Recurring Payments in 2025: The Opportunity, the Risk, and the New Rules You Can’t Ignore

Recurring billing merchants have become the backbone of many digital businesses. From subscription boxes to streaming services, SaaS tools to content platforms, merchants have embraced the promise of predictable revenue and high customer lifetime value.

But beneath the surface lies a payment processing landscape that is changing fast, and not always in the merchant’s favor.

Why Recurring Billing Works So Well

The recurring billing model has gained tremendous traction over the past decade, and for good reason. It offers businesses a powerful combination of financial stability, customer engagement, and scalable growth.

One of the biggest advantages is predictable cash flow. By obtaining more recurring revenue, businesses can more confidently plan expenses, investments, and growth initiatives without the unpredictability of one-time purchases.

Recurring customers also have a significantly higher customer lifetime value (LTV). Studies show that users on subscription models spend between 60% and 75% more over time compared to those who pay per transaction. This consistent engagement helps businesses build long-term relationships and improves retention.

In terms of loyalty and behavior, recurring billing models reduce friction in the buying cycle. Once a customer subscribes, they are less likely to churn unless there’s a major issue. The ease of passive payments leads to a more seamless user experience and stronger brand affinity.

As of 2024, the subscription economy continues to grow at pace. According to a report published by PR Newswire, the global subscription e-commerce market is projected to hit $904 billion by 2026, up from just $120 billion in 2020 (source). Industries like fitness, nutraceuticals, adult content, and professional services are all leveraging recurring billing to drive customer engagement.

This growth signals that recurring models are not a passing trend. For merchants that can execute them well, the upside is massive. But as this model scales, so do the risks and scrutiny, especially from regulators and card networks, making execution and compliance more critical than ever.

Key Trends in Recurring Payments for 2025

Recurring billing is evolving rapidly. What worked five years ago may now increase churn, risk, or regulatory red flags. Here’s what’s shaping the space today:

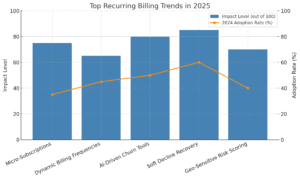

1. Micro-Subscriptions Are Booming

Low-entry pricing models like €1.99/week are gaining traction, particularly in AI products, home entertainment, gaming, and adult services. These boost conversion, but require solid retention and extremely low chargeback rates to remain viable.

35% of digital services in 2024 offered some form of sub-€5 recurring plan , more than double since 2021.

2. Dynamic Billing Frequencies

Customers now expect flexibility , from weekly billing to usage-based models. But with more billing cycles come more chances for failure, fraud, or dispute. Merchants must align their billing cadence with both risk appetite and acquirer tolerance.

3. AI-Driven Churn Reduction

From smart dunning to behavioral retention triggers, AI is helping reduce voluntary and involuntary churn. Advanced systems can detect signals that a user is about to cancel and automate recovery tactics.

Businesses using AI-driven billing saw a 28% reduction in churn in 2024.

4. Recovering Soft Declines with Automation

Soft declines from expired cards or insufficient funds account for a major slice of lost revenue. Automated retry logic and Account Updater tools are now critical.

Visa reports up to 70% of failed rebills can be recovered with Account Updater tools.

5. Risk Scoring and Geo-Sensitive Billing

Acquirers are now grading merchants not just on overall performance, but on geo- and MCC-specific risks. Merchants that adapt their billing strategies by region or risk profile are better positioned to stay compliant , especially under VAMP.

Visual Snapshot of 2025 Trends

Below is a visual breakdown showing the relative impact level of each trend and their adoption rate in 2024:

The VAMP Shift: Why Recurring Merchants Should Take Notice

As of early 2025, Visa has introduced stricter criteria under its Visa Acquirer Monitoring Program (VAMP). Among the most pressing changes:

Combined fraud and chargeback ratio must remain below 0.9% (From 2026)

High-risk MCCs and subscription models face faster intervention and penalties

Repeated violations can result in acquirer termination or merchant bans

What does this mean for recurring businesses? A single spike in refunds, poor onboarding, or a viral customer complaint could land you in hot water , or worse, see your merchant account shut down without warning.

Real-World Examples: Where Recurring Goes Right (and Wrong)

What works:

Recurring billing can be a powerful model when implemented with transparency and precision.

SaaS companies, for example, have successfully reduced churn by offering clear billing structures and flexible cancellation terms, allowing customers to remain in control. Content creators using platforms like Patreon benefit from direct relationships with their audiences, where monthly billing is expected and trusted.

