Your 2026 Starting Point

Getting approved for a merchant account in 2026 requires a complete and compliant setup. Acquirers across Europe now review each merchant based on KYC and KYB strength, subscription transparency, fraud filtering, chargeback prevention, age verification, and the quality of your payment flow.

This post breaks down what merchants should prepare before applying. It covers eCommerce, adult, travel, nutraceuticals, and subscription businesses. It also explains how both startups and experienced merchants can build stronger setups through pre-authorization, BIN routing, better support structures, and optimised gateway configurations.

If you want faster approvals, stronger ratios, and a stable long-term processing setup, this guide shows exactly how to structure your business.

Universal Requirements Before Applying

A strong foundation is the key to a smooth merchant account approval in 2026. Acquirers now pay close attention to your documentation, website presentation, operational clarity, fraud prevention, and how you manage customer expectations.

A complete application includes full KYC and KYB documentation such as company registration certificates, director identification, UBO verification, and proof of business address. Your website must be fully operational with clear terms, a visible privacy policy, refund rules, and contact details.

Fraud filtering and chargeback prevention tools are important indicators of operational maturity. Card-not-present transactions now account for nearly seventy percent of all payment fraud in Europe, which is why acquirers expect merchants to use real-time monitoring and modern fraud control systems.

Businesses operating in restricted categories such as adult content must have a certified age verification system such as Yoti, Veriff, or AgeChecked. This is now required in most markets across Europe and the UK.

Acquirers also appreciate a clear payment flow. This shows how customers move through your checkout, how delivery is handled, and how support is provided if something goes wrong.

eCommerce and General Retail

ECommerce remains a low to medium risk vertical, but acquirers still expect structure and clarity. Merchants should present a complete and trustworthy website with accurate product information, live stock displays, and transparent shipping terms. Refund and return policies need to be easy to find, and customer support channels must be accessible.

Local payment method coverage is now one of the biggest performance factors in Europe. More than half of online transactions in several major EU markets are completed through local payment methods such as iDEAL, Bancontact, or Sofort. Adding these options improves conversions and reduces disputes.

Strong Setup for Startups

Startups benefit from using pre-authorization to confirm card validity before funds are captured. Offering fast refunds creates trust and reduces early disputes. Light fraud scoring tools help maintain strong ratios during the early processing period.

Strong Setup for Experienced Merchants

More experienced merchants can benefit from BIN routing to send transactions to the acquirer with the highest approval performance. Dynamic retries for renewals and the use of multiple acquirers allow better approval consistency and lower risk exposure.

Adult Industry

The adult sector sits under strict regulatory frameworks that include the DMCA, the UK Online Safety Act, and the EU Digital Services Act. Acquirers expect proof of full compliance before considering approval.

Websites must integrate certified age verification before any adult content is visible. Platforms with user-generated content must maintain active moderation and fast takedown procedures. Refund policies and billing clarity must be easy for customers to understand.

Fraud and chargeback prevention is essential for adult merchants due to higher dispute ratios in this industry. Real-time monitoring, rapid support response times, and clear communication significantly reduce risk.

Strong Setup for Startups

Startups should build their compliance setup first. Age verification must be integrated before onboarding begins. Gateways should support subscription retries and tokenized renewals. Refund terms need to be short, clear, and easy to access.

Strong Setup for Experienced Merchants

Experienced adult merchants benefit from regional BIN routing for European, UK, and North American users. Pre-authorization filters out fraudulent traffic. Responsive support that responds within 24 to 48 hours helps prevent chargeback escalation and protects approval ratios.

Travel and Hospitality

Travel merchants carry added risk because bookings are paid long before the service is delivered. Acquirers want a complete understanding of how you manage refunds, cancellations, and supplier relationships.

Merchants should show proof of supplier agreements, clear refund terms, and evidence of customer support readiness. Fraud tools are necessary in this vertical due to stolen cards, fake bookings, and refund abuse.

Strong Setup for Startups

Pre-authorization on bookings confirms card validity and reduces failed payments. Flexible rescheduling options lower refund risk and support customer satisfaction.

Strong Setup for Experienced Merchants

More established travel merchants should route domestic and international transactions separately to improve approval rates. Automated chat support helps resolve issues quickly, and split settlements simplify payouts to suppliers.

Nutraceuticals and Health Supplements

Nutraceuticals are considered high risk due to recurring billing, trial-to-paid models, and strict compliance rules on health claims.

Websites must include clear ingredient lists, certification details, and disclaimers. Subscription terms need full transparency, especially around renewals. Marketing funnels should be reviewed for compliance before submitting your application.

Fraud scoring and refund monitoring are essential in this vertical because disputes occur more frequently.

Strong Setup for Startups

Pre-authorization is useful for trial offers. Automated renewal reminders reduce disputes. Proactive customer communication lowers churn and increases trust.

