How to Improve Approval Rates and Optimize Transaction Flow

Every payment matters, especially when a declined transaction can lose you a customer for good. For merchants operating online or globally, optimizing approval rates and transaction flow isn’t just good practice, it’s essential for growth and revenue protection. A guide for high-risk processing is needed to understand the basics of payment processing.

In this post, we’ll show you how to increase your approval rates, optimize payment flows, and reduce transaction failures, plus share real-world cases that prove it works.

Why Approval Rates Matter

Approval rates reflect the percentage of transactions successfully approved by card issuers and banks.

-

In-person payments: around 97% approval.

-

Online payments: between 85% and 95%, depending on your setup, region, and fraud prevention efforts.

A single decline can cost more than just the transaction:

-

39% of customers won’t try again if their payment fails.

-

Only 25% will attempt to pay with a different method.

Every percent gained in approval rates is a direct win for your revenue.

The Recurring Payments Challenge

Recurring payments, such as subscriptions or memberships, typically have lower approval rates compared to single transactions.

This often happens because cards may expire between billing cycles, customers might change their banks or cards, or issuers may flag recurring charges if customer behavior changes unexpectedly.

To overcome these challenges, merchants can implement account updater services, which keep card details updated automatically to reduce the risk of expired or outdated payment information.

Network tokenization also plays a vital role by ensuring that even if the underlying card details change, the token remains valid and functional across payments.

Additionally, employing smart retry logic allows merchants to reattempt failed payments at better times, such as after salary deposits or during periods when the customer’s bank may have fewer restrictions.

Optimizing your recurring payment processes in these ways not only improves approval rates but also helps reduce customer churn, enhances cash flow predictability, and supports stronger long-term subscriber retention.

7 Proven Strategies to Improve Approval Rates & Payment Flows

1. Smart Routing

Smart routing sends each transaction through the best payment processor based on the card type, geography, and success history.

Boost potential: Up to 4 to 6% improvement in approval rates.

