Introduction

For customers, making a payment looks simple. They type in their card details or select a wallet, click pay, and within seconds a confirmation appears. Behind the scenes, however, a complex sequence of events unfolds. Data is encrypted, fraud checks are performed, banks communicate through global networks, and the final decision is returned, all in under three seconds.

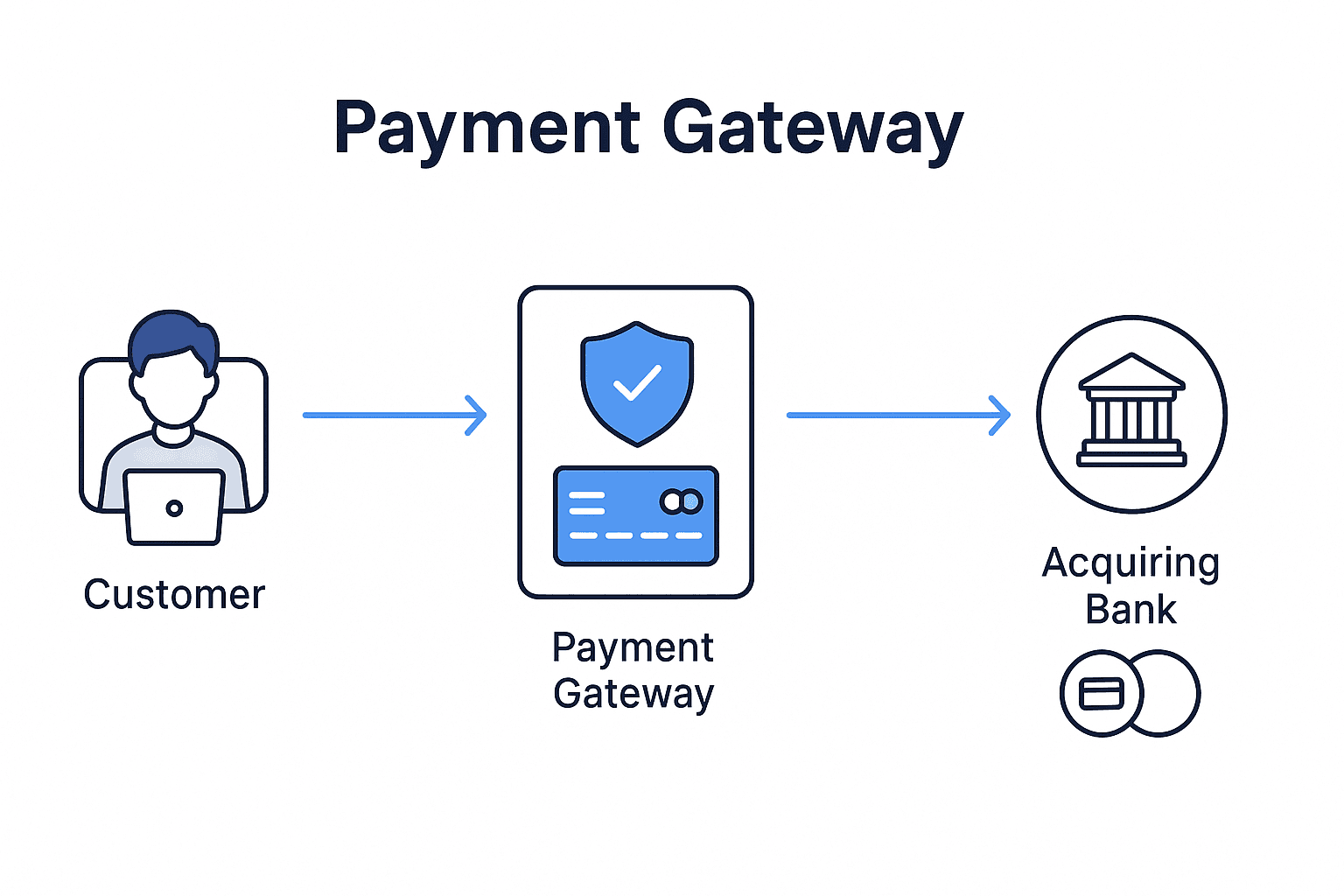

At the center of this process sits the payment gateway.

A gateway is more than a piece of software. It is the secure hub that connects merchants, customers, banks, and card networks. A strong gateway not only processes payments but also improves approval rates, supports recurring subscriptions, enables payouts, and gives businesses access to local payment methods worldwide.

