Your Boarding Pass to the Best Travel Merchant Account

Our secure, reliable payment gateway is built to handle all the unique challenges of the travel industry, so you can focus on delivering unforgettable journeys.

- Trusted by +500 companies

SOME OF OUR 500+ HAPPY CUSTOMERS

Why Choose FastoPayments for Your Travel Merchant Account

Why Banks Won't Let You Open a Travel Merchant Account

High chargeback rates

Complex regulations

Cross-border payments

Risk of fraudulent transcations

Seasonal demand spikes

Most platforms cap your growth when bookings peak. Our infrastructure scales automatically with your business, handling sudden volume increases while maintaining consistent processing speeds and pricing.

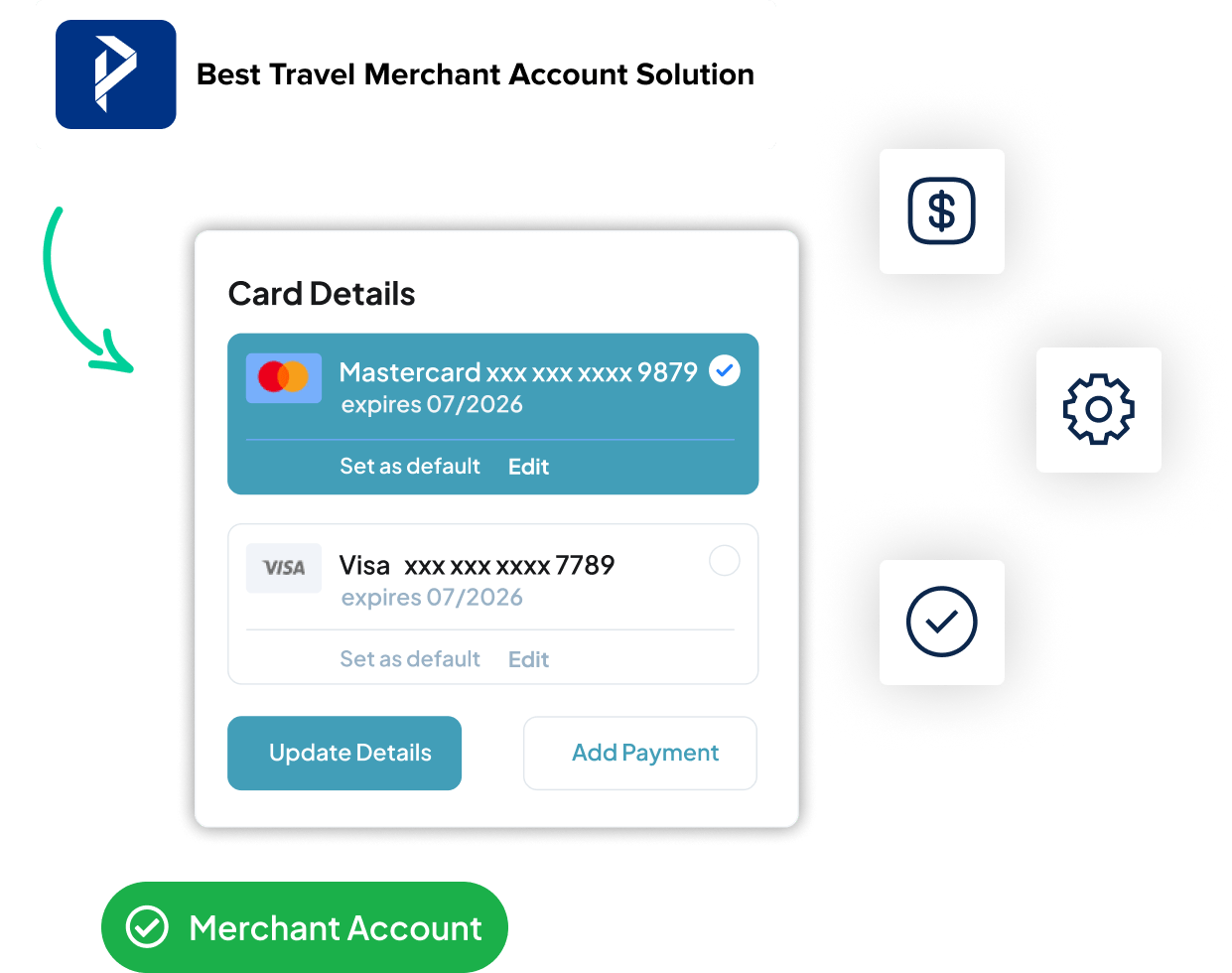

How to Open a Travel Merchant Account With Us

Sign Up & Get Verified

Start by providing the necessary documents: incorporation certificates, bank statements, and proof of location, to get your merchant account approved quickly.