Similarly, subscription services in the health and wellness space,particularly those that prioritize proactive communication and easy cancellation policies,report dispute rates well under industry thresholds. These examples show that when customers feel informed and empowered, recurring billing can be an engine for growth.

What fails:

When recurring billing is executed without clear communication or fails to meet evolving compliance standards, the risks escalate fast.

In recent years, a significant rise in disputes has been observed across subscription verticals. In 2024, chargeback rates for digital goods and recurring services were reported to have increased by nearly 60%, with a large portion attributed to friendly fraud and unrecognized billing. (source).

The travel and hospitality sectors,especially those with auto-renewal or dynamic pricing models,saw chargeback rates spike more than ninefold compared to the previous year. These shifts underscore just how volatile recurring models can become without the right infrastructure, communication practices, and customer support in place.

How to Stay Compliant , and Profitable

If you rely on recurring billing, staying compliant and profitable requires more than just a solid payment processor. You need a proactive strategy that adapts to changing regulations, customer behavior, and acquirer expectations.

Start by making your rebill terms unmistakably clear at checkout. Many chargebacks begin with poor communication, so transparency in pricing, billing frequency, and cancellation policies is your first line of defense.

Next, put a robust dunning process in place. Recovering failed transactions through automated reminders and card updater tools can significantly boost revenue and reduce involuntary churn.

It’s also important to assess risk by geography and business model. Acquirers are watching chargeback and fraud rates not only by merchant, but by vertical and region. A one-size-fits-all billing strategy could expose your account to unnecessary scrutiny.

Descriptors should be consistent and easily linked to your brand. If your customers don’t recognize a charge, they’re more likely to dispute it , even if it’s legitimate.

Lastly, have a contingency plan. That means setting up backup merchant accounts in advance, particularly if you’re in a high-risk sector. Waiting until you lose an account is already too late.

The Smart Move: Multiple Merchant Accounts

If you’re only processing with one acquirer, you’re exposed. FastoPayments works with global merchants to:

Set up multi-MID recurring strategies

Serve verticals like adult, AI, SaaS, dating, health, and subscription platforms

Stay VAMP-compliant and build acquirer trust

Recover lost revenue from failed rebills and disputes

Whether you’re scaling fast or trying to protect what you’ve built, we help you stay one step ahead of the rules and your competition.

Frequently Asked Questions (FAQ) About Recurring Payments in 2025

1. What is the biggest risk of recurring billing in 2025?

The biggest risk is breaching Visa’s VAMP thresholds. Even a small spike in chargebacks or fraud can lead to frozen accounts or permanent blacklisting from acquirers. Maintaining dispute rates below 0.9% is now critical.

2. Can I still use recurring billing if I’m in a high-risk industry?

Yes, but you’ll need to work with acquirers that specialize in high-risk recurring models. FastoPayments helps merchants amongst many industries, some of them are adult, dating, travel, AI, and content sectors set up reliable recurring processing with compliant structures.

3. How can I reduce chargebacks from rebills?

Clear billing descriptors, timely rebill notifications, and a simple cancellation process are key. Pair this with AI-based fraud filters and automated retries to keep your chargeback ratios low and retention high.

4. Should I use more than one merchant account for recurring billing?

Absolutely. Using multiple merchant accounts (MIDs) spreads your risk and gives you processing redundancy. This is especially important if one provider shuts you down unexpectedly.

5. What tools help with recurring billing success?

Smart dunning tools, Account Updater services, real-time fraud screening, and billing analytics dashboards are now standard. AI is also helping predict churn and improve customer lifetime value.

What FastoPayments Can Do for You

Navigating the world of recurring payments in 2025 requires more than a payment gateway. It takes expertise, agility, and access to the right banking relationships.

At FastoPayments, we help high-risk and innovative merchants set up tailored recurring billing infrastructures that not only convert but also comply. Whether you’re in adult content, SaaS, AI, dating, travel, or digital services, we understand your model and how to keep it stable at scale.

We offer:

Multiple merchant account options across jurisdictions

Smart tools for dunning, fraud control, and billing analytics

Hands-on support with onboarding, descriptor optimization, and chargeback mitigation

Let us help you future proof your recurring payment strategy and reduce the risk of acquirer disruptions or VAMP violations.

💡 Interested in learning more about what’s included in a typical high-risk merchant account? View our complete breakdown of FastoPayments’s high-risk merchant accounts.