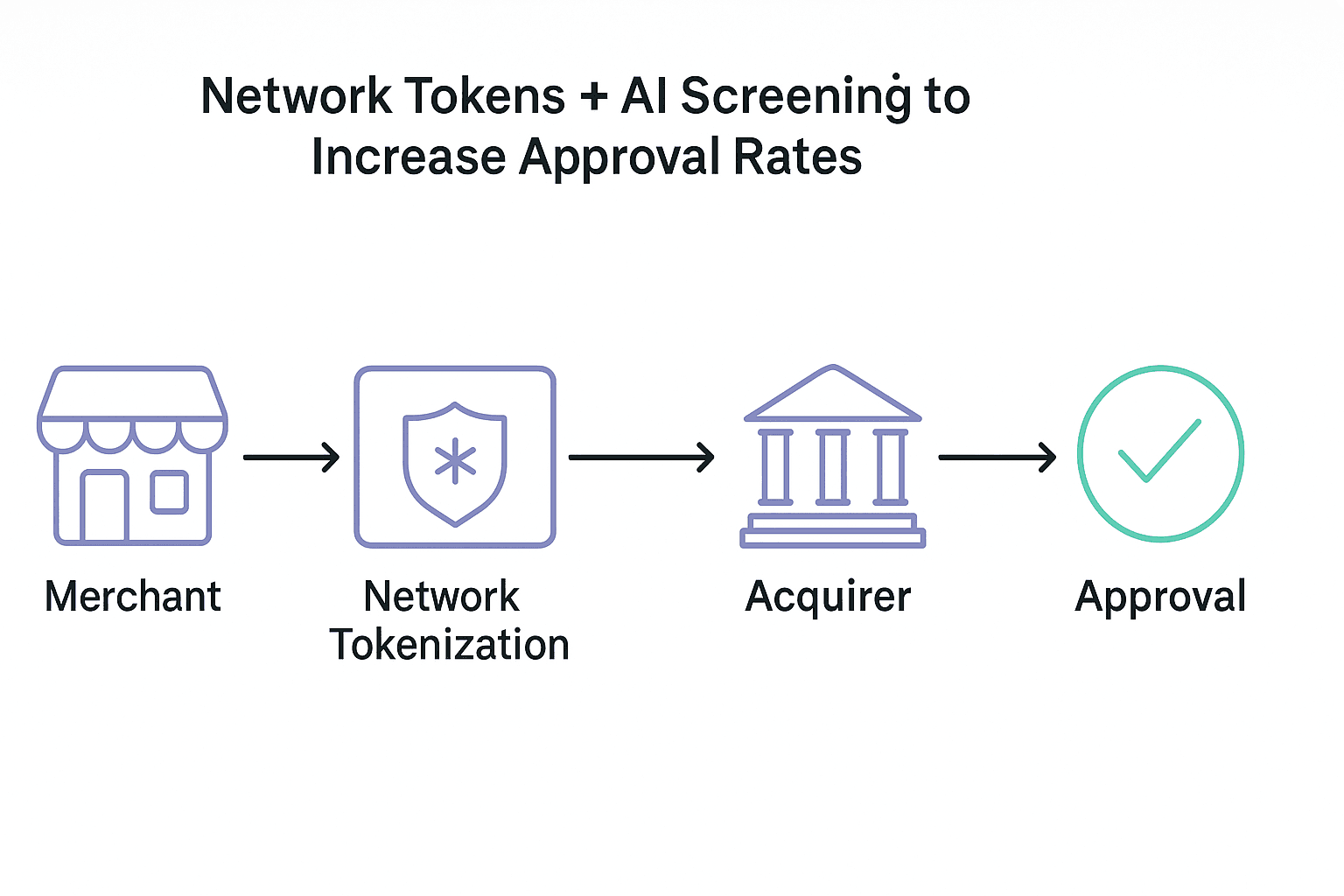

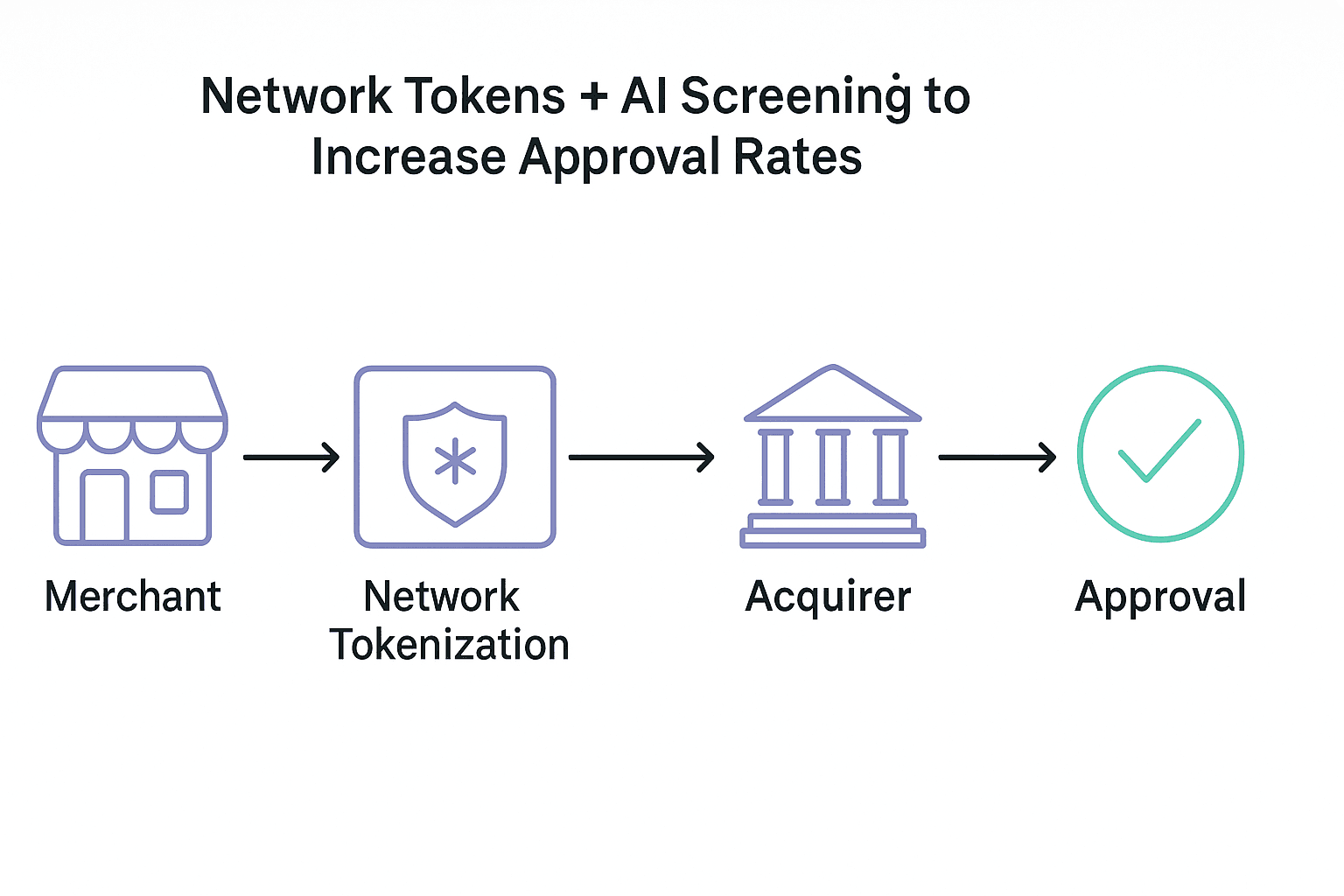

2. Network Tokenization

Network tokens replace sensitive card data with secure, network-issued tokens that issuers prefer.

Results in practice:

-

PayPal: +1% approval rate increase after adopting tokens.

-

Visa & Adyen: Up to 7% improvement globally, particularly in markets like Australia.

3. AI-Powered Transaction Screening

AI screens transactions for fraud and risk before they hit your acquirer, catching issues early and preventing declines.

Case in point: TickPick used AI-powered fraud screening and recovered $3 million in falsely declined payments in just three months.

4. Account Updater Services

Ensure recurring payments don’t fail by automatically updating expired or reissued card details via network services.

5. Automated Retry Logic

Don’t give up on a failed transaction. Smart retry systems attempt payments later or via alternate processors to recover potential revenue.

6. Balanced Fraud Prevention

Tight fraud filters can accidentally block real customers. Using adaptive fraud detection that scales based on behavior keeps approval rates high while blocking bad actors.

7. Monitor Decline Codes & Data

Analyze why transactions are failing. Decline codes offer insights you can act on, like fixing region-specific issues, card network problems, or fraud triggers.

Visual Guide: Payment Approval Optimization Flow

Real-World Examples that Prove It Works

-