Integrate Seamlessly

Connect our payment gateway with your existing systems, whether it’s your website, POS system or mobile app. Our integration process is designed to be straightforward, so you can be up and running in no time.

Start Processing Payments

Once integrated, begin accepting payments globally. Our platform ensures transactions are processed swiftly and securely, giving you real‑time access to funds.

Analyze & Optimize

Use our comprehensive reporting tools to track your performance and make data‑driven decisions that boost growth and improve customer satisfaction.

Get a Quote

A Travel Merchant Account Built for Every Type of Business

Fast, secure payments that keep bookings moving. With instant confirmations, automated refunds, and fraud protection, FastoPayments helps OTAs reduce declines and boost conversions, so customers book with confidence.

Smoother check-ins, fewer chargebacks. Accept pre-authorized payments, multi-currency transactions, and secure bookings with built-in fraud prevention. Refunds and disputes? Automated, so you can focus on hospitality from the get-go.

Scale effortlessly with a payment infrastructure designed for dynamic pricing, split settlements, and instant reconciliation. Keep bookings flowing smoothly with Strong Customer Authentication (SCA), which secures transactions without adding friction at checkout.

Real-time payments for every ride. From security deposits to surge pricing, FastoPayments makes transactions seamless, secure, and instant, so customers can hit the road without hassle.

How to Apply for a Travel Merchant Account

- Basic business information such as name, address, and email

- Projected sales volume for the next 3-6 months

- Preferred payment method (bank-to-bank, crypto, etc.)

Hear From Our Partners

FAQs

What is a Travel Merchant Account?

A travel merchant account is a specialized payment solution that enables travel businesses to accept and process payments efficiently. It’s designed to handle the unique challenges of the travel industry, from international bookings to high‑ticket transactions.

Why is a travel merchant account considered high-risk?

Travel combines every payment challenge: long payment windows that invite chargebacks, high-value transactions that attract fraud, and complex cross-border processing that makes banks nervous.

Which countries and regions does FastoPayments support?

FastoPayments is proud to serve the US, UK, and European markets, along with many other regions globally. Our multi‑currency and international processing capabilities mean that you can accept payments from customers around the world without worrying about conversion fees or regional restrictions.

How Much Does FastoPayments Charge in Fees?

Our fees vary depending on your transaction volume, processing history, and risk profile. However, our competitive, transparent pricing is designed specifically for high‑risk travel businesses, with processing fees as low as 3% for merchants with a proven track record.

How does FastoPayments reduce fraud for travel businesses?

Security is paramount, especially in the travel industry where high‑value transactions are common. Our platform uses cutting‑edge, AI‑powered fraud detection tools that analyze transaction patterns in real time.

We employ multiple layers of security, such as encryption, tokenization, and multi‑bank processing, to safeguard your funds. By catching suspicious activity before it becomes an issue, we significantly reduce the risk of fraud and provide you with a secure payment processing environment.

What are the benefits of multi-bank processing?

Multi‑bank processing is a key feature of our service that ensures your transactions are never held up by issues with a single banking partner.

By spreading transactions across multiple banks, we reduce the risk of account freezes and ensure higher transaction approval rates. This means that even if one bank faces a temporary problem, your payment processing remains uninterrupted, keeping your revenue secure and your operations running smoothly.

How does FastoPayments integrate with my existing system?

Our platform is designed to work seamlessly with the systems you already use. Whether you run a brick‑and‑mortar travel agency with a POS system or an online travel booking website, our API and integration tools allow for smooth connectivity.

Can FastoPayments handle recurring payments?

Yes, our platform is fully capable of handling recurring payments. This is especially useful for travel subscriptions, loyalty programs, or any service that requires regular billing. Our system automates the billing process, manages trial periods, and uses advanced retry logic to handle any payment declines.

How does FastoPayments handle cancellations and refunds?

We automate refund workflows without manual back-and-forth. Our chargeback protection tools also help prevent disputes and fraudulent refund claims.

Does FastoPayments integrate with popular booking and reservation systems?

Yes. Our API-first platform connects natively with leading booking engines, CRMs, and reservation tools via pre-built connectors. Launch a unified payment experience in days, not months, with synchronized data flows and 99.9% uptime. We handle the heavy lifting; you focus on seamless bookings.