What Is a Payment Gateway?

A payment gateway is the technology that transmits payment data between your checkout, the acquiring bank, and the card networks. It protects sensitive details, routes the request to the right bank, and delivers an approval or decline instantly.

Think of it as a digital cashier, security guard, and switchboard all working together. Without gateways, online payment processing as we know it would not exist.

Hosted vs Direct Integration

Hosted Gateways

Customers are redirected to a secure third-party page to complete payment. The advantage is reduced PCI compliance requirements because card data never touches your servers. The drawback is less control over branding and user experience.

Direct or Integrated Gateways

Payments are handled directly within your site or app through APIs or SDKs. This creates a smooth checkout flow and keeps your brand consistent. It does, however, require stricter PCI compliance and deeper technical resources.

Your choice depends on the balance between compliance burden and the need for a seamless customer journey.

How a Payment Gateway Processes a Transaction

A payment gateway works quietly in the background, making sure each transaction is handled safely and quickly. From the moment a customer enters their payment details, the gateway takes over. It encrypts or tokenizes the information, then passes it securely to the acquiring bank.

The acquiring bank sends the request through the card network, which routes it to the issuing bank. The issuer checks whether funds are available, verifies the customer’s identity, and runs fraud filters. Once the decision is made, the response travels back through the network to the acquiring bank and then to the gateway.

Within seconds, the gateway updates the checkout with an approval or decline message, ensuring the customer knows instantly whether their payment went through.

Core Functions of a Modern Payment Gateway

Security and Fraud Prevention

Compliance with PCI DSS is essential. Gateways add tokenization, encryption, and 3D Secure authentication to reduce risk. Advanced platforms use tools like AVS, CVV checks, velocity rules, device fingerprinting, and AI-driven scoring to block fraud without rejecting good customers.

Support for Local Payment Methods

Every market has unique preferences. In the Netherlands, iDEAL is dominant. In Spain, Bizum is widely used. Klarna leads in Northern Europe, while Alipay and WeChat Pay power commerce across China. Gateways that support these options expand conversion and improve trust with local buyers.

Recurring Billing and Tokenization

Subscriptions and memberships are now standard. Tokenization lets merchants securely store customer details for future charges. This enables recurring billing and one-click checkout experiences that reduce friction and increase retention.

Payouts

Modern commerce also requires outbound payments. Gateways can support payouts to affiliates, gig workers, or partners through cards, bank accounts, or digital wallets. This makes them essential not just for revenue collection but also for ecosystem management.

Smart Routing and Retries

Failed transactions cost revenue. Smart gateways increase approval rates by routing payments to the best acquirer, retrying at optimized times, and using BIN-level logic. Network tokens also help by keeping card-on-file credentials fresh and issuer-friendly.

Reporting and Settlement

Finance teams rely on clear reconciliation. Gateways provide dashboards, settlement files, and reporting tools that track transactions, fees, and deposits across multiple markets and payment methods.

Additional Capabilities and Considerations

Declines and Recovery

Transactions can be declined for many reasons such as insufficient funds, expired cards, issuer risk rules, or network timeouts. Modern gateways help merchants recover revenue by applying smart retries, using alternative acquirers, and adapting fraud settings to reduce false declines.

Settlement and Funding

Once a payment is approved, the funds are not immediately available to the merchant. Gateways manage settlement and payouts, which may occur daily, weekly, or on other schedules depending on the provider and risk profile. Understanding settlement timelines and potential rolling reserves is critical for cash flow planning.

Fee Structures

Merchants should evaluate the total cost of a gateway. Beyond per-transaction fees, there may be setup fees, monthly minimums, cross-border costs, currency conversion fees, and chargeback handling charges. Transparent pricing helps avoid unexpected costs as volumes grow.

Regulatory and Compliance Factors

Operating internationally requires attention to regulations such as PCI DSS, GDPR, and PSD2 with Strong Customer Authentication in the EEA. A compliant gateway reduces merchant risk by supporting regional requirements and reducing liability exposure.

User Experience and Conversion

Checkout design has a direct impact on conversion rates. Hosted redirects may add friction, while embedded APIs keep customers on-site. Security measures like 3D Secure add steps but protect merchants from fraud. The best gateways strike a balance between friction and security to maximize conversion.

