Introduction

The way customers pay is shifting at a pace we have never seen before. Credit and debit cards remain the most recognized payment option worldwide, but local payment methods (LPMs) are rewriting the rules in markets from Europe to Latin America to Asia.

For merchants, the real question is no longer whether to accept cards or LPMs, but how both can fit together in a sustainable payments strategy. This article explores the current state of card payments, the rise of local methods, and what the future looks like for businesses that want to expand globally while keeping approval rates high and costs under control.

The State of Cards Today

Cards have been the backbone of e-commerce and point-of-sale transactions for decades. They are instantly recognizable to consumers, supported by a global infrastructure, and still account for a large share of international online payments.

Globally, however, the balance is shifting. Digital wallets now account for 36% of all online payments, while credit cards make up about 23% and debit cards another 12 percent. This shows that while cards remain critical, consumer behavior is moving toward alternatives that offer more convenience and accessibility.

For merchants, cards bring global reach and consumer trust, along with extensive security frameworks such as 3DS 2.0, tokenization, and fraud monitoring. Yet the challenges are becoming clearer:

High fees from interchange and scheme costs

Chargeback exposure that creates operational strain

Lower approval rates in markets where card penetration is weak

Despite these hurdles, cards remain essential. They continue to be the primary payment tool for cross-border trade and will not disappear, even as alternatives expand.

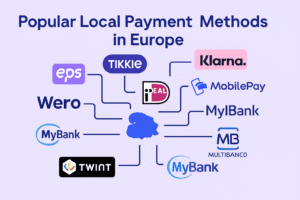

The Rise of Local Payment Methods (LPMs)

Top Local Payment Methods are payment solutions that operate on domestic or regional rails rather than international card schemes. They cover a wide range of options, including:

Bank transfers and instant payments such as SEPA Instant, PIX in Brazil, and UPI in India

E-wallets and mobile apps like Alipay, WeChat Pay, and PayPal

Buy Now, Pay Later (BNPL) platforms such as Klarna, Afterpay, and Scalapay

Cash-based vouchers including OXXO in Mexico and Boleto in Brazil

The success of LPMs comes from accessibility and trust. Consumers often prefer them because they feel safer, particularly in markets with high fraud rates, and because they do not require a credit card. For merchants, these methods typically reduce costs and improve approval rates.

The scale of adoption is striking. In India, the UPI system processed around 20 billion transactions in August 2025, which equals more than 7,500 payments per second. In Brazil, PIX has become the backbone of the economy, hitting a record 276.7 million transactions in a single day in June 2025. These figures show that in some countries, LPMs have already surpassed cards as the preferred way to pay.

Regional adoption highlights their growth:

In Asia, wallets dominate with Alipay, WeChat Pay, and India’s UPI

In Europe, iDEAL and Klarna are well established in e-commerce

In Latin America, PIX and OXXO have reshaped how consumers transact

For any business expanding internationally, offering local methods is no longer optional. If customers do not see their preferred option at checkout, they are likely to abandon the purchase.

LPMs vs Cards: Key Differences for Merchants

When comparing LPMs and cards, four areas stand out:

Costs: Cards involve interchange and scheme fees, while LPMs such as bank transfers and instant payments often come with lower costs.

Approval rates: Cards are reliable across borders, but LPMs usually achieve higher success rates within their home regions.

Risk and chargebacks: Cards include strong consumer protections that add financial risk for merchants. LPMs, as push payments, typically do not carry chargeback risk.

Coverage: Cards are unmatched for global commerce, whereas LPMs unlock regional markets that cards alone cannot reach.

The balance is clear. Cards and LPMs serve different purposes, and merchants benefit from using both.

The Future of Payments

The payments industry is moving toward convergence rather than competition. Several trends are driving this shift:

Open banking and real-time payments, supported by regulations like PSD3 in Europe

Network innovation from Visa and Mastercard, with products such as Visa Direct and Mastercard Send

The rise of wallets and super apps from Apple, Google, and regional players

Regulatory frameworks including Visa’s VAMP that push for faster and more transparent transactions

Cards will adapt to this new reality, but merchants who rely solely on them risk being left behind in markets where local methods dominate.

What This Means for Merchants

Merchants need to think strategically about their payment mix. Cards are crucial for international commerce, while LPMs drive higher conversion in regional markets. Combining both can reduce costs, improve approval rates, and give customers the freedom to pay how they want.

Those who act early will be better prepared for a world where real-time payments, wallets, and open banking coexist with traditional card networks. At FastoPayments, we support merchants in combining these solutions into one flexible, future-proof setup.

Conclusion

Cards remain the backbone of global commerce, but local payment methods are shaping the future. The smartest strategy is to use both, not choose between them. Customers want choice, regulators are pushing innovation, and payment providers are making it easier than ever to deliver.

The businesses that succeed will be the ones that offer every customer their preferred way to pay, whether that is a card, a wallet, or an instant bank transfer.

💡 Interested in learning more about what’s included in a typical high-risk merchant account? View our complete breakdown of FastoPayments’s high-risk merchant accounts.