expanding or refining your operations, our partnership gives you the tools to scale efficiently and grow sustainably.

- Trusted by +500 companies

WORLDCLASS PARTNERSHIP

Partnering with FastoPayments

We collaborate with trusted providers and networks across the world to deliver genuine global coverage. Our team works relentlessly to maintain, improve, and expand our portfolio of solutions, ensuring our partners have access to the best tools and opportunities available in every market they enter.

At FastoPayments, our core pillars are responsiveness, expertise, respect, and passion. These are not just words to us, they guide how we treat our partners and clients. We believe that success is built on real relationships, mutual growth, and a commitment to deliver value at every stage.

When you partner with FastoPayments, you gain more than just a service provider. You gain a dedicated partner who values open communication, strategic alignment, and consistent support. We schedule monthly calls, provide detailed overviews, and maintain clear and transparent communication at all times. With FastoPayments by your side, you will always know the status of your solutions and have a clear path for growth and expansion.

BENEFITS

Benefits of working with FastoPayments

- Fast onboarding

- Reliable service

- Various integrations

- Clear commission structure

- Payment experts

- Many, many solutions

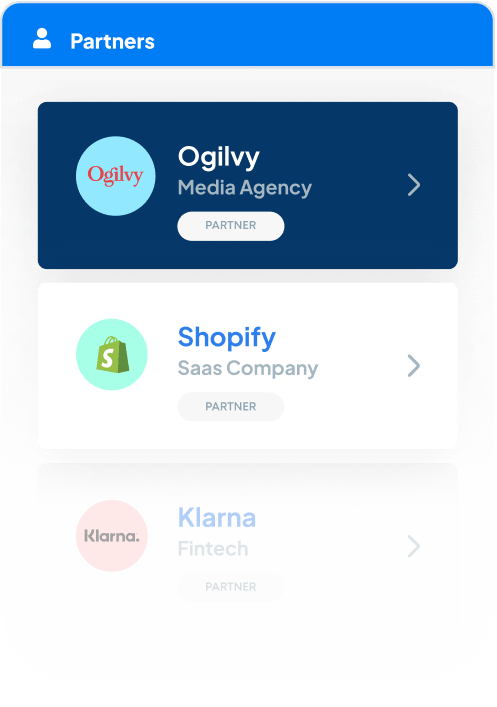

INDUSTRIES

Who can partner with us?

- Media agencies

- Hosting companies

- Development providers

- Marketing bureaus

- SaaS systems

- PSP/ISO/Corporate entities

Merchant Policy

Who can partner with us?

At FastoPayments, we prioritize compliance, transparency, and strong business partnerships. Our Partner Merchant Acceptance Policy outlines the criteria and guidelines for onboarding merchants across various industries, ensuring they align with our regulatory and operational standards. We provide secure payment solutions for high-risk sectors, including adult entertainment, travel, strip clubs, nightclubs & bars, dating, and more.

Our policy covers essential aspects such as KYC (Know Your Customer) requirements, chargeback limits (strictly adhering to Visa’s VAMP guidelines), and the types of merchants we can support, both online and offline. We work closely with our acquiring partners to ensure seamless integration, 24/7 support, and comprehensive monitoring for merchants, fostering long-term growth and compliance.

FastoPayments is committed to delivering flexible, efficient payment solutions, backed by a tiered fee structure, advanced fraud prevention, and global reach across Europe, the EEA, the UK, and North America.

Partner Form

FAQ

Frequently Asked Questions

Discover how partnering with FastoPayments can unlock new revenue streams, global payment solutions, and tailored support for your clients.

Below, we answer the most common questions about our partnership program, the industries we serve, and how we help you scale your business.

Why should I partner with FastoPayments instead of other payment providers?

FastoPayments is more than a payment provider. We offer a complete ecosystem for partners, combining global card processing, banking solutions, local payment methods, hosting, and corporate structuring.

Our agile and tailored approach helps partners unlock new markets while ensuring compliance, speed, and scalability. We provide transparent communication and dedicated support at every step.

What types of businesses or consultants can partner with FastoPayments?

We welcome partnerships with consultants, financial intermediaries, agencies, hosting providers, and corporate service firms.

If your clients need payment processing, IBAN banking, mass payouts, or merchant accounts in high-risk sectors such as adult, nutraceutical, travel, or digital services, FastoPayments provides the expertise and infrastructure to support your growth.

What regions and industries does FastoPayments cover for partnerships?

FastoPayments operates globally with a strong presence across the UK, EEA, Europe, and North America. We specialize in industries including dating, travel, edtech, adult, vape and nutraceuticals.

Our partnerships help you serve clients needing secure payment gateways, merchant accounts, or cross-border banking.

How does FastoPayments support its partners?

Partners receive monthly strategic calls, solution overviews, and priority support. We ensure clear and transparent communication, provide updates on new services, and offer co-branded opportunities to strengthen your offerings.

Our success-driven approach is built on mutual growth and to enable options for partners which are not currently available.

Can I earn commissions or revenue share as a FastoPayments partner?

Yes, our partnership model includes competitive revenue sharing and commission structures for successful referrals and onboarded merchants.

Whether you are referring startups, established merchants, or high-risk businesses in industries like adult, dating, or vape, we provide fair and scalable incentives tailored to your efforts. We can work on a referral basis or as the main point of contact, whichever is preferred by you.

Does FastoPayments offer custom solutions for partners’ clients?

Absolutely. We do not believe in one-size-fits-all. Every partner’s client portfolio is unique, so we tailor payment processing, banking, and corporate structuring solutions to each client’s needs.

This includes bespoke merchant accounts, mass payout systems, full paytech infrastructure, chargeback prevention and fraud detection plus much more.

What onboarding process should I expect as a partner?

Partnering with FastoPayments is a simple and structured process.

Once you contact us, we schedule an initial call to understand your business and explore the potential fit.

If there is alignment, we sign a mutual NDA to ensure confidentiality and to assess the opportunities in more detail.

From there, we proceed with a formal partner agreement. Once signed, you are fully onboarded and ready to move forward with us.

We are also developing a dedicated partner dashboard that will provide real-time overviews of your referred merchants and earned commissions, giving you full visibility and control.

How can I get started with the FastoPayments partnership program?

Simply reach out via our partnership inquiry form or contact our team directly.

We will discuss your business model, partnership potential, and how we can collaboratively grow your revenue streams with payment processing, banking, and business structuring solutions.

Working for FastoPayments?

FastoPayments is a dynamic and rapidly expanding leader in the payment processing, paytech platform development, and fintech sectors. With a strong presence across multiple global markets, we are shaping the future of banking, hosting, and corporate structuring. At FastoPayments, we are driven by a passion for innovation and are constantly evolving to stay ahead in an ever-changing landscape.

We believe in creating an environment where cutting-edge technology and big ideas are the foundation of everything we do. If you’re ready to be a part of a fast-paced, forward-thinking company that thrives on constant growth and innovation, you’ll find your place here.

At FastoPayments, we value ambition, drive, and the relentless pursuit of excellence. If you’re looking to work at a company where you’ll be challenged, inspired, and given the opportunity to continuously grow both professionally and personally, then FastoPayments is the place for you.

We’re not just building technology; we’re building a culture that empowers individuals to thrive and live life to the fullest. If you’re ready to push yourself and make a real impact in the fintech world, we’d love to hear from you. We’re always looking for individuals with the right mindset—people who aren’t afraid to take on new challenges and embrace opportunities.