High-Risk Verticals

Industries such as adult entertainment, nutraceuticals, EdTech, and travel face higher fraud and chargeback risks. Gateways serving these sectors include specialized tools like chargeback alerts, enhanced fraud filters, and more flexible routing to manage approval rates without increasing risk.

Why Payment Gateways Matter for Business Growth

Revenue Impact

Higher approval rates and intelligent retries transform declines into completed payments, helping merchants recover lost revenue and maximize sales.

Customer Trust

A secure and seamless checkout builds confidence, reduces drop-offs, and encourages customers to return, strengthening long-term loyalty.

Market Expansion

Support for local payment methods and multi-currency processing allows merchants to reach new regions and serve customers in the way they prefer to pay.

Operational Efficiency

Features such as recurring billing, automated payouts, discreet descriptors, and detailed reporting reduce manual work, improve accuracy, and free up resources for growth.

Conclusion

A payment gateway is the backbone of digital commerce. It secures data, prevents fraud, improves approval rates, supports local payment methods, enables recurring billing, and powers payouts.

For merchants, choosing the right gateway is not only about accepting payments. It is about unlocking growth, building customer trust, and scaling into new markets. The right gateway can make the difference between missed revenue and sustainable success.

What is the difference between a payment gateway and a processor?

A payment gateway is the technology that collects, encrypts, and transmits payment information between your checkout, the acquiring bank, and the card networks. It ensures sensitive data remains secure while verifying that the transaction request is legitimate.

A payment processor, on the other hand, is responsible for moving the funds between the issuing and acquiring banks once the transaction is authorized. In simple terms, the gateway manages the flow of information, while the processor manages the flow of money.

Do I need a payment gateway for in-store payments?

Yes. While payment gateways are often associated with online stores, they are equally critical for in-person transactions.

Modern point-of-sale terminals connect through gateways to route card data securely, perform authorization checks, and return instant approval or decline results. Without this technology, in-store card transactions would be slow, insecure, or impossible to process.

How do payment gateways help prevent fraud?

Payment gateways use multiple layers of security to protect merchants from fraud. These include tokenization, encryption, and mandatory standards like PCI DSS. They also apply advanced tools such as Address Verification Service (AVS), CVV verification, velocity checks, device fingerprinting, and machine learning models that detect unusual behavior.

In addition, 3D Secure authentication adds a layer of customer verification, which shifts liability for fraud back to the issuing bank. Together, these tools reduce chargebacks and protect both merchants and customers.

Can a payment gateway improve approval rates?

Yes. Many declines happen for avoidable reasons, such as temporary network issues, fraud misclassifications, or issuer preferences. A smart payment gateway can boost approval rates by retrying failed transactions at optimized times, rerouting payments through alternative acquiring banks, or using BIN-level logic to select the best pathway.

Some gateways also support network tokens, which replace outdated card details with secure, updated credentials provided by card schemes. These strategies recover sales that would otherwise be lost.

What payment methods can a gateway support?

A modern gateway is not limited to credit and debit cards. It can also support global digital wallets such as Apple Pay, Google Pay, and PayPal, as well as region-specific methods like Klarna, Swish, and MobilePay in the Nordics, iDEAL in the Netherlands, Bizum in Spain, and Alipay or WeChat Pay in Asia.

Offering local payment methods is often essential to winning customers in new regions, since many buyers prefer or even require them. By integrating these options, gateways increase conversion and help merchants expand internationally.

Do payment gateways handle recurring payments?

Yes. Through tokenization, gateways can securely store a customer’s details and use them for recurring transactions without exposing raw card data. This is crucial for subscription businesses, membership platforms, and services that rely on repeat billing.

A strong gateway will also manage renewal retries if a subscription charge initially fails, which helps reduce involuntary churn. Recurring functionality not only improves customer convenience but also builds predictable revenue streams for merchants.

Can a payment gateway process payouts?

Some gateways provide outbound payment solutions as well as inbound processing. This means they can handle payouts to affiliates, gig workers, suppliers, or content creators. Depending on the platform, payouts can be made to bank accounts, cards, or digital wallets, sometimes even in multiple currencies.

This capability is especially useful for marketplaces, platforms, and global businesses that need to move money in both directions. By consolidating collections and payouts in one system, gateways simplify financial operations and improve efficiency.

💡 Interested in learning more about what’s included in a typical high-risk merchant account? View our complete breakdown of FastoPayments’s high-risk merchant accounts.