Klarna by the Numbers

Klarna is one of the largest fintech companies in the world. In 2024, they served more than 111 million active consumers and partnered with 790,000 merchants across 26 countries. Their Gross Merchandise Volume reached nearly 93 billion USD, with a record-breaking month exceeding 10 billion USD in transactions. Klarna processes around 2.5 million transactions every single day, making it one of the most trusted and widely used payment providers globally.

Their financial strength is equally impressive. Klarna reported 823 million USD in revenue in Q2 2025, driven by strong expansion and more than 200,000 new merchant partners in the past year. The company has also achieved operational profitability for five consecutive quarters.

Innovation at Klarna

Klarna has built its scale through continuous innovation. Their use of artificial intelligence is a key driver, with AI already handling customer service and reducing resolution times from 11 minutes to only 2 minutes. This technology improves efficiency for both merchants and consumers.

The company has also expanded into new financial products including debit cards, banking services, and integrations with global leaders such as Walmart, eBay, Stripe, Nexi, and JPMorgan Payments. Klarna is not just a BNPL provider anymore, but a broad financial technology platform.

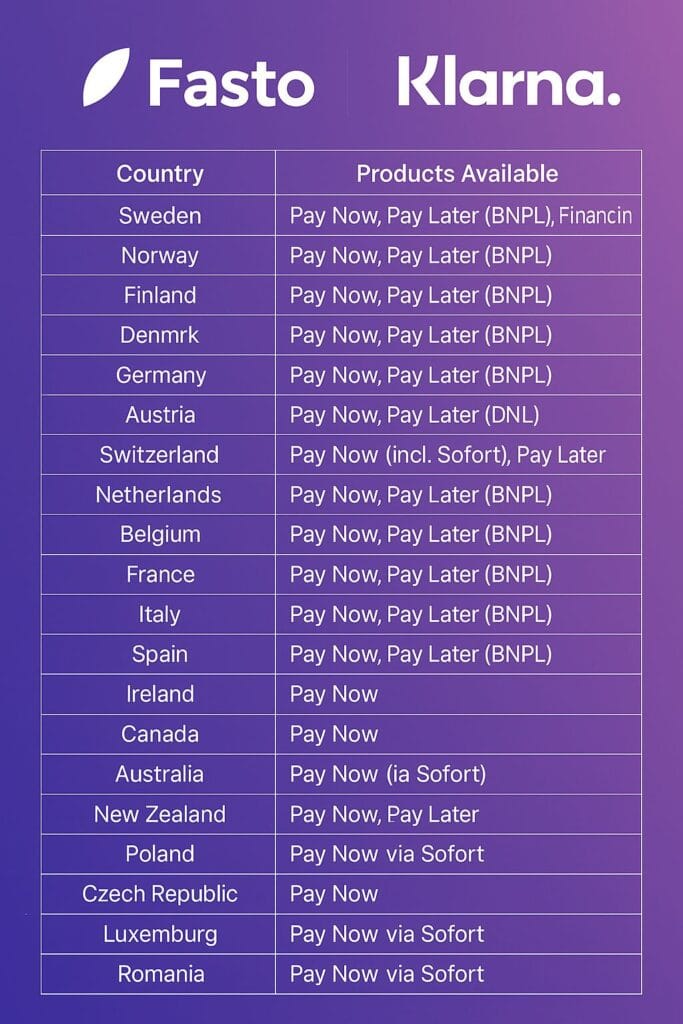

Klarna’s growth has also come through strategic acquisitions. In 2013, Klarna acquired the German payment provider Sofort for around 150 million USD. Sofort was a pioneer in direct bank transfer payments across Germany and Europe. Over the following decade, Klarna gradually integrated Sofort’s technology into its platform. By 2024, Sofort no longer existed as a standalone payment method and was fully merged into Klarna Pay Now, giving merchants and consumers a unified and trusted bank transfer option across Europe.

IPO as Proof of Influence

Klarna’s planned New York Stock Exchange listing, announced in September 2025, aims to raise more than 1.2 billion USD and values the company at around 14 billion USD. This move shows the strength of alternative payments and underlines Klarna’s influence on global commerce. For merchants, it is proof that Klarna is here to stay and that its payment methods are mainstream.

What is Klarna Pay Now

Klarna Pay Now allows consumers to pay instantly by bank transfer. Instead of relying on cards, the payment is processed directly from a customer’s bank account, creating faster and more reliable checkouts.

It is already popular across Scandinavia, Germany, and the wider EU, and it is expanding into the United States. Consumers trust the Klarna brand, and Pay Now offers them a familiar and safe way to shop online.

Where Klarna Pay Now Works

Klarna operates in 26 countries, but not every product is available everywhere. Merchants should know which solutions are live in each market.

Why Merchants Should Care

Higher approval rates: Direct bank transfers avoid card declines and increase successful transactions. This directly supports better approval optimization, which is especially important for merchants operating in high-risk industries.

Trusted consumer brand: Klarna is well known, which reduces checkout abandonment.

Expansion opportunities: Klarna Pay Now is available in growing markets across Europe and the United States.

Lower fraud risk: Transactions through Pay Now are safer compared to traditional cards. Stronger fraud protection also helps reduce chargebacks, giving merchants more stability when scaling online.

How Fasto Can Help You

Fasto enables merchants to integrate Klarna Pay Now without complexity. Our platform connects Klarna with other local payment methods such as Pix, Swish, MobilePay, and Bizum, allowing you to reach more customers through a single solution.

Fasto is also an approved vendor of Klarna, which means merchants get access to Klarna Pay Now and Klarna’s full suite of products through a fully recognized integration partner. This ensures compliance, reliability, and seamless onboarding.

With Fasto, you also gain access to approval optimization features such as BIN-level routing and tokenization, as well as a single dashboard to monitor performance across all payment flows. Our platform also supports recurring billing models, where payment reliability and approval rates are crucial for long-term growth.

💡 Interested in learning more about what’s included in a typical high-risk merchant account? View our complete breakdown of FastoPayments’s high-risk merchant accounts.