BIN-Level Routing: The Hidden Engine Behind Higher Approval Rates

Introduction

Merchants lose billions every year due to failed transactions. In fact, global ecommerce businesses lose an estimated 118 billion dollars annually to false declines alone (Aite-Novarica). BIN-level routing is one of the most powerful ways to reduce that loss, increase approval rates, and improve the customer experience.

Most merchants focus on their payment processor or payment gateway, but what really decides if a transaction is approved or declined often comes down to how it is routed. Yet many businesses have never heard of BIN-level routing.

At Fasto, we believe understanding BIN routing is essential for anyone serious about scaling globally. Let’s break it down and show how it connects to other critical areas such as chargebacks and recurring payments.

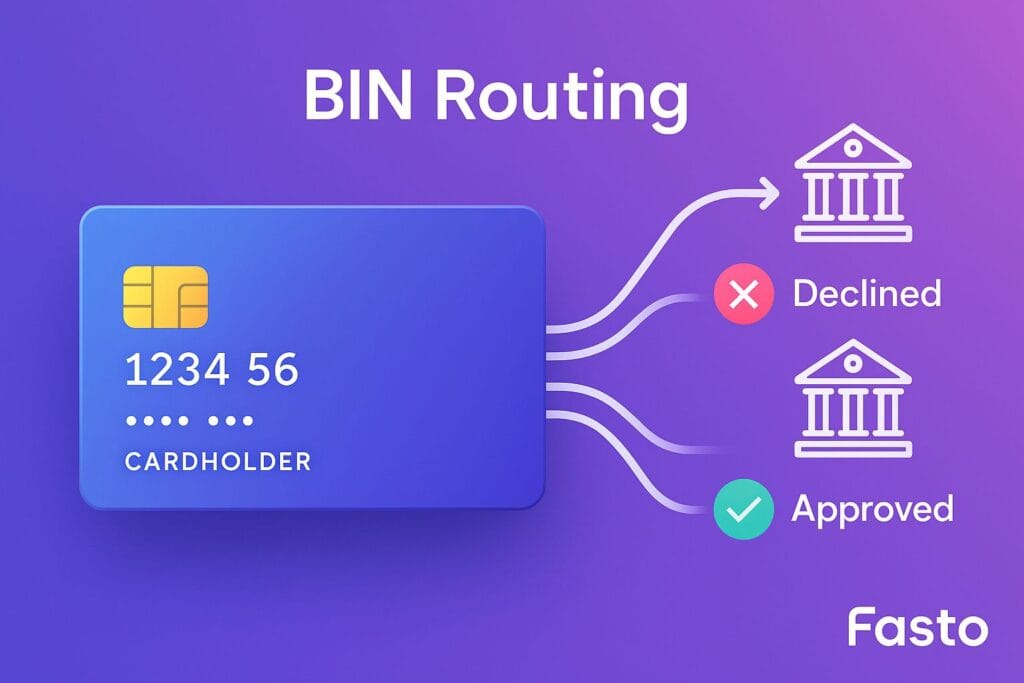

What Is BIN-Level Routing?

A BIN (Bank Identification Number) is the first 6 to 8 digits of a credit or debit card. These digits reveal key information such as: the issuing bank, the card type, the country of issuance, and the card brand.

When a customer enters their card details, a payment gateway can read the BIN and decide the best route to send that transaction. This is called BIN-level routing, and it is the backbone of smart payment optimization.

Why BIN Routing Matters for Merchants

The payment industry processes more than 14 trillion dollars annually (Nilson Report, 2023), and decline rates vary dramatically depending on how transactions are routed.

Higher approval rates

Routing a transaction to the acquirer most compatible with that card increases the chances of approval. This can create a swing of 10 to 20 percent in approval rates, which directly translates into higher revenue.

Lower processing costs

Each route comes with different fee structures. BIN-level routing allows merchants to optimize for the lowest-cost path while still protecting conversion rates. This can have a major impact on margins at scale.

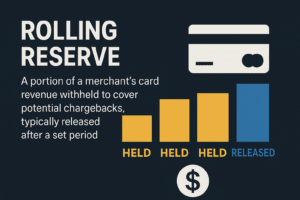

Fraud and chargeback reduction

Routing to acquirers with stronger fraud management for certain geographies or card types lowers exposure to both fraud and disputes. Cleaner traffic means fewer false declines, but also fewer transactions that later escalate into chargebacks. For more on handling disputes, see our chargeback guide.

