Introduction: Why Discreet Billing Is More Important Than You Think

For many businesses, what shows up on a customer’s bank statement might seem like a small detail. But in industries where discretion matters, that single line of text can make or break trust.

Discreet billing gives merchants the ability to process payments while keeping sensitive purchases private. It is commonly used in industries where customers may feel uncomfortable or judged if their purchase is revealed to others.

Whether you operate a fan site, a dating platform, a wellness product store, or a telehealth app, discreet billing can protect your customers and strengthen your brand.

This guide covers what discreet billing is, how it works, who needs it, and the best ways to implement it.

What Is Discreet Billing?

Discreet billing is a method of payment processing that replaces a business’s real name or product description with a neutral, non-identifying phrase on a customer’s bank or credit card statement.

For example:

Instead of “EliteCamsXXX”, the customer sees “Online Media EU”

Instead of “PleasureBox”, they see “Wellness Services”

The idea is not to hide the transaction from the customer, but to protect them from unwanted questions or attention from others who might see the statement.

Discreet billing is commonly used in high-risk industries, but it is also valuable in any industry where privacy is part of the customer experience.

How Discreet Billing Works

When a customer makes a purchase, their card issuer receives a descriptor. This is a short phrase, set by the merchant through the payment processor, that appears on the customer’s statement.

Most processors allow businesses to choose a billing descriptor during onboarding. This descriptor is submitted with each transaction and usually includes:

A neutral business or brand name

A customer support phone number or website

The goal is to keep the descriptor generic enough to protect the customer’s privacy, while still being clear enough to avoid confusion and prevent chargebacks.

If the descriptor is too vague, customers may not recognize the transaction and may dispute it. If it is too specific, the customer’s privacy could be compromised. The right balance is essential.

Who Needs Discreet Billing?

Discreet billing is essential for businesses that handle private, personal, or sensitive transactions. Some examples include:

Adult content platforms (fan sites, cam sites, subscription services)

Online dating apps and matchmaking services

Sexual wellness and intimacy product retailers

Mental health, therapy, or addiction counseling platforms

CBD, cannabis, or alternative medicine stores

Spiritual services, psychic readings, or life coaching

High-end gift or luxury concierge services

Financial aid, debt relief, or credit improvement services

Even if the product or service is completely legal and ethical, customers may still prefer a level of discretion. Respecting that preference builds loyalty and increases repeat business.

Use Case Examples: How Real Businesses Apply Discreet Billing

A Fan Platform Using a Neutral Descriptor

A subscription platform for adult creators bills users under “StreamMedia Ltd.” This prevents awkward situations for customers while reducing inquiries and chargebacks.

A Mental Health App Keeping It Simple

A therapy app chooses “MindSupport Digital” for its descriptor. Users recognize the name, but the statement does not reveal that it relates to counseling or mental health.

A Store Selling Intimate Wellness Products

An online retailer for personal health and wellness products uses “Wellbeing Solutions” as its descriptor. Customers receive professional and private service without concern.

In each example, the merchant supports privacy while keeping the transaction recognizable enough to avoid confusion.

Five Ways to Implement Discreet Billing

1. Neutral Business Names

Use a generic name that gives no indication of the service or product category. Avoid words like “adult,” “dating,” or anything that could raise questions.

2. Dynamic Descriptors

Some processors allow you to use different descriptors for different products or service types. This is ideal for platforms offering a mix of sensitive and general content.

3. Aggregated Billing

Marketplaces and multi-brand platforms can use a single neutral descriptor for all merchants under a parent company. This protects all users on the platform.

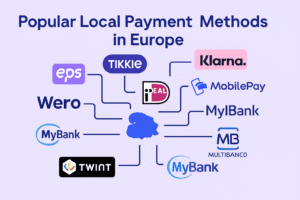

4. Alternative Payment Methods

Allow users to pay with prepaid cards, e-wallets, or crypto to avoid traditional statements altogether. These options offer even greater privacy.

5. Combined with Customer Support

Include a customer support number or site with your descriptor. If users forget the transaction, they have a clear way to get help without escalating to a chargeback.

Benefits of Discreet Billing for Your Business

Using discreet billing protects your customer, but it also benefits your business:

Reduces chargebacks from customers who do not recognize the charge

Builds customer trust by showing you care about privacy

Improves reputation in industries where discretion is expected

Complies with card network rules by maintaining transparency

Encourages repeat purchases from users who feel secure

In many cases, discreet billing is the final detail that makes a customer feel safe enough to buy.

Is Discreet Billing Legal?

Yes. Discreet billing is legal, as long as it does not mislead the customer. The descriptor should not be deceptive, but it can be general. Customers must still be able to identify the purchase and contact the merchant if needed.

Card networks like Visa and Mastercard allow discreet descriptors, but they require accuracy and transparency. Working with an experienced payment processor helps you stay compliant.

Final Thoughts: Privacy Builds Loyalty

Discreet billing is not about hiding. It is about creating a safer and more comfortable experience for the customer. In industries where privacy matters, it shows you understand your audience.

When implemented properly, discreet billing can reduce chargebacks, build stronger relationships, and give your business a competitive edge.

Get Started with Discreet Billing Today

At FastoPayments, we help privacy-focused and high-risk merchants implement discreet billing solutions that work across borders. Our team will help you set up neutral descriptors, dynamic billing tools, and full compliance with acquirer and card network rules.

Talk to us today and learn how to protect your customers and grow your business with discreet billing.

What does discreet billing mean?

Discreet billing means that the charge appearing on a customer’s bank or credit card statement uses a neutral or generic business name instead of revealing the actual product, service, or brand involved.

This approach is designed to protect the buyer’s privacy, especially in cases where the purchase might be personal, sensitive, or potentially misunderstood by others who view the statement.

While the transaction remains traceable and legitimate, the wording is intentionally chosen to avoid drawing attention or raising questions, helping customers feel more secure and respected during the payment process.

Is discreet billing allowed by Visa and Mastercard?

Yes, discreet billing is allowed by both Visa and Mastercard as long as it is not misleading. The descriptor must still help the customer recognize the charge, and support contact details must be available.

Using a neutral name is permitted, but merchants must remain transparent and compliant with network rules.

Can discreet billing reduce chargebacks?

Yes. Discreet billing helps reduce chargebacks by using a neutral descriptor that customers recognize.

When a charge looks familiar and non-sensitive, people are less likely to dispute it. It also avoids confusion or embarrassment, which are common triggers for chargebacks in privacy-focused industries.

💡 Interested in learning more about what’s included in a typical high-risk merchant account? View our complete breakdown of FastoPayments’s high-risk merchant accounts.