Boost Approval Rates with Smarter Gateway Optimization

Payment declines are more than a missed sale. They create friction, frustrate customers, and drain revenue over time. For merchants processing high volumes or relying on recurring payments, even a small percentage of declines can have a major impact.

For example, a subscription merchant processing €2 million monthly could lose €40,000 per month if approval rates drop by just 2%. Optimizing your gateway can recover this revenue without adding new customers, making it one of the highest return improvements available.

Why do Transactions Fail

Before fixing payment failures, you need to know why they happen. Each decline reason signals a different issue and requires a customand serviced response.

Do Not Honor

This is a very vague, but also common decline which means the issuer blocked the transaction without specifying why. It often happens due to temporary risk checks or unusual spending patterns from the consumer. Merchants see these account for up to 30% of soft declines, making them a major opportunity for revenue recovery and growth.

Insufficient Funds

The customer lacks available balance or credit. These soft declines represent 15–20% of recurring payment failures and are often recoverable with strategic retries around known salary dates.

Expired or Invalid Card

Card details that are outdated or mistyped will trigger declines. For recurring merchants, automatic account updater services can reduce these declines by up to 50%.

Stolen or Lost Card

These are hard declines flagged for fraud. They must never be retried. Industry data shows that retrying flagged fraud cards can increase your risk score and lead to higher chargeback monitoring fees as well as shadow bans from the acquirer.

Fraud Filters

Both the merchants and issuers fraud system can block legitimate transactions if rules are too strict. False positives can make up as much as 10% of declined volume for high risk merchants.

Cross Border Restrictions

Many issuers block transactions from certain countries or merchant categories. Merchants adding local acquiring in key markets often report 5–8% approval lifts almost immediately.

Technical Failures

Acquirer outages or network errors are common in global payment flows. Orchestration with automatic failover can reduce failed payments during outages by over 90%.

Prevent Declines Before They Happen

The best way to improve approval rates is to stop declines at the source. Building preventative measures into your gateway setup reduces failures and creates a seamless customer experience.

Account Updaters

Recurring businesses that add account updater services often see 30–50% fewer declines from expired cards. This is critical for subscription models where customer friction must stay low.

Tokenization and Vaulting

Tokenized transactions are recognized by issuers as more secure, resulting in 2–3% higher approval rates compared to manually entered data.

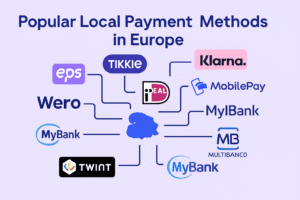

Local Payment Methods

Merchants introducing local cards or wallets in new regions have reported up to 10% higher approvals for cross border customers, while also cutting processing fees.

Optimized Fraud Settings

Fine tuning fraud tools can reduce false positives by 20–30%, which means fewer good customers are blocked. This balance between security and conversions is critical in high risk industries.

Clear Soft Descriptors

Chargeback studies show 15% of disputes occur because customers do not recognize the transaction. Clear descriptors prevent confusion and disputes.

Multiple Acquirers

Merchants using multi acquirer setups often see approval lifts of 5–15% by routing traffic to the best performing provider for each card BIN or geography.

Smarter Retries

Retries can recover lost revenue, but only when applied strategically. Blind retries risk penalties and lower future approval rates.

Use Decline Codes

Retry soft declines like “Insufficient Funds” or “Do Not Honor.” Never retry hard declines like “Stolen Card” or “Invalid Account,” as these are unlikely to succeed and can harm your merchant profile.

Time Retries Carefully

Immediate retries often fail. Waiting hours or days improves success, especially for insufficient funds, where success rates may double if retried after payday.

Limit Retry Attempts

Capping retries at two or three prevents issuers from flagging your merchant ID. Over retrying can trigger monitoring programs like Visa’s VAMP, increasing costs and scrutiny.

Alternate Routing

If a payment fails with one acquirer, try another. Case studies show cross routing can recover up to 8% of failed transactions in international sales.

Dynamic Customer Messaging

If retries fail, notify customers immediately. Merchants prompting customers to update payment details see 20–25% faster recovery of failed subscriptions.