PayPal: +1% approval lift via network tokenization.

-

Adyen + Visa: 2 to 7% improvement in authorization rates.

-

TickPick: $3M in recovered revenue using AI screening.

Bonus: Tips for High-Risk Merchants

If you operate in a high-risk industry, here’s how to stay ahead:

-

Monitor your approval rates regularly.

-

Work with multiple acquirers to spread risk.

-

Ensure solid KYC and compliance standards.

-

Keep your fraud prevention balanced, not overly aggressive.

Download the Full Guide

Want even deeper insights and a practical checklist? Download our free PDF guide:

Download our Guide to Approval Rates

Inside you’ll find:

-

Advanced strategies

-

Real merchant case studie

-

A 10-step checklist to optimize your payments

Conclusion for you

Better approval rates mean more revenue, less churn, and happier customers. If you’re ready to turn your payment flow into a revenue generator, FastoPayments can help with smart routing, tokenization, AI fraud screening, and other services which includes help with chargebacks, corporate structuring and banking.

How to Improve Approval Rates and Optimize Transaction Flow

Every payment matters, especially when a declined transaction can lose you a customer for good. For merchants operating online or globally, optimizing approval rates and transaction flow isn’t just good practice, it’s essential for growth and revenue protection. A guide for high-risk processing is needed to understand the basics of payment processing.