Strong Setup for Experienced Merchants

Experienced nutraceutical merchants can benefit from routing one-off and recurring transactions separately. Tokenised renewals and dynamic retry cycles improve approval consistency. Using multiple acquirers spreads risk and prevents dependency.

Subscription Businesses Across All Industries

Recurring billing is closely monitored in 2026. Acquirers look for visible clarity on billing cycles, reliable product delivery, cancellation simplicity, and secure payment authentication.

Merchants should provide clear subscription terms and automated notifications before renewals. Pre-authorization is recommended when customers sign up.

Strong Setup for Startups

Begin with a single acquirer to stabilise ratios. Use staggered retry intervals and tokenized billing for renewals.

Strong Setup for Experienced Merchants

Advanced routing for different card types and markets ensures higher approval rates. Combining fraud scoring with transaction ranking analytics protects revenue and reduces subscription churn.

Choosing the Right PSP or Acquirer

Selecting the right PSP or acquirer is one of the most important decisions for any merchant in 2026. Your provider influences approval rates, decline levels, dispute outcomes, and how easily you can expand into new regions. A PSP is more than a gateway or a place where payments pass through. It becomes your risk partner, compliance partner, and support partner.

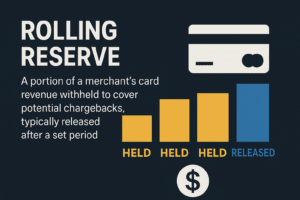

The right PSP improves approval performance with smart routing, stronger fraud filtering, and local payment method coverage. It provides clear onboarding guidance, transparent reserve terms, and support when disputes or unexpected issues occur. A strong PSP helps you protect ratios, stabilise billing flows, and position your business for long-term growth.

The wrong provider can create avoidable declines, slow settlements, and higher chargeback ratios. Poor risk management from a PSP can affect the relationship with the acquiring bank and make future onboarding more difficult. For many merchants, the PSP choice directly affects revenue, customer experience, and compliance standing.

Merchants should evaluate PSPs based on routing capability, dispute handling, reserve release timelines, fraud protection, onboarding quality, and market coverage rather than price alone. A payment partner should understand your industry, your billing style, and your target regions.

Why You Should Choose FastoPayments

FastoPayments supports merchants by combining strong compliance guidance with flexible gateway configurations that match each industry. Our onboarding team helps prepare documentation, review website compliance, set up fraud tools, and design routing strategies that improve approval results.

We also provide local payment method coverage across Europe, the UK, and North America. This improves conversions and reduces decline rates. Our support team is responsive and experienced across both low risk and high risk verticals including adult, nutraceuticals, travel, and subscription businesses.

FastoPayments focuses on stable long-term processing, clear communication, and a payment setup that grows with your business. By choosing us, merchants gain a partner that understands risk, supports scale, and provides the technical and operational structure needed for global expansion.

What We See for Merchants in 2026

Merchants entering 2026 face a landscape where compliance, billing clarity, and strong risk controls matter more than ever. Startups perform well when they present structure, transparency, and a clean onboarding package. Established merchants see the best results when they combine routing logic, tokenized renewals, proactive customer support, and advanced fraud prevention that protects approval performance.

FastoPayments supports merchants across every stage of growth with secure onboarding, optimised gateway setups, local payment method integration, chargeback protection, and processing strategies designed for long-term success across Europe, the UK, and North America.

What do I need to apply for a merchant account in Europe in 2026?

To apply in 2026, merchants need complete KYC and KYB documents, a compliant website, transparent billing terms, proof of delivery methods, fraud filtering, chargeback prevention, and in some industries, certified age verification.

Acquirers now check operational structure, risk controls, and website readiness before approving any account.

How hard is it for high risk merchants to get a merchant account in Europe?

High risk merchants such as adult, nutraceuticals, and travel face stricter checks in 2026.

Acquirers review age verification, subscription transparency, marketing compliance, customer support readiness, and past processing history. Approval is still possible, but only with a complete and compliant setup.

What payment methods do I need for higher approval rates in Europe?

Local payment methods are essential for conversion and approval strength. More than half of online payments in several EU markets use LPMs such as iDEAL, Bancontact, SEPA, or Sofort.

Adding these improves success rates and reduces card declines.

How do I increase my approval rate when applying for a merchant account?

Approval rates improve when merchants use pre-authorization, BIN routing, modern fraud filtering, tokenized renewals, and clear checkout structures.

Acquirers favour merchants with transparent policies, fast customer support, and a proven ability to manage disputes and prevent chargebacks.

Why do acquirers require fraud tools and chargeback prevention in 2026?

Card-not-present fraud continues to rise in Europe, now representing nearly seventy percent of all payment fraud.

Because of this, acquirers expect merchants to use real-time fraud filters, risk scoring, 3DS2, and dispute alerts. These tools protect approval ratios and reduce the risk of early account termination.

💡 Interested in learning more about what’s included in a typical high-risk merchant account? View our complete breakdown of FastoPayments’s high-risk merchant accounts.