Better customer experience and recurring payments

When a payment is declined, customers are less likely to retry. Visa reports that retry rates fall by 39 percent after a single failure. For merchants with subscription models, unnecessary declines can directly lead to subscription churn. BIN routing prevents many of these declines, improving retention and protecting recurring revenue streams. You can explore more in our guide to recurring billing.

Example: A French-issued Visa card may have a 15 percent higher approval rate when routed to a European acquirer compared to sending it through a US-based one.

How BIN Routing Works in Real Time

Here is a simplified view of what happens when a customer pays:

Customer enters card details.

The gateway identifies the BIN and gathers data such as bank, country, and card type.

The system chooses the acquirer most likely to approve that card.

The transaction is processed along the optimal route.

This decision is made in only milliseconds, but it can mean thousands of dollars in recovered revenue every single day for merchants processing at scale.

BIN Routing in High-Risk Industries

High-risk merchants face some of the toughest approval challenges. Decline rates in high-risk verticals can reach 30 to 50 percent, compared to 10 to 15 percent in mainstream retail.

Lifting approval rates

With BIN-level routing, approval rates in high-risk industries can often be lifted by 15 to 25 percent. This creates a direct impact on monthly revenue that cannot be ignored.

Example impact

A high-risk merchant processing 5 million dollars monthly at a 50 percent decline rate could lose 2.5 million dollars in potential revenue. If smart BIN routing improves approvals by just 15 percent, that represents 750,000 dollars recovered each month.

Fasto’s Approach to BIN Routing

At Fasto, we built our gateway technology to make BIN routing smarter, not just simpler. Using our FURY system, merchants benefit from a powerful combination of features.

Dynamic decision-making

Our routing engine looks beyond basic country matching. It evaluates geography, risk profile, and approval history before choosing the best acquirer.

Real-time optimization

Card scheme rules are constantly changing. Our system adapts in real time so merchants do not lose approvals due to outdated routing logic.

Fallback routing

When one acquirer declines a transaction, FURY automatically reroutes it through another path within milliseconds. This saves payments that would otherwise be lost, directly increasing revenue.

Merchants using Fasto’s routing technology typically see approval rates up to 20 percent higher compared to single-acquirer setups, while also benefiting from lower costs, fewer chargebacks, and stronger acquirer relationships.

The Future of BIN Routing

Payments are evolving quickly, and the future of routing is predictive. Artificial intelligence and machine learning will play an even greater role by analyzing millions of data points to decide the best route for every transaction in real time.

The next evolution also combines routing with local payment methods as a backup option. If a card payment fails, systems can automatically offer an alternative method such as Pix, iDEAL, Swish, or MobilePay, ensuring global merchants achieve near-frictionless payments.

Fasto’s Conclusion

BIN-level routing may sound technical, but for merchants it is simple. It means more approvals, fewer chargebacks, stronger recurring billing performance, and better overall business results.

Ignoring it means leaving revenue on the table.

At Fasto, we help businesses unlock the power of smart routing so they can grow confidently in any market.

How does BIN-level routing actually increase approval rates?

BIN-level routing increases approval rates by matching each card to the acquirer most likely to approve it. For example, a card issued in France often performs better with a European acquirer than a US acquirer.

By making this decision in milliseconds, merchants avoid unnecessary declines, which directly improves revenue. Merchants using smart BIN routing often see approval rates rise by 10 to 20 percent compared to single-acquirer setups.

Can BIN routing help reduce chargebacks and fraud?

Yes. BIN routing is not only about approvals, it is also about sending transactions through the safest possible path. By routing specific BIN ranges to acquirers with stronger fraud filters or better risk tolerance for that industry, merchants reduce false positives and block suspicious transactions before they escalate into disputes.

This lowers overall chargeback ratios and helps merchants maintain cleaner processing traffic.

Why is BIN routing important for recurring or subscription payments?

Recurring payments often fail because the routing is not optimized for card type, issuing bank, or region. When a subscription renewal is declined, customers may cancel, creating unnecessary churn.

BIN routing ensures recurring transactions are sent to the acquirer with the highest chance of approval, keeping subscription models stable and predictable. For merchants, this means stronger retention and more reliable recurring revenue.

💡 Interested in learning more about what’s included in a typical high-risk merchant account? View our complete breakdown of FastoPayments’s high-risk merchant accounts.