In this post, we’ll show you how to increase your approval rates, optimize payment flows, and reduce transaction failures, plus share real-world cases that prove it works.

Why Approval Rates Matter

Approval rates reflect the percentage of transactions successfully approved by card issuers and banks.

-

In-person payments: around 97% approval.

-

Online payments: between 85% and 95%, depending on your setup, region, and fraud prevention efforts.

A single decline can cost more than just the transaction:

-

39% of customers won’t try again if their payment fails.

-

Only 25% will attempt to pay with a different method.

Every percent gained in approval rates is a direct win for your revenue.

The Recurring Payments Challenge

Recurring payments, such as subscriptions or memberships, typically have lower approval rates compared to single transactions.

This often happens because cards may expire between billing cycles, customers might change their banks or cards, or issuers may flag recurring charges if customer behavior changes unexpectedly.

To overcome these challenges, merchants can implement account updater services, which keep card details updated automatically to reduce the risk of expired or outdated payment information.

Network tokenization also plays a vital role by ensuring that even if the underlying card details change, the token remains valid and functional across payments.

Additionally, employing smart retry logic allows merchants to reattempt failed payments at better times, such as after salary deposits or during periods when the customer’s bank may have fewer restrictions.

Optimizing your recurring payment processes in these ways not only improves approval rates but also helps reduce customer churn, enhances cash flow predictability, and supports stronger long-term subscriber retention.

7 Proven Strategies to Improve Approval Rates & Payment Flows

1. Smart Routing

Smart routing sends each transaction through the best payment processor based on the card type, geography, and success history.

Boost potential: Up to 4 to 6% improvement in approval rates.

2. Network Tokenization

Network tokens replace sensitive card data with secure, network-issued tokens that issuers prefer.

Results in practice:

-

PayPal: +1% approval rate increase after adopting tokens.

-

Visa & Adyen: Up to 7% improvement globally, particularly in markets like Australia.

3. AI-Powered Transaction Screening

AI screens transactions for fraud and risk before they hit your acquirer, catching issues early and preventing declines.

Case in point: TickPick used AI-powered fraud screening and recovered $3 million in falsely declined payments in just three months.

4. Account Updater Services

Ensure recurring payments don’t fail by automatically updating expired or reissued card details via network services.

5. Automated Retry Logic

Don’t give up on a failed transaction. Smart retry systems attempt payments later or via alternate processors to recover potential revenue.

6. Balanced Fraud Prevention

Tight fraud filters can accidentally block real customers. Using adaptive fraud detection that scales based on behavior keeps approval rates high while blocking bad actors.

7. Monitor Decline Codes & Data

Analyze why transactions are failing. Decline codes offer insights you can act on, like fixing region-specific issues, card network problems, or fraud triggers.

Visual Guide: Payment Approval Optimization Flow

Real-World Examples that Prove It Works

-

PayPal: +1% approval lift via network tokenization.

-

Adyen + Visa: 2 to 7% improvement in authorization rates.

-

TickPick: $3M in recovered revenue using AI screening.

Bonus: Tips for High-Risk Merchants

If you operate in a high-risk industry, here’s how to stay ahead:

-

Monitor your approval rates regularly.

-

Work with multiple acquirers to spread risk.

-

Ensure solid KYC and compliance standards.

-

Keep your fraud prevention balanced, not overly aggressive.

Download the Full Guide

Want even deeper insights and a practical checklist? Download our free PDF guide:

Download our Guide to Approval Rates

Inside you’ll find:

-

Advanced strategies

-

Real merchant case studie

-

A 10-step checklist to optimize your payments

Conclusion for you

Better approval rates mean more revenue, less churn, and happier customers. If you’re ready to turn your payment flow into a revenue generator, FastoPayments can help with smart routing, tokenization, AI fraud screening, and other services which includes help with chargebacks, corporate structuring and banking.

💡 Interested in learning more about what’s included in a typical high-risk merchant account? View our complete breakdown of FastoPayments’s high-risk merchant accounts.