Introduction

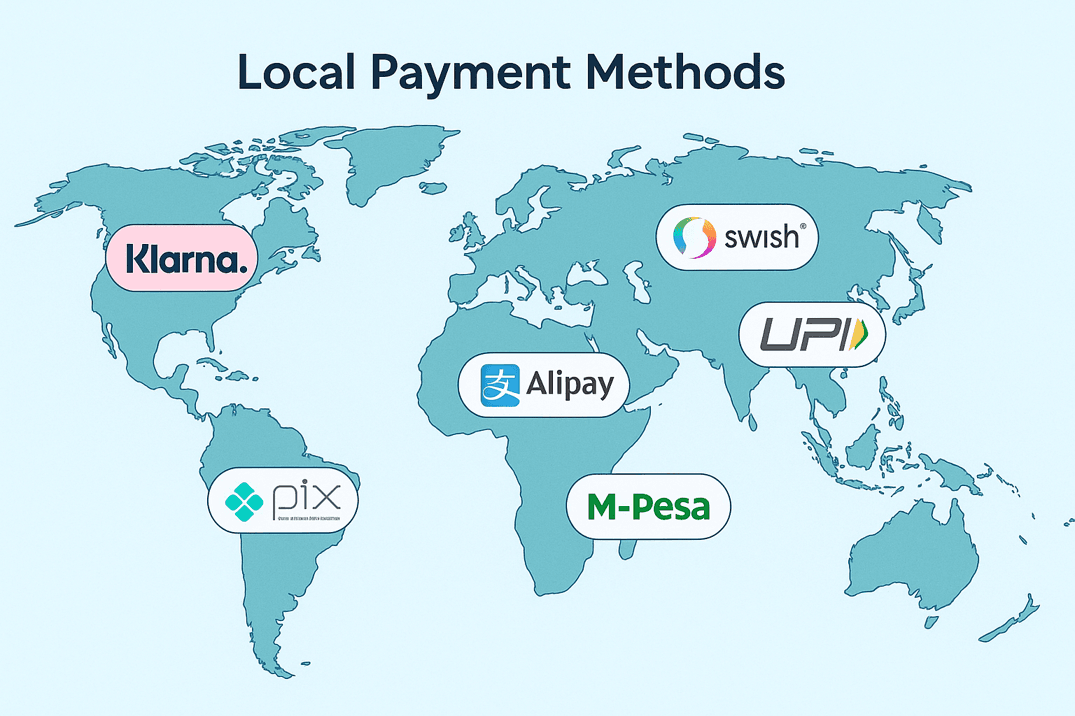

Global expansion is no longer just about shipping products abroad. The real challenge for merchants is getting paid. Customers trust the payment methods they know, and without them, cart abandonment skyrockets.

In fact, studies show that up to 69% of shoppers have abandoned a purchase when their preferred payment method was not available. Other reports reveal that 13% to 22% of cart abandonments are directly linked to limited payment options. That means offering local payment methods (LPMs) is not just a nice-to-have, it directly impacts revenue and customer trust. The key is having a payment gateway that can support these methods at checkout, not just cards.

Why Local Payment Methods Matter

Trust and familiarity matter. Customers prefer their local bank transfer, wallet, or instant payment option. Conversion rates increase when buyers see the option they trust. Some LPMs also reduce interchange and processing fees, and in many regions regulators actively encourage or even mandate their use. To make this possible, merchants need their merchant account configured to support local options, otherwise customers are left with fewer ways to pay.

Europe Example: iDEAL in the Netherlands

A Spanish fashion brand expands into the Netherlands and only offers cards and PayPal. Dutch shoppers hesitate, since more than 70 percent prefer iDEAL. Checkout abandonment spikes. Once the brand integrates iDEAL, approval rates improve by approximately 18 percent and monthly revenue from the Dutch market grows by 22 percent.

Asia Example: UPI in India

A UK-based SaaS provider enters India, offering only international card processing. Many Indian users either do not have international cards enabled or prefer UPI for security. Payment failures occur regularly. By integrating UPI, approval rates jump by approximately 25 percent, and monthly recurring revenue from India increases by 30 percent.

Latin America Example: Pix in Brazil

A US digital services company launches in Brazil but accepts only cards. Many Brazilian consumers prefer Pix for its speed and zero cost. Transactions drop at checkout. After enabling Pix, approval rates climb by approximately 20 percent, with overall revenue in Brazil rising by 28 percent within the first quarter.