Payment Orchestration

Payment orchestration connects multiple acquirers, payment gateways, and payment methods in real time, automatically selecting the best path for each transaction. For high volume merchants, orchestration delivers measurable gains.

Geographic Routing

Domestic routing can lift approvals by 5–7% compared to cross border processing.

Performance Based Routing

By continuously analyzing approval rates by BIN and issuer, merchants can route to the acquirer with the highest success rate, often improving overall approvals by 3–5%.

Failover Protection

During acquirer outages, failover routing keeps transactions flowing. This has saved some merchants tens of thousands in recovered revenue per hour during downtime events.

Cost Optimization

Routing low risk traffic to low fee acquirers while reserving premium acquirers for challenging traffic can cut processing costs by up to 20% annually.

Continuous Testing

Merchants running A/B routing tests often discover hidden approval lifts of 2–3% that compound over time.

Continuous Monitoring and Optimization

Gateway optimization is not set and forget. Issuer rules, fraud patterns, and acquirer performance evolve constantly. Continuous analysis ensures merchants maintain peak performance.

Approval Rate Analysis

Tracking approval rates by BIN, card type, and region highlights underperforming routes, enabling corrective action quickly.

Decline Reason Insights

Segmenting soft vs hard declines prevents wasted retries and informs customer communication strategies.

Retry Performance Tracking

Monitoring retry success rates helps refine timing and routing strategies for better recovery.

Fraud and Chargeback Trends

Keeping a close eye on chargeback ratios ensures you remain below network thresholds, avoiding penalties and higher fees.

Regular Optimization Cycles

Merchants who review performance monthly and adjust routing strategies regularly can maintain consistent approval lifts of 3–6% over time.

Why This Matters

Even small improvements in approval rates drive significant returns. For a business processing €5 million per month, a 3% approval lift equals €150,000 in recovered revenue without any extra marketing spend.

Optimizing your gateway improves conversions, strengthens customer trust, and reduces operational costs. It is one of the most impactful yet overlooked growth levers in payments.

FastoPayments offers a free review of your current gateway setup. We will show you where declines are happening, explain what can be improved, and create a clear plan to raise your approval rates. If you want to see how much revenue you could recover, contact our team today.

What is the difference between a soft decline and a hard decline?

A soft decline is temporary. Examples include insufficient funds, expired cards, or network timeouts.

These are often caused by factors that can be resolved automatically or with a retry. A hard decline is permanent and happens when the card is stolen, closed, or blocked due to fraud.

Hard declines should never be retried, as they will always fail and may negatively affect your merchant risk profile. Understanding this difference helps merchants apply smart retry logic and avoid unnecessary costs.

How many times should you retry a failed payment?

Most merchants see the best results with two or three retries. The timing of these retries is critical. Soft declines like insufficient funds can succeed if retried after a payday, while network errors may be resolved within minutes or hours.

Exceeding three retries can raise red flags with issuers and harm approval rates. Intelligent retry logic that adapts based on decline reason is far more effective than blindly reattempting the same transaction.

Why do I get “Do Not Honor” declines?

“Do Not Honor” is one of the most common issuer responses, yet it provides little detail. It usually signals that the issuer’s risk engine blocked the transaction, which could be due to unusual spending patterns, high transaction values, or regional restrictions.

While frustrating, these declines are often soft and can succeed if retried later or routed through a different acquirer. Analyzing when and where these declines occur can uncover patterns and highlight the need for routing optimization.

What is payment orchestration and why is it important?

Payment orchestration allows merchants to manage multiple acquirers and payment methods through one system. Instead of relying on a single gateway, transactions can be routed dynamically to the acquirer most likely to approve them. This improves approval rates, reduces processing costs, and ensures failover during outages.

For businesses operating globally or in high‑risk industries, orchestration is essential for maintaining uptime and maximizing revenue from every transaction.

💡 Interested in learning more about what’s included in a typical high-risk merchant account? View our complete breakdown of FastoPayments’s high-risk merchant accounts.