These examples highlight a simple truth: merchants cannot rely on cards alone. If you want to succeed in cross-border commerce, adopting local payment methods is one of the fastest ways to unlock new revenue streams.

Top Local Payment Methods in Europe

iDEAL (Netherlands)

iDEAL was launched in 2005 by a consortium of major Dutch banks including ABN AMRO, ING, Postbank, and Rabobank. It set out to create a standardized and secure online payment method. Its innovation is simple but powerful: real-time account-to-account transfers that are low cost and trusted by consumers. Today, iDEAL handles over 70 percent of Dutch e-commerce transactions.

Best Use Case: Merchants targeting Dutch customers who expect secure bank transfers for online shopping.

Sofort (Germany, Austria)

Sofort was developed in the mid-2000s by SOFORT GmbH, later acquired by Klarna. It enables customers to authorize payments using their online banking credentials, transferring money directly from their bank accounts. Its main innovation is instant confirmation of payments without requiring a credit card. It remains one of the most trusted options across Germany and Austria.

Best Use Case: Merchants expanding into Germany or Austria who want fast, low-cost, and familiar payments.

Trustly (Nordics, wider EU)

Founded in Sweden in 2008, Trustly pioneered online banking payments without the need for cards or separate apps. It connects directly to consumer bank accounts and allows merchants to collect funds instantly across Europe. Its innovation lies in making cross-border payments seamless, particularly for subscriptions and recurring billing.

Best Use Case: Cross-border e-commerce and recurring billing where instant settlement is valuable.

Swish (Sweden)

Swish was launched in 2012 by a group of major Swedish banks in collaboration with the Central Bank of Sweden. It quickly became a staple in daily transactions, offering instant mobile payments directly linked to user bank accounts. Its innovation is the combination of bank-backed security with the convenience of a mobile app.

Best Use Case: Swedish merchants offering both online and in-store mobile-first payments.

Vipps (Norway)

Vipps started in 2015 as Norway’s leading mobile wallet and is directly tied to bank accounts. It has since expanded into a complete payment ecosystem for peer-to-peer, e-commerce, and physical store transactions. Its innovation is a simple mobile-first experience in a highly digital society.

Best Use Case: Norwegian businesses catering to consumers who expect seamless mobile checkout.

Bancontact (Belgium)

Bancontact was introduced in 1979 as Belgium’s national debit card scheme and has evolved into a modern payment platform integrated into both online and POS transactions. Its innovation lies in nationwide standardization and broad consumer trust over decades.

Best Use Case: Belgian merchants and international brands serving Belgian customers with a trusted debit option.

Giropay (Germany)

Giropay launched in 2006, backed by German banks to allow secure direct bank payments for online commerce. It leverages existing online banking infrastructure, offering security and familiarity to German consumers.

Best Use Case: German-based stores seeking a trusted direct bank transfer method alongside cards.

MobilePay (Denmark and Finland)

MobilePay was developed in 2013 by Danske Bank and later expanded across the Nordics. It links to user bank accounts and cards, enabling mobile-first payments both online and in-store. Its innovation is broad adoption: more than 4.5 million Danes use it, making it nearly universal in Denmark, with growth in Finland.

Best Use Case: Nordic merchants wanting to capture mobile-first consumers both online and in physical retail.

Bizum (Spain and Portugal)

Bizum was founded in 2016 by a consortium of 27 Spanish banks, creating a unified mobile instant payment solution. It uses phone numbers for bank transfers and has been rapidly integrated into online shopping, utilities, and government payments. Its innovation is how it consolidated competing banks into one platform with over 25 million users in Spain and expansion into Portugal.

Best Use Case: Businesses in Spain or Portugal aiming to boost checkout conversions with a trusted, mobile-first, bank-backed option.

Global Local Payment Methods

Pix (Brazil)

Pix was launched in November 2020 by Brazil’s central bank as a public instant payment system. It allows 24/7 account-to-account transfers at no cost for individuals and very low cost for businesses. Its innovation is government-led adoption, making it one of the fastest-growing payment systems globally.

Best Use Case: Merchants entering Brazil who need instant settlement and broad consumer reach.

UPI (India)

The Unified Payments Interface (UPI) was introduced in 2016 by the National Payments Corporation of India (NPCI). It enables real-time mobile payments across banks, integrated with apps like Google Pay and PhonePe. Its innovation is the seamless interoperability across banks and apps. Today it processes billions of transactions monthly.

Best Use Case: Businesses entering the Indian market that want to tap into one of the world’s largest mobile-first payment networks.

Alipay (China)

Alipay was launched in 2004 by Ant Financial (an affiliate of Alibaba). It grew from a simple escrow service for Alibaba marketplaces into one of the world’s largest super-apps, combining payments, lending, and lifestyle services. Its innovation is deep integration into daily life and e-commerce.

Best Use Case: International brands targeting Chinese consumers via online and in-store channels.

WeChat Pay (China)

WeChat Pay was integrated into Tencent’s WeChat in 2013, turning a messaging app into a full financial ecosystem. It enables payments within chats, social commerce, and offline shopping. Its innovation is embedding payments directly into social and communication channels, making it part of everyday consumer interactions.

Best Use Case: Brands selling to Chinese consumers who want to combine marketing, engagement, and payments in one ecosystem.

Quick Reference Guide: Comparison of Local Payment Methods

| Payment Method | Region | Launch Year & Founder | Adoption / Market Share | Best Use Case |

|---|---|---|---|---|

| iDEAL | Netherlands | 2005 by Dutch banks consortium | 70%+ of Dutch e-commerce | Dutch shoppers expecting secure bank transfers |

| Sofort | Germany, Austria | Mid-2000s, SOFORT GmbH (now Klarna) | Widely trusted in DACH | Fast, low-cost payments in Germany and Austria |

| Trustly | Nordics, EU | 2008, Sweden-based fintech | Growing across Europe | Cross-border e-commerce and subscriptions |

| Swish | Sweden | 2012, Swedish banks with Riksbank | Millions of daily users | Online and in-store mobile payments in Sweden |

| Vipps | Norway | 2015, Norwegian banks | 4M+ users | Mobile-first checkout in Norway |

| Bancontact | Belgium | 1979 national debit scheme | Ubiquitous in Belgium | Debit option trusted by Belgian consumers |

| Giropay | Germany | 2006, German banks | Widely used for e-commerce | Trusted bank transfer for German shoppers |

| MobilePay | Denmark, Finland | 2013, Danske Bank | 4.5M+ Danes, growing in Finland | Mobile-first consumers in Nordics |

| Bizum | Spain, Portugal | 2016 by 27 Spanish banks | 25M+ users in Spain | Mobile-first payments in Spain and Portugal |

| Pix | Brazil | 2020, Central Bank of Brazil | Massive adoption nationwide | Instant settlement in Brazil |

| UPI | India | 2016, NPCI | Billions of transactions monthly | Tap into India’s mobile-first market |

| Alipay | China | 2004, Ant Financial | One of world’s largest wallets | Reach Chinese shoppers globally |

| WeChat Pay | China | 2013, Tencent | Integrated into daily social app | Social + payment ecosystem in China |

Our Advice to Merchants

If you want to expand internationally, treat local payment methods as essential, not optional. Customers in each market already know and trust their preferred method, whether it is iDEAL in the Netherlands, Swish in Sweden, UPI in India, or Pix in Brazil.

Our advice is simple:

Review where your customers are coming from and match their payment expectations.

Make sure your merchant account is enabled for local acceptance in your target regions.

Choose a payment gateway that supports multiple LPMs in one integration. This keeps your checkout simple, scalable, and cost-effective.

Test and measure approval rates and revenue impact after integration, you will often see double-digit improvements.

At FastoPayments, we see this every day. Merchants who adapt quickly to local preferences build trust faster, convert more sales, and scale smoothly into new regions.

What are local payment methods and why do they matter?

Local payment methods are region-specific ways customers prefer to pay, such as iDEAL in the Netherlands, UPI in India, Pix in Brazil, or M-Pesa in Africa.

They matter because they build trust with local consumers and significantly reduce checkout abandonment.

Do I need a merchant account to accept local payment methods?

Yes. Your merchant account needs to be configured to support local acceptance. At the same time, your payment gateway must integrate with these methods so customers can actually use them at checkout.

Without both, transactions may fail or never be offered to the customer.

How much can offering local payment methods improve my sales?

Merchants that add the right local payment methods often see approval rates improve by 18–30 percent, with revenue growth in new markets reaching 20–28 percent within the first quarter.

It is one of the fastest ways to boost conversions when expanding internationally.

💡 Interested in learning more about what’s included in a typical high-risk merchant account? View our complete breakdown of FastoPayments’s high-risk merchant accounts.